“Don’t fight the tape ” – Jesse Livermore

Jesse Livermore was a legendary stock market trader born way back in 1877, both a famous and must read book for any avid investor / trader was written on his life titled "Reminiscences of a Stock Operator". His success in the markets was that incredible that he amassed a ~$US100m fortune back in 1929, literally billions of dollars today. We have actually used a lot of poetic licence with today's title but the price action in yesterday’s Australian market reminded us of the Jesse Livermore story, with the main point being don't ignore what the markets trying to tell you - he often called it the tape as there were no screens in his day!

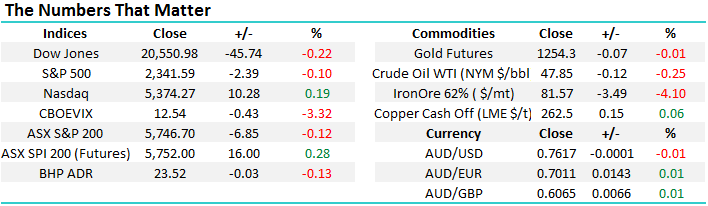

As we commence typing this report on Monday evening the US Futures market are pointing to the Dow opening down 200-points but the SPI futures are showing the ASX200 opening unchanged on Tuesday morning after only falling 6.8-points on Monday. The Australian market had the kitchen sink thrown at it on Monday with the US futures getting smacked plus iron ore was in free fall in China trade. However after falling ~55-points in early trade the local market slowly but surely rallied all day to only close down 0.12%, led by the "big 4" banks which all closed positive, a huge performance that should not be ignored. This morning we awake and the US market has recovered well with the broad S&P500 closing down only 0.1%, again the NASDAQ led the recovery closing up 0.2% - we remain very bullish the NASDAQ medium term. The ASX200 is set to open up around 20-points, this is a market that currently does not want to fall.

The important take outs for us:

1. If global markets can hold together after Donald Trump's embarrassing defeat on Obamacare the Australian market looks poised to rally towards 5900-6000 over the coming 4-5 weeks.

2. This bullish outlook which we have held for a while is founded on April being seasonally the strongest month for Australian equities.

3. We are looking for the Australian banks to rally ~4% in April and yesterday’s strength certainly added weight to this view. Repricing of mortgages is seeing earnings upgrades for the sector.

4. Lastly the simple fundamentals to help our market over the coming 4-5 weeks - (1) Investors are about to receive huge dividends in coming weeks from the likes of BHP, Telstra, Wesfarmers and Commonwealth Bank. (2) ANZ, NAB and Westpac's dividends are looming in May and many investors like to get set early to avoid worries around the 45-day holding rule with franking credits.

ASX200 Seasonality Chart

Yesterday shares in Myer surged close to 20% after a mystery buyer purchased ~10% of Myer stock with Solomon Lew's name being the rumoured purchaser. A week ago we wrote a morning report titled "Is a takeover tsunami unfolding" and the activity in Myer illustrated our view perfectly that 2017 is likely to see plenty of corporate activity with aggressors looking to lock in low interest rates while they can. As subscribers know we are bullish stocks over the next 4-5 weeks so we are comfortable buying potential "situation" stocks at this stage of cycle. Below we have touched on 4 stocks below we are watching carefully in today's market, with 2 of them in the potential "takeover target" basket:

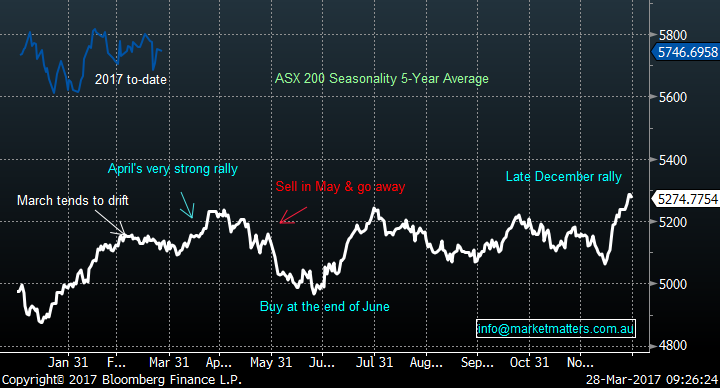

1. Fairfax Group (FXJ) $1.05

We wrote on Fairfax last Friday, FXJ has been very strong since it reported its half yearly profit result in February, their profit rose over 200% to $84m plus a Domain demerger is underway + there is speculation that private equity may be sniffing around for the entire group. Fundamentally, we like Domain for the same reasons as REA Group i.e. the bulk of fees from selling property we believe is destined to move away from traditional real estate agents.

Technically FXJ looks excellent threatening a breakout above its 2015 $1.11 high.

