Subscribers questions

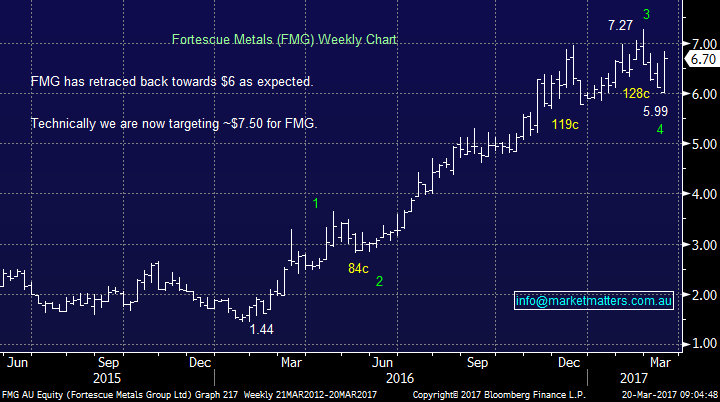

While the index was quiet last week individual sectors experienced very different results with the banks falling 1.5% while good gains in energy and resources stocks more than made up for these declines. MM were extremely happy on two very different fronts last week:

1. All four stocks that we have been recently accumulating closed strongly for the week i.e. BHP +4.9%, EVN +17.85, RIO +6.7% and RRL +7.6%.

2. We received a record number of subscriber questions for today's report, sorry if we could not cover yours today but a big thanks to everybody who made the effort!

One quick slice of news over the weekend was Deutsche Bank confirming they would raise $US8.6bn via a rights issue that is at a discount of around 35% to Fridays close. This increased supply of banking shares to fund managers may assist our view that US banks look set for a 6-7% correction, which is one of the main reasons underpinning our call to take profits on Macquarie last week.

Question 1

"Hello, A question for you: I have held Bluescope Steel (BSL) for a while now, it has recently enjoyed a resurgence – what are your views on this stock in the current market? Should I sell or hold on for a little more gain?? " Thanks, Matt.

Good morning Matt, thanks for the question which obviously we will answer in general terms only. Indeed BSL has rallied magnificently, along with most stocks exposed to steel prices, and technically we can see a test of the $17 resistance area. Stocks that enjoy profit upgrades as did BSL in late January usually outperform the market for at least a few months - BSL has benefitted from strong steel prices, some tax breaks, pay freezes but above all, they’re being innovative in their products offerings and have some very well regarding brands.

Our purchases of BHP and RIO over the last 2 weeks tells the story that we believe the sector should rally to fresh highs during 2017 which should be good news for BSL - assuming we are correct.

1. Given the strong trend perhaps consider selling 1/3 of your holding at $14, $15.50 and $16.50, this can be used in conjunction with point 3.

2. Conversely a slightly more aggressive plan would be to hold all your position using our exit of BHP and RIO as a proxy on timing.

3. If you are bullish resources medium term, like ourselves, you could utilise a "trailing stop", which we would currently have at $12.50 i.e. sell the shares if BSL falls back under this level.

Have a great week Matt and we hope one of these thoughts helps.

BlueScope Steel (BSL) Weekly Chart

Question 2

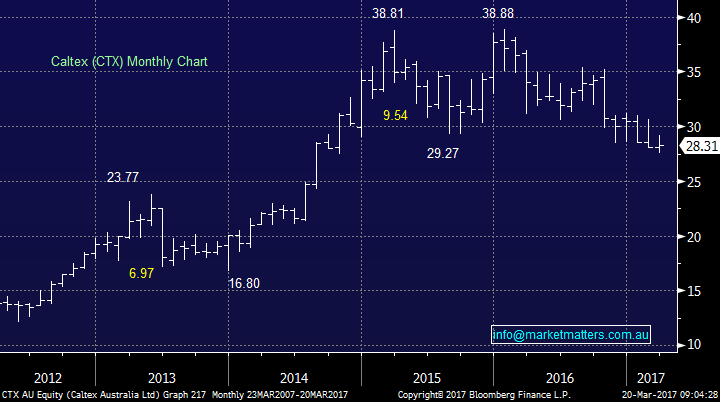

"Hi guys, Great info, thank you very much. I have a question outside of what you have been writing about but hoped you could confirm for me. I currently hold a long option on the Australian index at 5250 which expires tomorrow. If I allow it to expire, does it automatically settle into my account with my broker? I also have a short option on FMG at $7.00 expiring in May (the one you guys sold out of). I realise I can sell the option, what happens if I exercise the option before the expiry date? I assume if I let the option expire it is worthless? Thanks in advance," - Simon

