Is it premature to revisit the “yield play” stocks?

On Friday the US Federal Reserve Chair Janet Yellen made some very strong suggestions that the Fed will raise interest rates this month, the market listened and is now agreeing by factoring in a 95% likelihood compared to well under 50% only a few weeks ago. This Friday night we will receive the US Employment numbers and assuming there is not a nasty surprise we feel a rise in US interest rates is a given next week. It should be remembered that the Fed are targeting 3 hikes in 2017, hence getting the first one dealt with early on in the year, when the market is expecting it makes 100% sense. However what has really caught our eye over recent times as the market embraces this March rate hike has been the reaction of the relevant markets to the change in sentiment.

The 3 following different reactions has given us excellent ongoing insight to the current strength / market positioning in these respective markets:

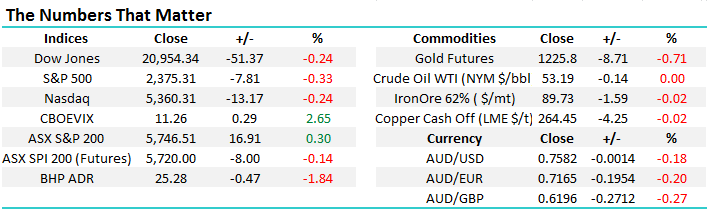

- The stock market has shrugged off the news and continued with its strong rally = US stocks remain in a bull market and while a "rest" feels likely in the near future we remain bullish later into 2017.

- The $US has bounced ~2% from its February lows but is still down for 2017 = the market is extremely long the $US and while it may eke out further gains we believe the next decent move is down.

- American bonds have come under pressure recently sending yields higher = the US bond market has not adjusted enough to rising interest rates in the US and further weakness is expected i.e. higher interest rates.

Looking at these markets in a little more detail while considering the "yield play" stocks will hopefully answer the question "which tail is wagging this dog?" and whether it's time to plunge back into the "yield play" sector. We feel in the groove with this sector at present having avoided all the recent ~20% decline from August 2016, plus having made some nice short term profits from their bounce into 2017 with TCL and WFD.

We currently remain bullish US stocks through 2017 and potentially into 2018, although at least one decent pullback is expected ~5% in that time. That does not mean we are stepping away for our call for a larger correction (~25%), it simply means we need to be open minded in terms of timing. Hence being long stocks in general does not concern us however the correlation between the Dow and some of our headline "yield play" stocks is clearly inverted i.e. since August 2016 when the Australian "yield play" stocks experienced a large unwind the Dow is +13.7% while Sydney Airports -21%, Transurban -13% and Westfield -17%.

Hence this is one sector we would consider buying when we believe US stocks will fall. Our explanation is that US stocks are rallying on an improving US economy and interest rates slowly normalising is currently not slowing down this optimism in equities.

1. US Dow Jones Daily Chart

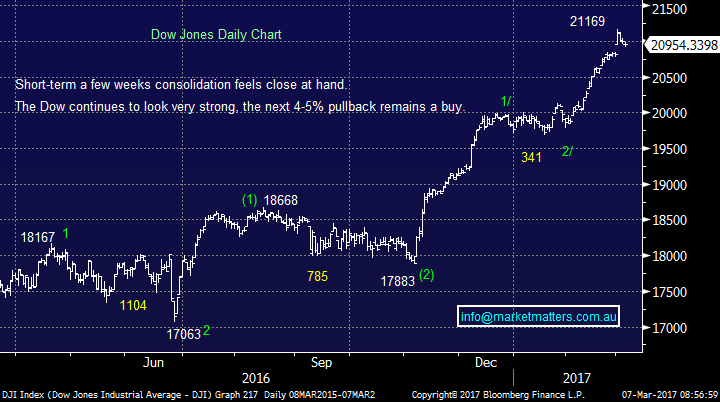

As we mentioned earlier the $US is struggling to rally even with positive support from the US economy and rising interest rates - remember a market that cannot rally on good news is often a weak market. On balance we still think the $US can eke out gains to around the 105 area on an index level i.e. ~3% higher. However we continue to be medium term bearish targeting 8-10% lower levels.

The $US and our "yield play" stocks have also been inversely correlated over recent times. Hence if the $US can rally towards 105 the likelihood is the local "yield play" stocks will remain subdued. Two important points to garner from our $US view:

(1) There is strong possibility that a push up to the 105 area will coincide with a low in the "yield play" stocks, and perhaps a short-term top in US stocks.

(2) Again if the $US reaches the 105 area we will review the stocks in the MM portfolio that benefit from a strong $US with a consideration to locking in some profits in e.g. Ansell, CSL, Macquarie and QBE Insurance.

