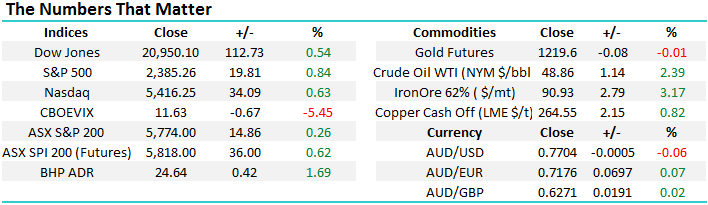

The trend is your friend – for now

Last night the Fed did everything that stock markets wanted to hear - they raised US interest rates from 0.75% to 1% while strongly implying there were no plans to accelerate the return of "normal" monetary policy. Hence the investors are now looking for interest rates in the US to be at 1.5% by Christmas, not the 1.75% that some economists were fearing. (i.e 2 more hikes rather than the 3 priced in by the market). Concerns were mounting that interest rates may need to be hiked more rapidly than previously forecast given recent strength in US Economic data. Not surprisingly the result this morning was a big "thumbs up" from equities which rallied strongly led buying in stocks that would normally be under pressure from higher US interest rates.

As we suggested in the afternoon report yesterday it seemed to us that this is more likely than not one of those buy the rumour sell the fact type scenarios and we saw that start to play out in the market (yesterday) with the strong performance from utilities and real estate stocks – normally sectors that would struggle in a higher interest rate environment. So if interest rates are going higher, presumably the $US goes higher, Bond yields go higher and those stocks / sectors that are negatively correlated to those trends would struggle, however its seems we’ve already seen the positioning play out ahead of time, which is fairly normal and therefore the inverse of those trends seemed more likely.

Today we will cover how we see stocks / sectors moving forward following the Feds decision / speech and how we intend to "tweak" our MM portfolio accordingly.

Overall our preferred scenario for US stocks would be a continuation of the "Trump rally" towards 21,500 but with noticeably reduced momentum, followed by a ~4% correction. In simple terms we believe US stocks have significant good news baked into their prices and a pullback is very close at hand. Note we are not bearish US stocks at this point in time but believe a period of consolidation is just around the corner.

US Dow Jones Daily Chart

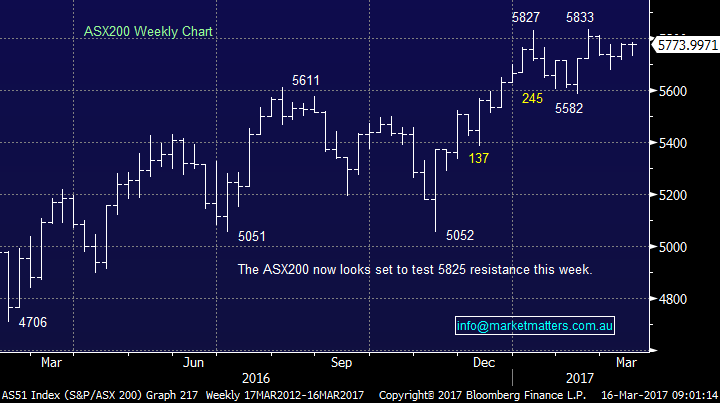

Locally the ASX200 as an index is not as clear short-term but we remain bullish for 2017 overall. We expect the highs of 2017 in the 5830 area to be tested today and potentially 5900 in the month. Also remember the seasonally blockbuster month of April is looming. We anticipate local stocks will follow the lead from US stocks overnight with strength in resources and interest rate sensitive stocks but relative weakness in the financials who benefit from higher bond yields.

ASX200 Weekly Chart

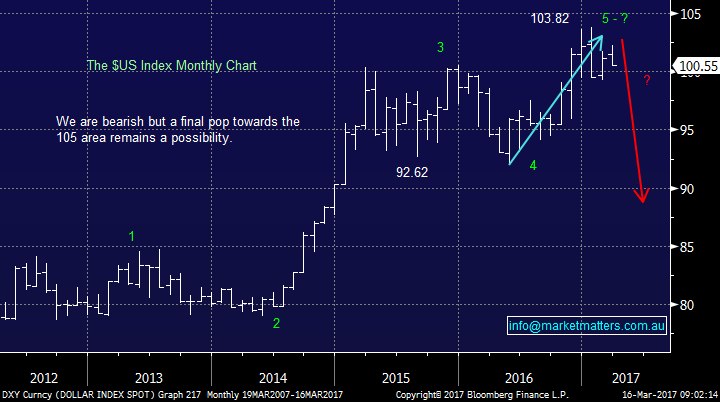

A weaker $US remains one of our core views for 2017 and this is slowly playing out as expected with the Dollar Index now -1.6% for the year, yet the Fed is on track to raise interest rates three times in 2017. Fund managers number one call for this year was a higher $US with the American economy improving nicely and the Fed looking set to raise interest rates steadily through both 2017 and 2018. We often like to position ourselves against the crowd simply because when you are correct the "bang for your buck" can be simply awesome as everyone needs to realign their positions / portfolio - similar to a short squeeze in a stock that suddenly performs well. We remain bearish the $US.

