Two stocks who are sitting in our buy, and sell sights

US stocks looked poised to rally strongly overnight, until the news hit the wires that House leaders had delayed the crucial vote on the Trump administrations health-care bill - markets hate uncertainty. The delay came because an agreement had not been reached after the White House made what it called, a final offer - a political Mexican stand off? Markets continue to assess the outcome of these efforts to repeal Obamacare as a strong indication of Donald Trump's ability to implement his very market friendly policies during his tenure. Prior to the news of the votes delay the Dow was up ~100-points before closing down 4-points.

We believe Trump will ultimately get the approval from his Republican Party around healthcare, but the struggle to get this vote over the line does not bode well moving forward, especially considering the strength US equities have enjoyed since the November US election.

Our view on US stocks remains short term bullish, targeting a rally for the Dow towards 21,500 through the seasonally strong April, before a few months consolidation / pullback. Interestingly the overnight SPI futures are calling the ASX200 up ~20-points this morning, if the market can hold this degree of gains to end the week, it would bode well for stocks through to the end of March, and beyond into April.

US Dow Jones Daily Chart

Today we are looking at 4 stocks that MM are watching with a view to both buying / selling over coming weeks, remember we remain short bullish as we approach April, the seasonally strongest month of the year.

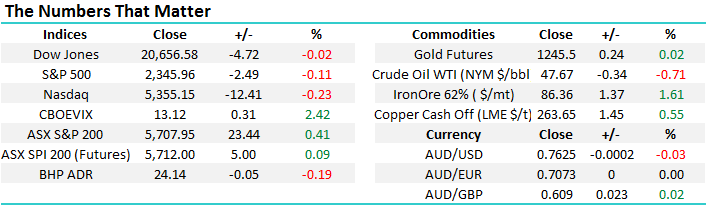

1. APA Group (APA) $8.83

APA Group is an infrastructure company who owns and / or operates gas transmission and distribution assets throughout Australia. The stock currently pays a grossed up yield of 5.1%.

Technically, APA is an excellent buy, targeting the $10 area, but the combination of a high valuation with the stock trading on an est. 2017 P/E of 41.7x and the stocks strength since last November, puts any purchase on the aggressive side of the ledger.

However we do like APA very much, targeting a ~15% advance, the lack of correlation with other stocks within our portfolio is also attractive.

We are buyers of APA ~$8.80.

APA Group (APA) Monthly Chart

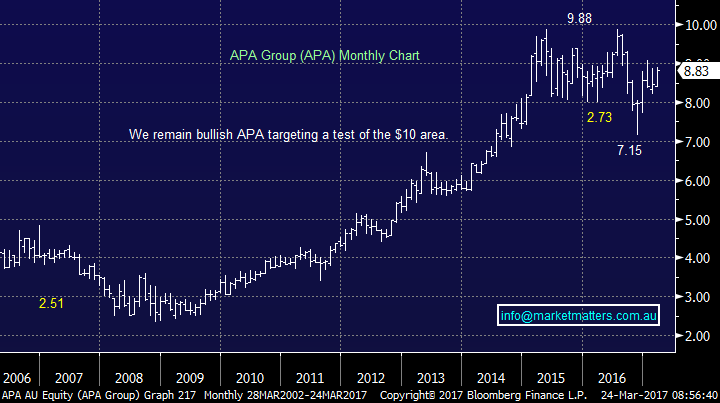

2. Fairfax Group (FXJ) $1.02

FXJ has been very strong since it reported its half yearly profit result in February, their profit rose over 200% to $84m plus a Domain demerger is underway.

Fundamentally will like Domain for the same reasons as REA Group i.e. the bulk of fees from selling property we believe is destined to move away from traditional real estate agents.

Technically FXJ looks excellent, threatening a breakout above its 2015 $1.11 high.

We are buyers of FXJ around $1.02, targeting fresh recent highs - similar to APA, we would regard this as a more aggressive position as FXJ has already advance strongly in February and March.