Hi Simon, thanks for your questions which may help some of our subscribers understand the option market in more detail. Happily for a Monday morning your questions are relatively straightforward:

1.Yes, the option will automatically settle into your account assuming it has value. The settlement price is calculated by the using the opening price of stocks in the index on expiry day, hence it can be a random and very volatile opening few minutes with the final price regularly being 10-30 points higher, or lower, than anticipated but in our experience the majority of the time the market "squeezes" higher. Hence if the market opened at say 5750 your option position is worth 500-points, it's irrelevant where the market closes on the day. Importantly, only Index options are cash settled automatically.

2. The FMG position is in two parts:

a. If you exercise the option early you simply sell your shares at $7 that day, with usual settlement timeframes applying. Note if you do not hold the stock you will then be short FMG shares. Exercising makes sense if you hold the stock.

b. If you hold the position until expiry, you will need to instruct your broker to exercise the position if its in the money. i.e the stock is trading below $7. Most brokers have this set up automatically and as a default however it’s worth checking.

ASX200 Daily Chart

Question 3

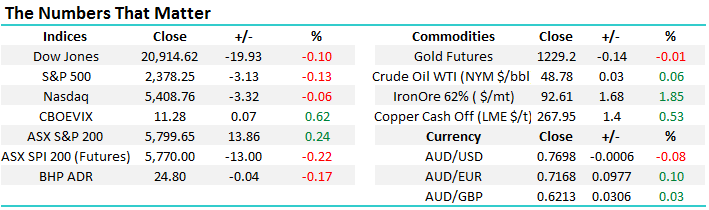

"Hello Team MM. thanks for today’s very well put together resume on your ALERT process. I asked a subscribers question some weeks ago that was never responded to: i.e. - Who were the valuable assets = people who left Platinum Asset Management, causing its performance to drop. I see that you still believe in this dog. I have lost a considerable amount of $ by “investing” = buying Platinum, based on Kerr Neilson’s reputation instead of looking at PTM’s YOY numbers. Never mind! You probably gave away more than you intended with your initial comments and now want to avoid answering this question: However, are you up for a private one on one phone call or face to face? Anyway, moving on. I would appreciate any comments you are prepared to offer on the whole HHL schmozzle and any subsequent investment possibilities in the Funds/ LICs mentioned in the following extract. Thanks for any response" - Doug.

Morning Doug, thanks for another question which is as to the point as usual, just as we like it. In terms of staff departures, these have been reasonably high relative to the sector which isn’t a surprise given PTM has the lowest cost to income ratio in the sector (i.e, the amount they spend on staff relative to their earnings). Without making specific reference to names, there have been key investment team members who have exited the business, however this should not be a major issue to performance for a business of that size and structure. It is unfortunate that you bought at higher levels but backing the individual without taking into consideration the broader investment case will often lead to disappointment.

Fortunately, we have only recently bought PTM and including its dividend we are showing a mere 1.5% paper loss based on Fridays close. We see 2 factors supporting the stock short term:

1. PTM is paying a 6.13% fully franked dividend, which we believe is sustainable

2. The company has announced a massive buyback of 10% of the company. This shows how the strength of PTM's current balance sheet BUT we are concerned they have not yet commenced buying any shares many months after the announcement.

Hence overall we remain positive targeting at least $5.40 and ideally $5.75, importantly the stock should have limited downside from this $5 area.

In terms of HHL, we’re not big in the LIC space and without a seat at the boardroom table, we’d be struggling to offer any value add insight here.