We are buyers of FXJ around $1.05 targeting fresh recent highs - while we would regard this as a more aggressive play we do see very limited downside at this stage with the jewel Domain under FXJ's umbrella.

Fairfax Group (FXJ) Monthly Chart

2. Mantra Group (MTR) $2.61

At MM we took a loss on hotel operator Mantra (MTR) in mid-January close to $3, today the stock is ~13% lower and again catching our eye. The company is enjoying some strong profit growth as inbound tourism grows but the stock remains unloved. Recently rumours of interest in MTR from the world's largest hotel chain, The Intercontinental Group was reported in the Australian, yet the stock failed to rally. Importantly hotel rooms, particularly in Sydney and Melbourne, are in short supply and MTR looks very well positioned to at least maintain its 4% fully franked yield.

We will revisit MTR closer to $2.50, but do perceive the risks to be slightly higher than in FXJ.

Mantra Group (MTR) Daily Chart

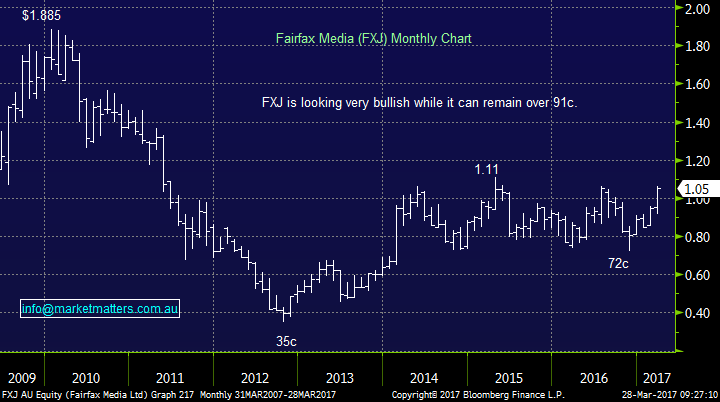

3. OZ Minerals (OZL) $8.04

OZL has been hammered over 20% as resource stocks fell out of favour with investors since mid-February. OZL is a well run company with an extremely strong balance sheet, and some very good growth projects available to it

We are trading buyers of OZL on any spike under $7.90 targeting a sharp ~15% rally.

OZ Minerals (OZL) Daily Chart

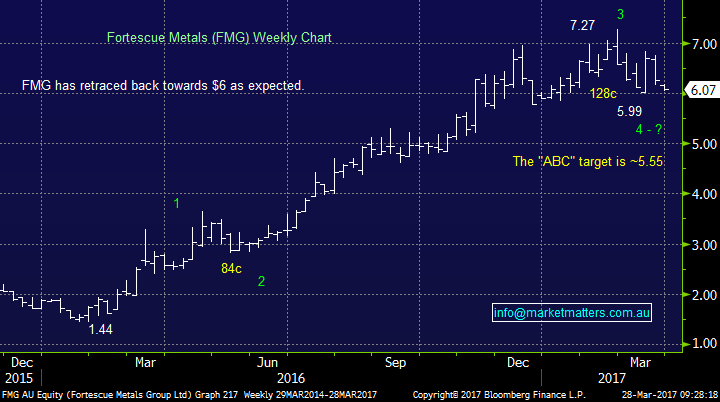

4. Fortescue Metals (FMG) $6.07

FMG has been hammered during the recent aggressive correction in iron ore but on the company level FMG continues to pay down debt at a rapid level and is likely to become a "cash cow" in the years ahead. FMG can be a very volatile stock regularly moving 15% in one week helping it to become our most successful trading vehicle since our inception.

If FMG spikes down towards $5.60 we are trading buyers.

Fortescue Metals (FMG) Weekly Chart

Conclusion

We remain bullish equities over the next 4-5 weeks, helping our comfort with the following 4 ideas:

1. Investment Buyers - we are buyers of FXJ around $1.05 and will look at MTR closer to $2.50. We perceive limited downside from both these stocks from current levels even when / if the market follows its usual path lower in May.

2. Trading Buyers - we are buyers of OZL on a spike under $7.90 and FMG around $5.60. However, from a risk / reward perspective we will not chase these stocks at higher levels.

Overnight Market Matters Wrap

· A good recovery from the lows in the US market overnight, with the market closing lower, but well up from session lows.

· Iron Ore continued its weakness from Asia’s session, ending the day down 4.1%, while BHP in the US closed an equivalent -0.13% to $23.52 from Australia’s previous close.

· M&A activity continues to grow in Australia – Vocus (VOC) sold its stake in Macquarie Telecom (MAQ) for $40m yesterday, while rumours continue that Solomon Lew was linked to the Myer (MYR) trade.

· A jump of 22 points higher is expected this morning in the ASX 200, towards the 5770 area, as indicated by the June SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here