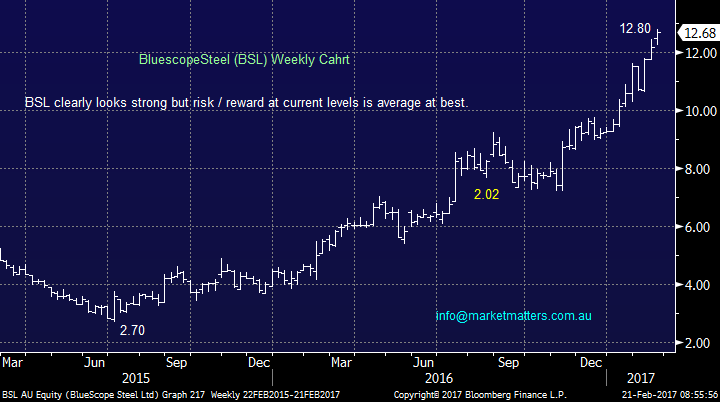

Yet more reporting extremes – Part 4

With the US markets closed for Presidents Day overnight, leads will be focused around European markets and importantly the ongoing local reporting season - perhaps a day off in his honour will improve Donald Trump's popularity. Today we see some large local companies show us how they are currently performing including BHP Billiton, Oil Search, Scentre Group, SEEK, Caltex, Aconex and Seven Group - it should again be an interesting day on the stock level.

Last night the German DAX which we are watching closely rallied 0.6%, leaving it ~1.5% below our target for the coming weeks, hence we would be looking for short-term selling opportunities not buying ones at current levels. This is reflected in our overall feeling for both US and local stocks where we believe a pullback is close at hand.

German Dax Daily Chart

Today we will look at 4 stocks that caught our eye after reporting yesterday as we continue to look for opportunities during reporting season.

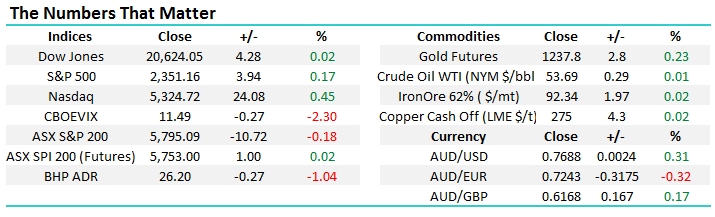

1 Brambles (BXB) $9.47

Yesterday BXB fell -9.9% after reporting earnings which were basically in-line with recent downgraded guidance but the future looks uncertain and this is clearly where the market focused. Outgoing Brambles chief executive Tom Gorman said the result was disappointing with the majority of the problems focused around its US business where the economy is supposed to be strongest. The logistics / pallet company is struggling with the shift in consumer behaviour as on-line shopping, which is creating goliaths like Amazon, are thriving leading to a surge in small parcels travelling by post, rather than on pallets between shops.

Interestingly only a few years ago investors thought postal companies were in trouble due to the arrival of email but now with on-line shopping growing exponentially they have enjoyed a significant renaissance.

Although BXB has reached our technical buy zone, after correcting ~30% since August, it's hard to imagine investors chasing this stock due to growing uncertainty. BXB is still not cheap and only pays a grossed up dividend of ~3.4% so we will be observers, not investors for now.

