The $A gets smacked with metals!

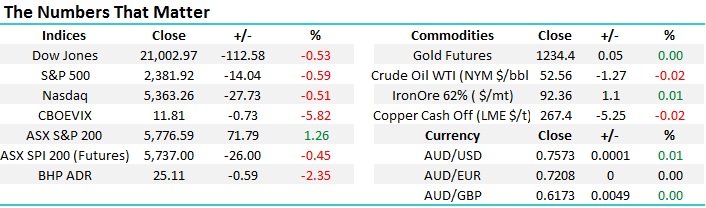

Yesterday night was a little calmer in overseas global markets compared to the previous night’s Donald Trump inspired 300-point rally in the Dow. However, what did catch our eye was the 1.4% fall in the $A following its correlated commodities - gold -1.4%, Copper -1.7% and oil -1.2% lower. With BHP for example set to give up around 70% of its gains from yesterday’s strong market surge, it's hard to imagine the ASX200 not giving back at least 1/3 of yesterday's gains - this will mean the ASX200 has traded in a 101-point weekly range, hence why we follow statistics as the ASX200 continues to trade in weekly ranges of ~105-points with very small deviations. We reiterate our monthly numbers from yesterday - if the monthly low of 5675 holds for the ASX200 the index is likely to test 5900 in March but conversely if it rolls over and cannot hold the Trump gains another test back below 5600 is likely, nothing particularly outlandish in those extremes but important to keep in mind for entry / exit into stocks.

Remember the following simple rule we often use / quote which combined with statistical ranges that have a low standard deviation can be extremely powerful:

"85% of the time a market will make the high, or low, of any time frame in the first 20% of that timeframe" - The DOT Theory.

Today not surprisingly, we have again focused closely on the metals as this is where we anticipating deploying some of our capital in the coming weeks and potentially today with the gold sector. Note we usually focus on a sector / stock if we expect to be active that day even if it is to a degree covering "old ground".

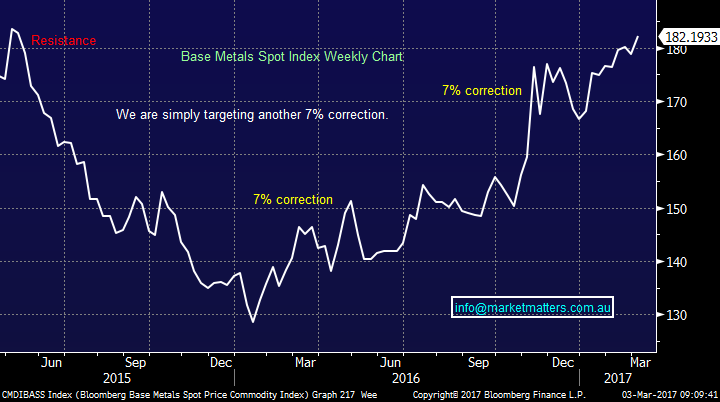

Back on the 19th of February, we looked at the base metals as an overall index with the conclusion that we were targeting another 7% correction. This has clearly not occurred and the index has actually ground 1% higher, however at this point in time after the almost 40% appreciation since December 2015 our preferred scenario remains a 7% correction for metals moving forward.

Base Metals Spot Index Weekly Chart

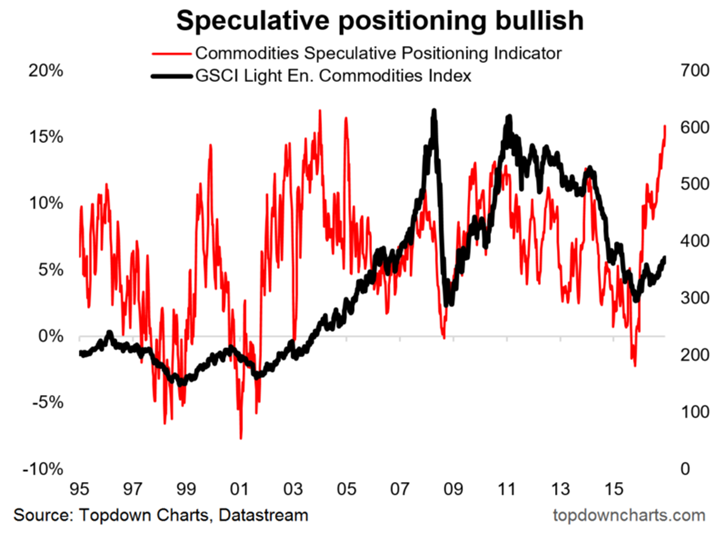

An important point that we often discuss in reports is how the market positioned and importantly, is it at extreme levels. Currently the bullish position in commodities is the highest in over a decade, this adds weight to our current stance of being patient to enter our resources sector. When investors and traders alike are all positioned in one direction, short / sharp counter trend moves are common occurrences.

