Is it time to consider Aged Care stocks?

The ASX200 drifted 0.26% lower yesterday with the selling focused in private aged care space following Japara Healthcare's result, plus from an index point of view the banks which underperformed the market for the first time since both ANZ and CBA impressed the market with their recent strong profit results. Global markets overnight were very quiet, although the Dow did again make marginal fresh all-time highs, as all eyes are firmly on Donald Trump. The new US president will address congress and markets are looking for some details around his future plans, after taking credit for the share market rally since November it's unlikely he will want to disappoint in a speech that will be watched by many – let’s hope PwC isn’t feeding the auto que and we get a repeat of the Oscars!

We were very active in the market yesterday switching / tweaking our portfolio in line with recent reports, a recap is below:

1. We sold our 5% holding in Newcrest Mining (NCM) for a ~11% profit with an intention of re-entering gold sector more aggressively at lower levels - we are specifically watching both Evolution Mining (EVN) and Regis Resources (RRL).

2. We sold our 5% holding in Healthscope (HSO), at ~breakeven, after its recent ok report the stock continues to struggle to rally over $2.40. We believe it will take 1 / 2 more reports for the market to again believe in HSO.

3. We sold 25% of our Vocus (VOC) holding for a painful loss, after its recent good report it was tempting to maintain the whole position but prudent money management must prevail.

4. We increased our Platinum Asset Management position from 5% to 7.5% ahead of its 15c fully franked dividend this week. Technically the stock looks excellent after its recent strong result targeting at least a further 10% upside.

5. We allocated 4% into both Ramsay Healthcare (RHC) and Ansell (ANN) who have both experienced decent corrections of 22% and 20% respectively. Importantly during the same period our HSO position was unchanged creating an attractive switch.

6. Our net cash position increased marginally from 20.5% to 23% as we look to buy further weakness in the resources sector.

Looking at the local stock market we have again focused on the SPI futures contract which as we've explained takes into account looming dividends from major local companies which includes Challenger (CGF), Platinum Asset Management (PTM), NIB (NHF), Fortescue (FMG), Woolworths (WOW), Woodside (WPL) and Telstra (TLS). Technically we remain bullish the SPI while it can hold over 5650 but a break of this area will target under 5550 fairly quickly i.e. another 2% lower. However, when we apply simple common sense it is a rising concern that the ASX200 continues to slip lower while the US market rallies to all-time highs - the ASX200 has drifted 1.9% over the last 8 trading days while the Dow has rallied 2.2% to fresh all-time highs during the same period. When US stocks do finally experience a decent pullback we are unfortunately likely to follow.

Our "Gut Feel" is the ASX200 will again test the 5600 area in March. This ties in with a characteristic we have witnessed over many years of following the Australian market - which is we often lead global equities both up and down, we simply have a habit of getting ahead of ourselves with both optimism and pessimism.