2. The $US Monthly Chart

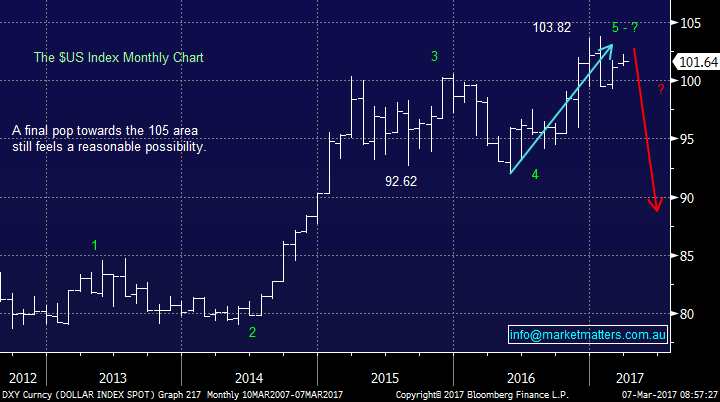

US bond yields remain firm with the 10-years on track to test the 3% region over coming weeks / months. We predicted this move back in mid-2016 and at the time it was not a common view as was illustrated perfectly by the carnage in our "yield play" sector. However we like to keep ahead of the pack so now its a case of what comes next and importantly how will it influence the sector we are reviewing today. Our view remains that US 10-year yields will relatively soon break above their recent 2.64% high and potentially challenge the psychological 3% area, although our best guess is they fall short at around the 2.8% level. Similarly to the previous markets there is a clear inverse correlation between our "yield play" stocks and US bond yields - which is hardly surprising.

Hence we would advocate remaining patient on the "yield play" sector until US 10-year bond yield have spike over their Decembers 2.64% high - obviously we will watch this carefully for subscribers.

3.US 10-year Bonds Yield Monthly Chart

We generally focus on 3 prominent "yield play" stocks which we have again touched on in the following 3 charts - note we have not discussed Banks and Telstra as we have covered them extensively over recent days / weeks.

1. Sydney Airports (SYD) $6.01

SYD continues to struggle around the $6 region having corrected over 20% in recent months. SYD is currently yielding a reliable 5.16% unfranked.

Due to the stocks acceptance of the $6 region at this stage we would want to see a spike under the recent $5.80 low before considering SYD.

Sydney Airports (SYD) Monthly Chart

2. Transurban (TCL)$10.99

TCL has bounced well from its $9.45 low last November with a sharp ~10% appreciation in February following an excellent company report. This is one stock we will consider into weakness but levels are currently hard to determine. TCL currently yields 4.64% grossed up.

Transurban (TCL) Monthly Chart

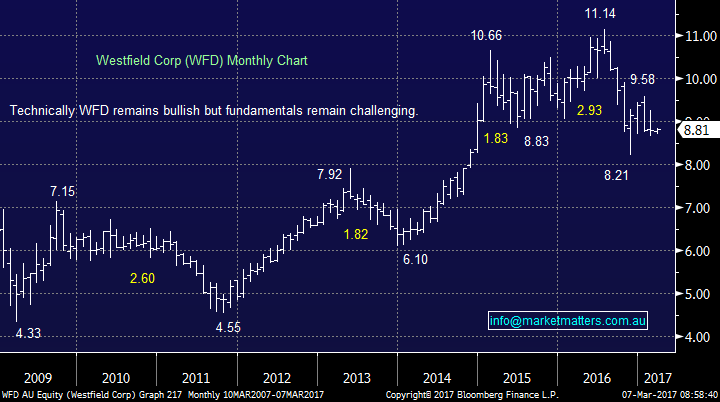

3. Westfield (WFD) $8.81

Technically WFD does currently look interesting under $9, well over 20% below its 2016 high and Trump’s plan to cut taxes should help U.S retailers. Another spike higher in US Bond yields may easily generate a buying opportunity back towards its $8.21 November 2016 low. WFD currently yields 3.7% unfranked.

Westfield (WFD) Monthly Chart

Conclusion

We have 2 clear and important conclusions that are likely to lead to some activity in the MM portfolio moving forward in 2017:

- We will consider gaining some exposure to the "yield play" sector when / if the $US tests 105 and US 10-year bond yields break over 2.7%.

- We are likely to reduce our exposure to our $US earners at the same time e.g. ANN, CSL and QBE.

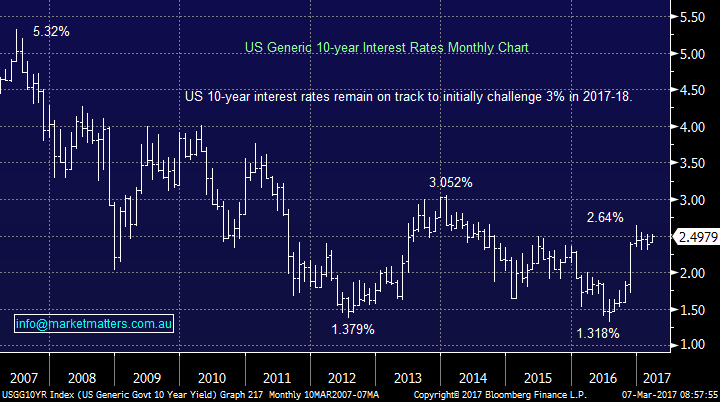

Overnight Market Matters Wrap

- The US markets closed lower overnight, as the probability of an interest rate increase this month grew close to 100% with the REITs being the laggard.

- The major miners are expected to underperform the broader market and give back yesterday’s gains, with BHP ending its US session down an equivalent -1.84% towards $25.28 from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open 15 points lower, testing the 5,730 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here