1 out of 4 so far, its getting busier!

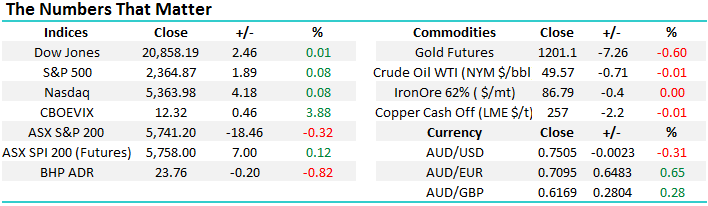

This morning, the Dow is battling to avoid its 4th consecutive fall on the anniversary of its 8-year bull market - as I type, it's a mere 15-points. Exactly as we have been experiencing in the local market, Financials and Healthcare are positive, while stocks exposed to rising interest rates and resource stocks are weak. Crude oil fell below $US49/barrel for the first time this year and we remain very comfortable holding zero exposure to pure energy stocks at present. US bond yields have now risen for 9 straight days this time, aided by the European Central Bank's (ECB) growing optimism on global growth, but they have maintained interest rates at zero.

The Dow has now experienced its largest correction since the US election - it's been slow and generally unnoticed i.e. 392-pints / 1.9%. While US stocks have pulled back since the 1st of March, the local market has firmed, gaining 29-points. This is easy to explain when considering our index’s heavy weighting to banks and financials. The US employment data which is released tonight is likely to determine the direction for stocks over coming weeks and our best "guess" is the current correction has run its course and US stocks will be higher on Monday.

US Dow Jones Daily Chart

This morning, the Dow is battling to avoid its 4th consecutive fall on the anniversary of its 8-year bull market - as I type, it's a mere 15-points. Exactly as we have been experiencing in the local market, Financials and Healthcare are positive, while stocks exposed to rising interest rates and resource stocks are weak. Crude oil fell below $US49/barrel for the first time this year and we remain very comfortable holding zero exposure to pure energy stocks at present. US bond yields have now risen for 9 straight days this time, aided by the European Central Bank's (ECB) growing optimism on global growth, but they have maintained interest rates at zero.

The Dow has now experienced its largest correction since the US election - it's been slow and generally unnoticed i.e. 392-pints / 1.9%. While US stocks have pulled back since the 1st of March, the local market has firmed, gaining 29-points. This is easy to explain when considering our index’s heavy weighting to banks and financials. The US employment data which is released tonight is likely to determine the direction for stocks over coming weeks and our best "guess" is the current correction has run its course and US stocks will be higher on Monday.

US Dow Jones Daily Chart

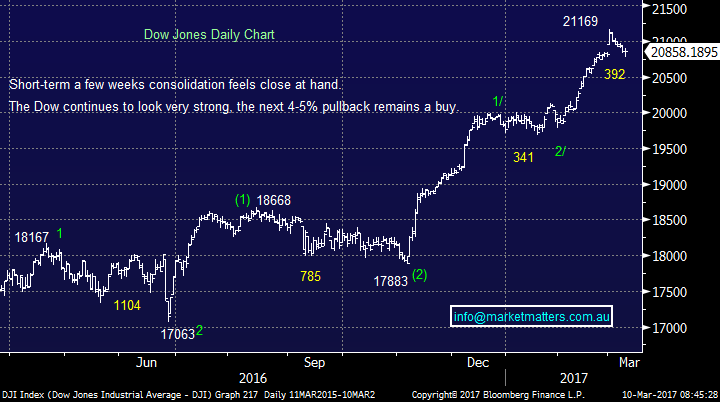

At one stage yesterday, it looked like we might be extremely busy in the market, but finally we ended just allocating 5% of our portfolio into BHP at around $24, which has been our intention for around 6-weeks. The ASX200 was yet again a classic "game of two halves", very similar to what we have experienced recently with the banks strong and resources weak. Impressively ANZ, NAB and WBC all traded at 18-month highs, however we shouldn't get too ahead of ourselves. We expect the banks to gain ~6% over the March-April period but Westpac is already up 4% after only 9-days of March, while the banking index has gained 2.4% - regional banks Bendigo and Bank of Queensland have struggled. Hence while we remain comfortably overweight the banks / financials, expecting further gains, they are likely to slow down over coming weeks. The next potential push higher by the ASX200 is likely to come from the resources sector, which are at / very close to our retracement targets and if we are correct, they should bounce strongly in coming weeks.

BHP Billiton (BHP) $23.96 - BHP has now corrected $4.07 (14.6%) from its late January high. MM bought BHP yesterday in the morning ~$24.10 with a target of ~$30. Considering we believe RIO and FMG are likely to correct a little further, it would be no surprise if BHP fell another few percent, but we are happy with our planned entry level.