Platinum Asset Mgt. (PTM) Daily Chart

Question 4

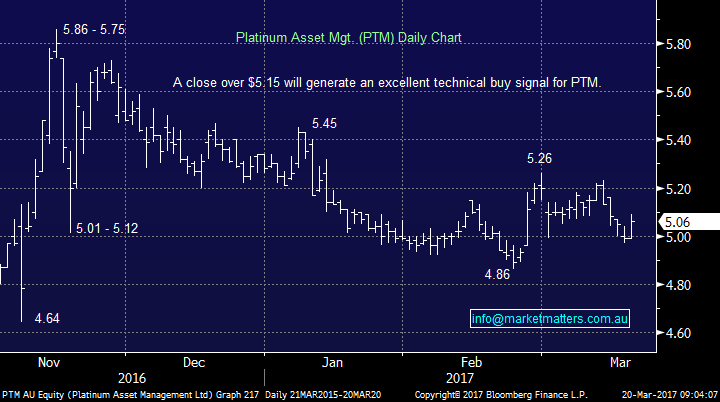

"Hi, I was after your outlook on Caltex (CTX). Ranging from $28.50 to $31 then I sell calls. But now it could break below $28 and drop to $23?" - Thanks Mark.

Hi Mark, thanks for the question we have answered primarily on a stock level. Importantly CTX is an oil refiner as opposed to producer and us such has actually performed well over the last few years when the oil price collapsed, dragging most of the energy sector with it. The stock pays a 3.2% fully franked yield, while trading on a conservative valuation of 13x estimated earnings for 2017. Our concern long term is the world's transition away from fossil fuels to the likes of solar and wind. Hence overall we are not interested in long term investments into the energy sector but more aggressive short term opportunities will still arise.

CTX is currently one of our preferred investments in the energy sector at current levels, especially after its 27% correction. We would not be panic selling at current levels and while selling calls over your holding makes total sense perhaps lower you targeted sell level to the $29.50 area - if any subscribers have questions around selling call options over stock to improve their yield please ask us.

Caltex (CTX) Monthly Chart

Question 5

"I’m trying to understand why you are showing proceeds based on the midpoint between the buy and sell price. I would have thought the price you have to pay to buy an option would be whatever the market shows for the “Ask” price and the price you receive when selling would be whatever the “Bid” price is. Would you be able to clarify this please. With thanks," - Paul

Hi Paul thanks for a great question, the answer is relatively simple, these are prices that we were able to transact at on the day. A couple of important specific points:

1. If you are trading spreads like we did with FMG, buying one put while selling another, you should never have to trade at bids / offers always somewhere in between depending on the market's volatility on the day and the size of the order

2. We often specify a price for the option (s) that we are trading and we never publish the figures if we were unable to transact a decent order at that price e.g. we purchased a FMG put spread when FMG was ~$7, the price we stipulated we traded.

3. If you are transacting via an online platform it can be harder to get good prices because you have no direct access to market makers – fortunately we do through our brokers at Shaw and Partners.

If you have further questions on this please ask.

Fortescue Metals (FMG) Weekly Chart

Question 6

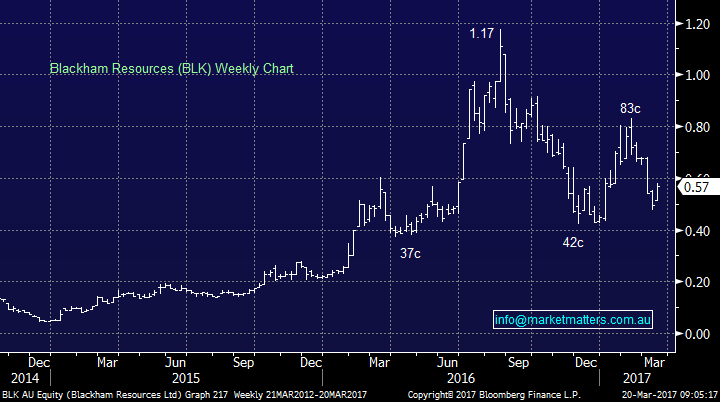

"Hi, I was wondering what you thought of Blackham Resources (BLK) at today's current price? Thanks" - Alex

Hi Alex were sorry but BLK is a casino style stock for us as it regularly surges / falls well over 30% in a month. Technically it's also very 50-50 but if we were long stops would be under last week’s 51c low.

Blackham Resources (BLK) Chart

Overnight Market Matters Wrap

- The US equity markets closed slightly lower, led by the financials last Friday.

- Iron Ore remained resilient, however BHP in the US closed 0.16% lower from Australia’s previous close.

- The June SPI Futures is indicating the ASX 200 to open 14 points lower, towards the 5785 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here