$US Index Monthly Chart

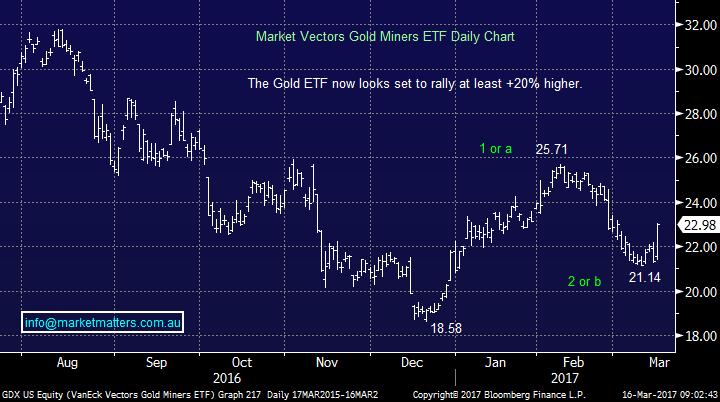

Probably the number one beneficiary of a weaker $US is the gold sector and last night the gold ETF we follow rallied almost 8% which should be reflected by strong buying in our gold sector today. At MM we now see this gold ETF rallying at least another 20% but obviously we will be monitoring it carefully as it can be a volatile beast! We remain bullish gold stocks and like our recent 6.5% investment in the local gold sector via Evolution Mining (EVN) and Regis Resources (RRL).

Market Vectors Gold ETF Daily Chart

The resources space should also open very strongly today with BHP closing ~$24.60 in the US this morning, up a healthy 40c (1.7%). Similar to gold we are bullish the resources sector moving forward and remain comfortable with our recent 10% MM portfolio investment into BHP and RIO.

The ASX200 may finally enjoy a period of out performance over the US if the resources can really power ahead.

At this stage our target for our RIO position is fresh 2017 highs, over $70, or around 15% higher than yesterdays close. As an aside, this morning we sat around the boardroom table with New Power, CEO of Fortescue (FMG) and a number of his key management team. Interestingly, Fortescue believe Iron Ore prices will come back from recent highs however they sighted the October ‘People’s Congress’ in China as a swing factor, suggesting that the Govt is very focussed on maintaining stability into this date, which would suggests that Steel Prices could remain around current levels and that has positive implications for the Iron Ore price, which might ‘hang around’ here longer than we think – a supporting factor for RIO and others.

RIO Tinto (RIO) Weekly Chart

After enduring an awful time since August 2016 we expect a strong relief style rally in the "yield play" stocks over coming weeks e.g. Sydney Airports (SYD), Transurban (TCL) and to a lesser extent Westfield (WFD). Last night the Real Estate sector was up almost 2% in the US and the Utilities +1.6% supporting this thought.

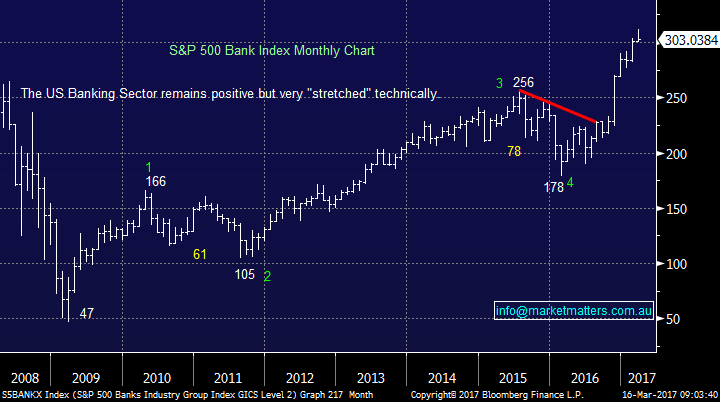

Moving onto the Financial / Banking sectors where we have a large exposure in the MM portfolio. The Financials have been a standout performer over the last 6 months, rallying 28% in the US, doubling the performance of all others. However, last night's news is not supportive of these stocks and even with the Dow up over 100-points the Financials fell 0.2%.

After our recent aggressive forays into the Resources / Gold Sectors MM has a 94% commitment to equities and as we outlined yesterday we are now wearing our sellers hat, looking to increase this cash position. We believe the Financials are likely to be underperformers over coming weeks / months hence it makes sense to take some profits in this sector - Macquarie Bank (MQG) is our most likely candidate.

*Watch for alerts.

US S&P Banking Index Monthly Chart

Conclusion

We again have a number of clear and important points that are again likely to lead to some activity in the MM portfolio in the near future:

1. We are wearing our "sellers hat" looking to increase our relatively small 6% cash position.

2. We will be looking for an ideal area to take profit on our Macquarie (MQG) "investment" position, probably below the $90.50 previously target.

3. We are also looking for areas to exit our "high risk" position in Altium (ALU) and "trade" in TPG Telecom (TPM).

*Watch for alerts*

Overnight Market Matters Wrap

- A rate rise was given as expected over in the US, but comments of less than anticipated rate rises this year sent the indices higher overnight. The US 10-year bonds however, lost 4.12% post US Fed comments.

- Iron Ore rallied, sending BHP in the US to rally an equivalent of +1.69% from Australia’s previous close – expect this space to outperform the broader market.

- The June SPI Futures is indicating the ASX 200 to open 46 points stronger this morning, towards the 5,820 level. Please note, volatility is expected this morning as it is March SPI Futures expiry.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here