Brambles (BXB) Monthly Chart

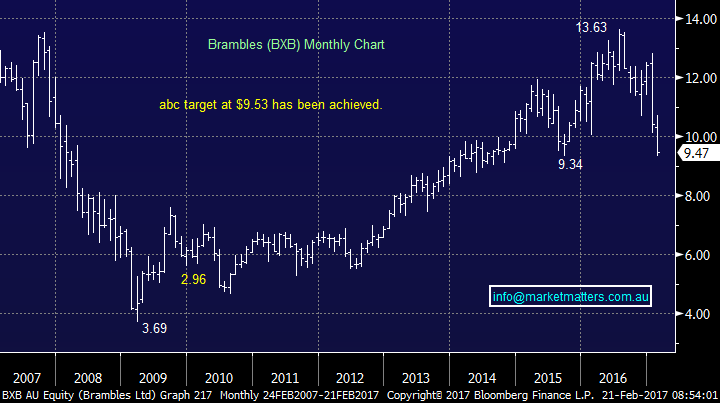

2 Worley Parsons (WOR) $8.60

Engineering services firm WOR fell 12.8% yesterday after reporting disappointing profit numbers. The headline result does not make exciting reading especially as resource companies are performing so well. They missed in terms of revenue, profit while debt was higher than expected – three strikes and the stock was hit hard. The net debt figure is the concerning one and the rise for the half (+$149m to $1.015b) is largely a result of $230m in receivables from 4 state owned customers in the Middle East & Latin America. The other issue for WOR, and it’s relevant for other companies as well, is that cost reduction initiatives are also running out of puff. They’ve done well so far but the big layer of fat has been removed. In terms of outlook, it was OK and more upbeat than we’ve seen however it’s hard to reconcile that against the weak numbers that we saw. This is a complex business and winning work is just the start of it. Margins are very tight and a lot can wrong, and when customers fail to pay on time (or at all), then poor results can often happen.

With the company struggling and market now concerned about a potential capital raising we see no reason to invest in WOR.

Worley Parsons (WOR) Monthly Chart

3 NIB Holdings (NHF) $5.10

NIB shares had a solid day increasing by over 8% after reporting a net profit that rose by around two thirds after enjoying an increase in customers. Their profit was close to $72m and a 8.5c dividend was announced leaving the stock on a grossed up yield of 4.1%. However the company did also say the second half of the year was unlikely to be as strong, and their full year guidance actually implies a large drop off in earnings. This was likely to have been the reason that NHF fell over 6% from its high yesterday. In terms of NIB versus MPL, MPL is still the giant in the sector with ~27% market share and very good margins, but they are losing customers in aggregate. NIB have ~8% market share, lower margins but they’re improving and they’re adding customers.

NIB looks correctly priced to us hence showing no opportunity plus there is the obvious risk that Medibank gets its act together and forgoes some margin to protect market share – just as Woolies is doing to Coles.

NIB Holdings (NHF) Monthly Chart

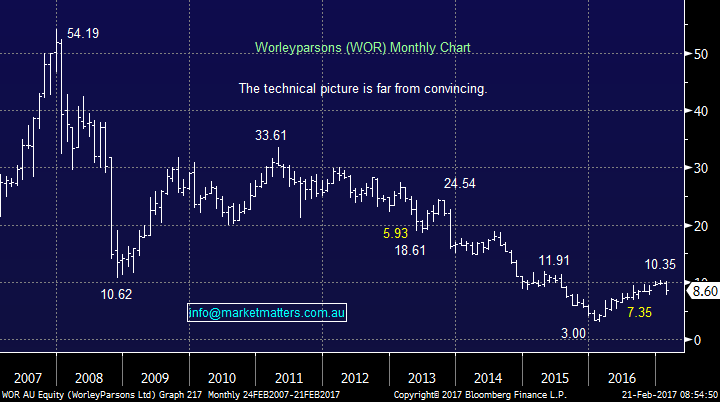

4 BlueScope Steel (BSL) $12.68

Australia's largest steelmaker BSL rallied 4% after its profit report beat the market's expectations with an impressive 79% rise in net profit for the half year. They have benefitted from both higher prices and cost cutting. The company also announced a$150m share buyback. Unfortunately on a risk / reward basis we believe this train has well and truly left the station and would only consider buying the stock into a decent correction.

One interesting comment by the CEO Paul O'Malley was energy costs in the US are 10x lower than in Australia calling into concern our competitiveness. It's a balance of clean energy but at what price, something Malcolm Turnbull is looking at closely.

BlueScope Steel (BSL) Weekly Chart

Conclusion

No investing / trading opportunities from the 4 stocks we looked at today, hopefully better luck tomorrow.

Overnight Market Matters Wrap

- The European markets closed skewed to the upside, with miners and telcos leading the way.

- The RBA’s minutes are due to be released today, while FOMC minutes are due on Wednesday. Both will provide a better indication on current interest rate direction.

- Iron ore rallied 2.2% to $US92.34/t. Oil rallied 0.5% while copper moved into the black, as a dispute in Chile affecting production worsened.

- Major companies reporting today - BHP, OSH, SEK and CTX.

- The ASX 200 is expected to open marginally higher this morning, above the 5,800 level as indicated by the March SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here