ASX200 Share Price Index (SPI) March 60-mins Chart

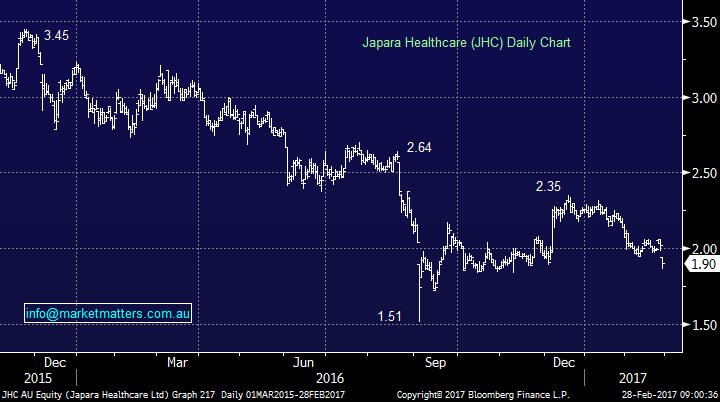

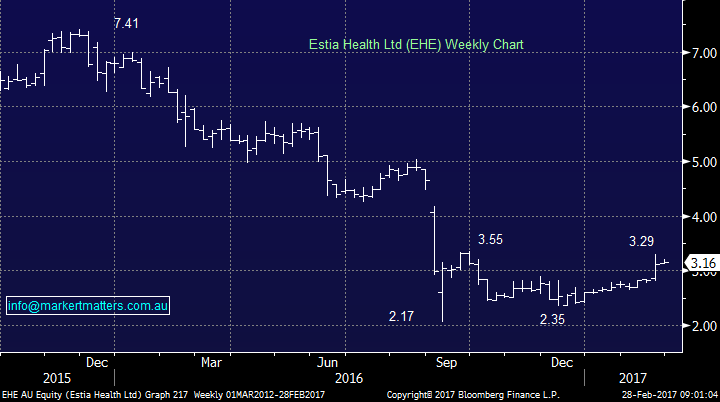

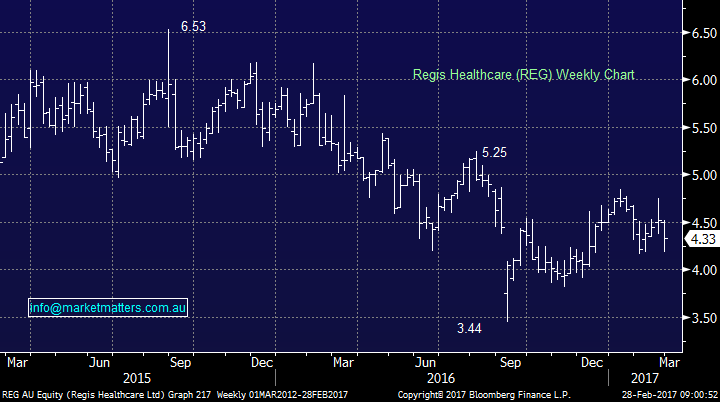

Moving onto the aged care space which has been battered since late 2015 and Japara's (JHC) result yesterday did not help with the stock falling 5.9% to $1.90. The question we ask ourselves is it time to step up and buy the sector which clearly should benefit from an ageing Australian population - around 75,000 extra beds are estimated to be required for the aged by 2027. The Short Sellers are reasonably low in this stock which is probably not a big vote of confidence in the sector but more a view that the majority of the sector unwind has occurred. The current short positions is: Japara (JHC) - 4.9% / 57th most shorted stock, Estia Health (EHE) - 6.8% / 30th and Regis Healthcare (REG) at 3.7% / 81st.

This morning the Australian Financial Review ran an article on Estia Health describing it as the gold standard on how listed companies should NOT manage their financial obligations. An interesting read in the AFR and not one that gives confidence in EHE at present, importantly this might add further weakness to the stock / sector moving forward. Let's look at a snapshot of each company before forming a conclusion.

JHC's result yesterday was a poor one with earnings down 10% to $14.6m while the dividend was maintained at 5.5c fully franked, putting the stock on a 8.65% grossed up yield. The valuation still feels a little rich with it trading on a P/E of 16.4x for 2017 while it continues to put its house in order following changes to Government funding. The business is expanding with 1,100 new beds expected by 2020, increasing JHC's total by close to 30% which should in theory lead to higher profits moving forward. They guided to FY17 earnings growth of 7% to 10% on FY16

Looking at the stock technically shows a pretty average picture with a break under $1.50 not out of the question. Also, a company in a growth sector, looking set to expand profitability and trading on a P/E of 16.4x while paying a 8.65% grossed up yield feels too good to be true. Remember while investing if it looks too good to be true it usually is. We feel the best approach to JHC at current levels is wait and see, especially as their result was clearly inferior to its peers.

Japara Healthcare (JHC) Daily Chart

EHE reported last week and the market liked what it saw sending the stock up an impressive 15% on the day, the majority of these gains have been maintained. The company confirmed full year earnings guidance of $86-90m while producing a strong $19.8m net profit up 85% since its acquisition of Kennedy Health Care Group, plus net debt fell to $140m from $224m following a successful capital raising which was finalised in January. We also noticed they appointed a new CFO from Ramsay Healthcare, on the surface a solid move. The stock trades on a P/E of 17.5x for estimated earnings for 2017, but they recently cut their dividend.

As we mentioned earlier a pretty average article is in the AFR today around EHE, today's price action will interesting.

Technically we are neutral the stock at current levels.

Estia Health (EHE) Weekly Chart

REG reported an increase in revenue of 20% to $284.7m and a half year net profit after tax up 9% to 30.9m. The stock initially spiked up to $4.75 but yesterday it closed at $4.33 after testing the lows for the month. The company's valuation is rich within the sector at 21.4x est. earnings for 2017 while the stock is paying a 5% grossed up yield. Regis is the lowest risk play in the sector.

Technically we are neutral REG at current levels, the same view as both JHC and EHE.

Regis Healthcare (REG) Weekly Chart

Conclusion

We believe value should present itself in the sector moving forward but from a risk / reward perspective at current levels there feels no hurry.

Overnight Market Matters Wrap

- The US Share markets continue to edge marginally higher as investors are warm to the expected tax reforms and infrastructure spending being addressed to congress by President Trump tonight.

- Oil was pretty much flat, while Iron Ore followed Asia trade and rallied 2.02% overnight. – BHP is expected to outperform the broader market this morning, after closing an equivalent of +0.62% in the US vs. Australia’s previous close.

- The March SPI Futures is indicating another soft open with an upside bias with the ASX 200 this morning, towards the 5,730 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here