Reviewing our $US exposure carefully

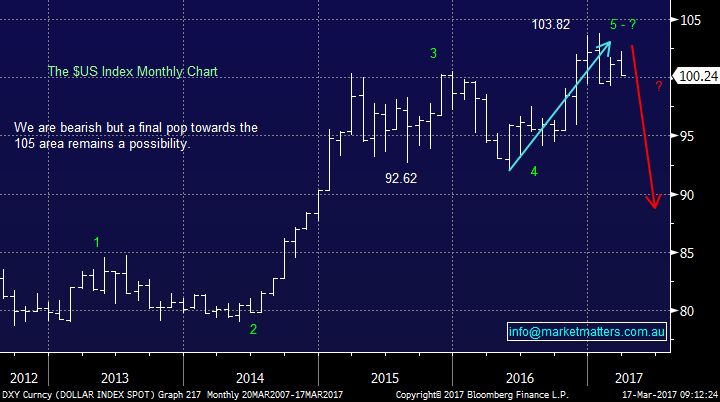

Last night, with the Fed behind us, markets were a touch quieter with Financials regaining some losses, Resources giving back some gains and Healthcare weak. The Dow closed down a mere 15-point after earlier in the session rallying to again test the psychological 21,000 area. There is no change to our short-term outlook for US stocks, targeting a very choppy advance towards the 21,500 area prior to 4-5% correction - we remind subscribers that short-term markets are harder to forecast with news flow often creating plenty of unpredictable volatility.

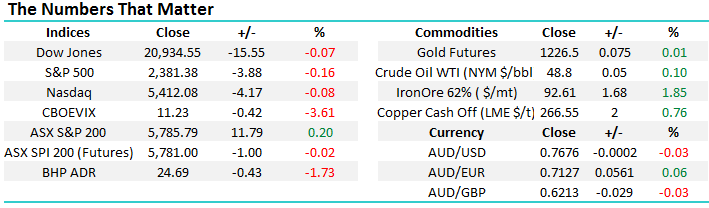

One market which did catch our eye last night was the Emerging Markets Index (EEM) which reached its highest level since July 2015, Australian stocks are far more correlated to the EEM than US stocks, note we remain bullish on Emerging Markets.

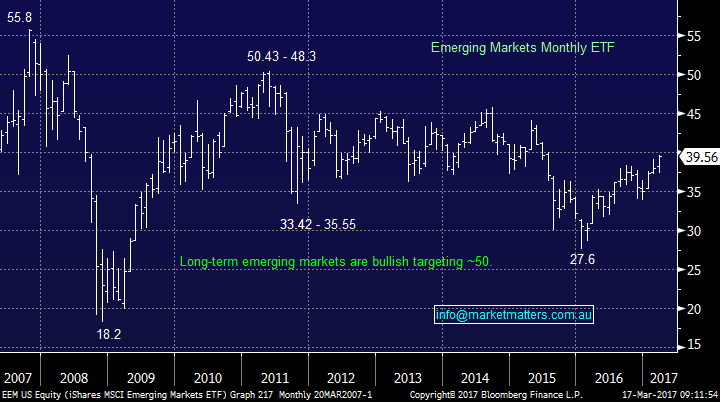

Importantly overnight, the $US followed through with its weakness falling another 0.5%. Today we are going to review the stocks in our portfolio with $US earnings as we are bearish the currency and believe the "masses" are long $US earners believing it’s an easy way to outperform the Australian Market - that scenario scares us.

Locally the local ASX200 remains in one of its strongest seasonal periods which generally lasts until the end of April, we can see our big 4 banks rallying another ~4% through to the end of April as investors receive some nice dividends from the likes of CBA / Telstra, and then position themselves for ANZ, NAB and WBC trading ex-dividend in May.

Looking into the second quarter of 2017 we currently expect a correction for local stocks in May / June which will coincide with our thoughts on US stocks and historical seasonal performance - nothing too dramatic, or complicated.

Yesterday we sent an alert to sell our investment in Macquarie Bank (MQG) at $89 and trading position in TPG Telecom (TPM) at $6.60, neither was filled, but we will leave the sell orders in the market today and then reassess over the weekend if they remain unfilled.

Emerging Markets (EEM) ETF Monthly Chart

The stocks which we hold with $US exposure are:

1. Altium (ALU) $7.50 / 4% - the software company receives ~45% of its revenue from the US. The stock has struggled since its recent result, after recently trading ex-dividend 11c its "rich" estimated P/E for 2017 of 26x is likely to hinder the stock's performance, potentially until its next result.

2. Ansell (ANN) $22.77 / 4% - the glove and condom maker receives ~40% of its revenue from the US. We still like ANN and believe the stock has further upside, especially as it’s trading on a very manageable valuation of 16.5x 2017 earnings.

3. CSL Ltd (CSL) $124.03 / 5% - the specialty biopharmaceutical company receives ~40% of its revenue from the US. CSL has been a recent and long-term star performer reaching an all-time high over $125 last week. There is no doubt this is an excellent company but the current valuation of 31.8x 2017 earnings is becoming rich.

4. Henderson Group (HGG) $3.67 / 8% - the fund manager will receive 50% of its revenue in $US after it merger with Janus. We still like HGG believing the stock is undervalued while it currently trades on a P/E of 13.8x 2017 earnings, we are currently targeting over $4.25.

5. Macquarie Group (MQG) $88.25 / 4% - Australia's 5th bank receives just under 30% of its revenue in $US. We are currently trying to sell this position in the market at $89 to reduce both our heavy financials and $US exposure.

6. QBE Insurance (QBE) $12.89 / 4% - receives ~10% of its pre-tax income from the US. We continue to believe there is a very real potential for corporate activity for QBE and while US interest rates look likely to advance we feel QBE is a good investment plus 10% $US exposure is relatively small.

While we're glad to say non of our holdings are exposed to the huge degree of over 75% like James Hardie (JHX) and Westfield (WFD) having 35% of our portfolio at risk to a falling $US is not a position we like.

Fortunately some of this $US exposure is offset by our recent foray into resources / gold sectors who actually benefit from a falling $US i.e. ~16.5% of our portfolio.

The obvious question we ask ourselves is which stock (s) do we want to reduce / exit to make our $US exposure more comfortable - remember we are bearish the $US.

Please note when we evaluate each individual holding there is zero thought as to where we acquired the position, what matters is today's price, plus the stocks valuation and outlook.

At current prices the two stocks that standout to us at MM as potential sells, not including MQG, are CSL and ALU.

*Watch for alerts.

$US Index Monthly Chart

Conclusion

There are again 3 important conclusions that we have reached from our work on $US stocks that has been summarised above. Subscribers should remember we are wearing our seller’s hat at present looking to increase our small 6% cash position.

1. We may lower both our $89 sell level for Macquarie Bank (MQG) and $6.60 for TPG Telecom (TPM).

2. We are seriously considering taking a good profit on our CSL position - note the stock went ex-dividend 64c unfranked 2 days ago.

3. We are seriously considering taking a small loss on our ALU position - note the stock went ex-dividend 11c unfranked 2 days ago.

Overnight Market Matters Wrap

- The US Markets closed with little change as investors were absorbing the US rate rise and the Fed’s message regarding the speed of future rate rises.

- Most metals on the LME were stronger, gold is up, iron ore is ahead by nearly 2% and oil is a touch weaker.

- The June SPI Futures is indicating a soft open to the upside in the ASX 200, towards the 5790 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here