Commodities Position Chart

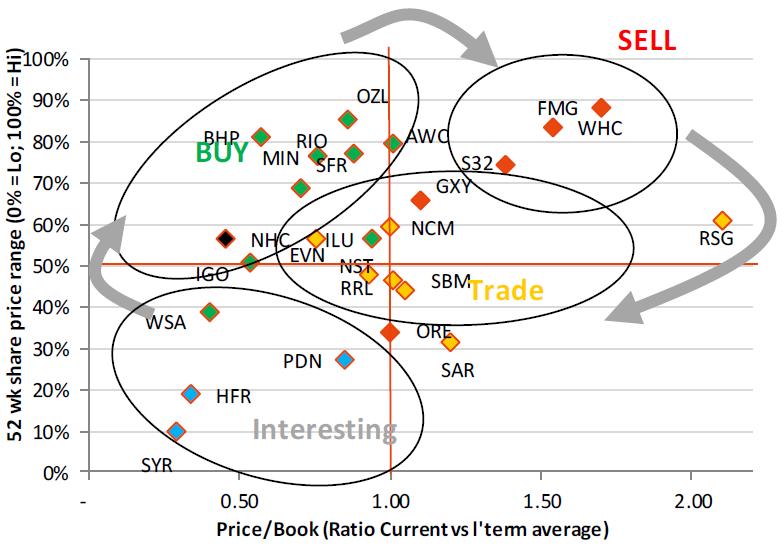

In this morning's report, we have also included an excellent visual representation from Shaw and Partners Limited, of where the value is in resources space, the conclusion is buy the big names BHP and RIO, sell the bulks (we are short FMG).

In the gold sector which we will be watching closely today, it’s pleasing to see better value emerging in our target EVN than NCM, where we recently took profit.

Source; Shaw and Partners

Our ideal target area for BHP remains in the $24 area, ~ $1/~4% below where it will be today.

BHP Billiton (BHP) Weekly Chart

Following last night's $US16/oz fall, the related gold ETF's fell ~4%. It's likely that our sector names will follow, the question for us at MM is when do we commence accumulating our favoured gold names?

1. Evolution Mining (EVN) $2.16 - The ideal initial buy zone is around $2.05, a 16% correction of its recent advance. This may be achievable today!

2. Newcrest Mining (NCM) $21.75 - We recently took profit on our 5% holding in NCM at ~$23.40,with a view to buying EVN closer to $2.05 - this is unfolding nicely. NCM itself is a buy closer to $20.50.

3. Regis Resources (RRL) $3 - The initial buy zone is around $3.20, but closer to $3 looks possible - the stock goes ex-div. 7c fully franked in 4 days time.

We cannot rule out a deeper and more aggressive correction for gold as the US starts raising rates, which is now regarded as a 70% possibility this month. Hence we anticipate our buying will be slow accumulation into weakness.

*Watch for alerts today in EVN.

Evolution Mining (EVN) Weekly Chart

Conclusion

Overall we remain bullish stocks until at least late April when a 4-5% pullback may unfold as is a seasonal habit.

- Today we anticipate allocating some MM monies into EVN ~$2.05.

- We will remain patient on the major miners BHP, FMG and RIO.

*Watch for alerts.

Overnight Market Matters Wrap

- The US markets retreated after its recent acceleration, with the major equity indices down over 0.5%.

- Investors don’t seem too concerned about an increasingly likely rate rise in the US when the Fed meets this month. Four Fed officials will speak tonight on the US economy.

- Metals on the LME were weaker. Gold and iron ore are also in the red while oil is trading more than 2% lower as Russian oil production remained unchanged in February.

- Snap(chat) listed strongly giving the company a market capitalisation of nearly US$29B.

- The March SPI Futures is indicating the ASX 200 to open 25 points lower, towards the 5,750 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here