BHP Billiton (BHP) Weekly Chart

At one stage yesterday, it looked like we might be extremely busy in the market, but finally we ended just allocating 5% of our portfolio into BHP at around $24, which has been our intention for around 6-weeks. The ASX200 was yet again a classic "game of two halves", very similar to what we have experienced recently with the banks strong and resources weak. Impressively ANZ, NAB and WBC all traded at 18-month highs, however we shouldn't get too ahead of ourselves. We expect the banks to gain ~6% over the March-April period but Westpac is already up 4% after only 9-days of March, while the banking index has gained 2.4% - regional banks Bendigo and Bank of Queensland have struggled. Hence while we remain comfortably overweight the banks / financials, expecting further gains, they are likely to slow down over coming weeks. The next potential push higher by the ASX200 is likely to come from the resources sector, which are at / very close to our retracement targets and if we are correct, they should bounce strongly in coming weeks.

BHP Billiton (BHP) $23.96 - BHP has now corrected $4.07 (14.6%) from its late January high. MM bought BHP yesterday in the morning ~$24.10 with a target of ~$30. Considering we believe RIO and FMG are likely to correct a little further, it would be no surprise if BHP fell another few percent, but we are happy with our planned entry level.

BHP Billiton (BHP) Weekly Chart

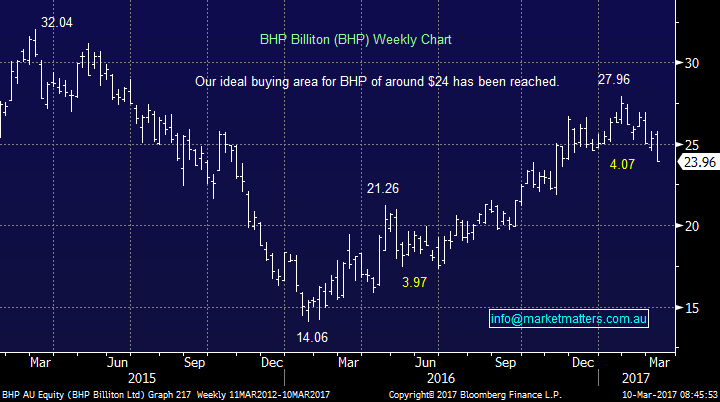

Today, let's simply focus on our investing intentions over coming days:

1. RIO Tinto (RIO) $60.14 - RIO has now corrected over $10 (14.5%) from its high in mid-February. MM still intend to buy RIO under $59, if the opportunity arises i.e. only 2% lower.

2. Fortescue Metals (FMG) $6.25 - MM are holding a trading short in FMG via an options position which is currently showing a profit of ~30%. While our technical target remains the $6 area we will probably take profit on FMG early today.The logic is simple, we will have a significant percentage of the positions profit potential without having to wait to the end of May plus we expect resources to recover shortly.

3. Regis Resources (RRL) $3.04 - Yesterday MM tried to buy RRL between $2.95 and $3, unfortunately the stock fell short at $3.01 but we remain on the bid for RRL at $2.98.

An interesting side note when both Bill Gates and Warren Buffett were independently asked to sum up the reason for their success in one word they amazingly both wrote "focus".

RIO Tinto (RIO) Weekly Chart

Today, let's simply focus on our investing intentions over coming days:

1. RIO Tinto (RIO) $60.14 - RIO has now corrected over $10 (14.5%) from its high in mid-February. MM still intend to buy RIO under $59, if the opportunity arises i.e. only 2% lower.

2. Fortescue Metals (FMG) $6.25 - MM are holding a trading short in FMG via an options position which is currently showing a profit of ~30%. While our technical target remains the $6 area we will probably take profit on FMG early today.The logic is simple, we will have a significant percentage of the positions profit potential without having to wait to the end of May plus we expect resources to recover shortly.

3. Regis Resources (RRL) $3.04 - Yesterday MM tried to buy RRL between $2.95 and $3, unfortunately the stock fell short at $3.01 but we remain on the bid for RRL at $2.98.

An interesting side note when both Bill Gates and Warren Buffett were independently asked to sum up the reason for their success in one word they amazingly both wrote "focus".

RIO Tinto (RIO) Weekly Chart

Conclusion

We have a number of clear and important conclusions that are again likely to lead to some activity in the MM portfolio today!

Conclusion

We have a number of clear and important conclusions that are again likely to lead to some activity in the MM portfolio today!

- We are buyers of RIO under $59.

- We will take profit on our FMG trading position, via options, around the recent $6.23 low.

- Today we will allocate 2.5% of our portfolio into RRL at $2.98.

- The US markets closed with little change overnight as investors sit on the sideline ahead of the jobs data tonight, which would indicate further on the anticipated rate hike this month.

- Commodities were weak, with Iron Ore off 0.46% and gold futures down 0.5%.

- The March SPI Futures is indicating an 18 point rise in the ASX 200 this morning testing the 5,760 area.