Fairfax Group (FXJ) Monthly Chart

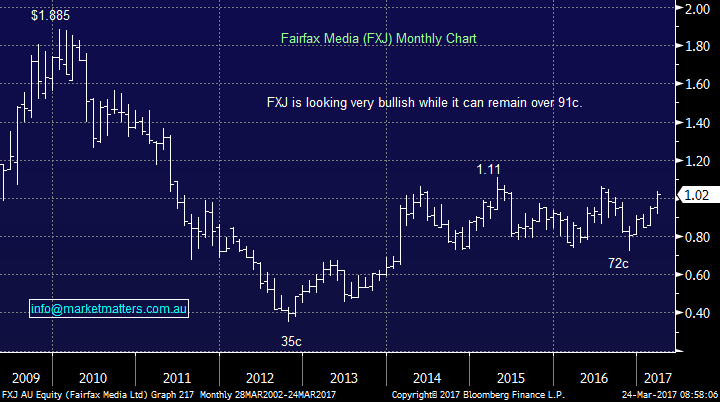

3. Ansell (ANN) $23.35

Ansell (ANN) is a stock we've enjoyed over the last year, haven taken some good profits around $25 and then a month ago buying back into the stock ~$21 - a significant 16% improvement in price.

ANN is a stock that can regularly move $3 in one month and MM are already showing a nice 10% paper profit on our purchase in February. With volatile stocks in particular, it's important to be prepared if opportunities present themselves, similar to our purchase of both BHP and RIO over the last few weeks.

We are sellers of our ANN position ~$26. - This would produce a profit of ~24%.

Ansell (ANN) Monthly Chart

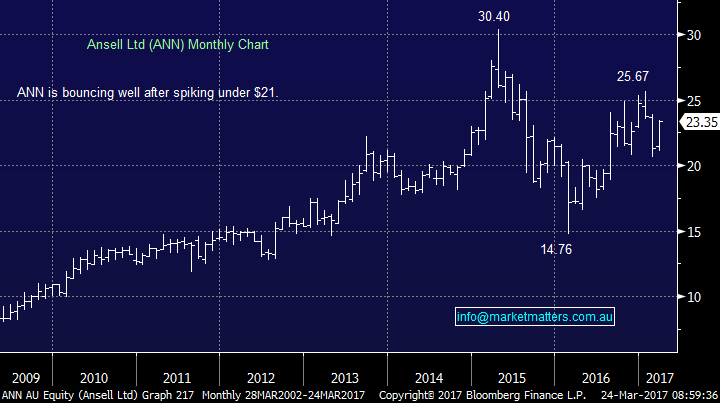

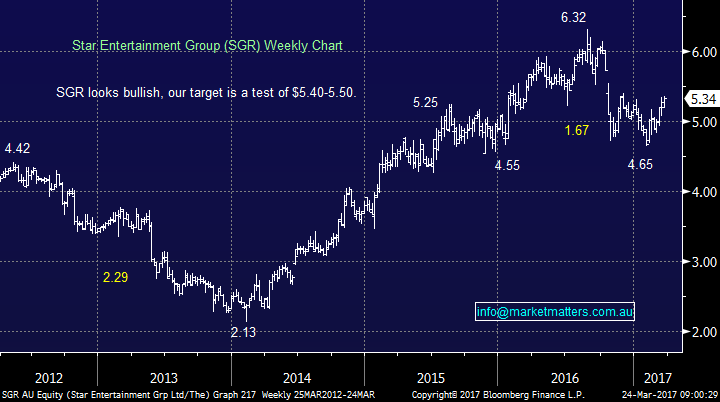

4. Star Entertainment (SGR) $5.34

MM have been long SGR since the first week of February from very close to its 12-month low. After receiving a 7.5c fully franked dividend, our investment is currently showing a healthy 14.2% paper profit, not including franking benefits.

We remain sellers in the $4.40-50 region - this would generate a nice 17-18% return.

Star Entertainment (SGR) Weekly Chart

Conclusion

We remain bullish equities over the next 4-5 weeks, leading us to the following 4 ideas:

1. Buyers - we are buyers of APA around $8.80 and FXJ around $1.02.

2. Selling -we are sellers of ANN around $26 and SGR around $5.40-50.

Overnight Market Matters Wrap

• US stocks fell after a vote on a health-care bill was delayed. The bill was seen as President Trump’s first policy test.

• Chinese President Li said that the recent back down on cross border laws which would benefit Australian vitamin and infant formula makers, wouldn’t be rolled back.

• Oil and gold are slightly lower, while iron ore is better and copper is in the black despite BHP workers at Escondida ending their strike.

• The June SPI Futures is indicating the ASX 200 to open 21 points higher, towards the 5,730 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here