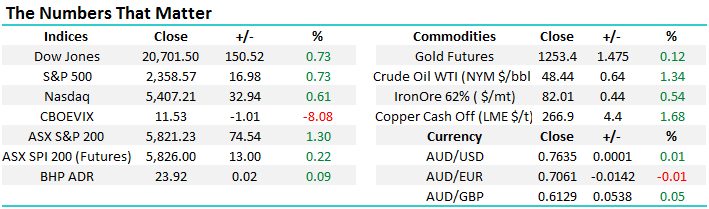

Stand back and enjoy the market rally.

Recently we've been pushing the bullish view for local stocks very hard, hopefully it hasn't become too boring! Yesterday's 75-point surge by the ASX200 illustrates perfectly that fund managers are underweight the local market hoping for a fall to buy, unfortunately for them "hope" rarely is rewarded in the stock market. We may not be witnessing massive buying at this stage but a lack of selling can lead to equally dramatic rallies. It doesn't matter how overvalued fund managers may believe stocks have become if they are underweight they cannot sell, and potentially may even be mandated to buy just when they should actually be considering selling - this is how tops are created.

Lastly for good measure as we have mentioned recently some large dividends are paid locally this time of year, starting with almost $8bn this week alone, some of these monies will come straight back into the market and this increased demand can have a dramatic impact on prices when there is a dearth of selling.

After yesterday’s very strong performance by Australian stocks, led by the Banking Sector which rallied 2.7%, lets update exactly how we see the local market moving forward:

1. The ASX20 does still remain in its 5833 - 5675 trading range of the last 32 trading days but today it should punch higher to fresh 2017 highs. The 5833 resistance now becomes support. and we will remain short term bullish while 5810 holds.

2. Yesterday the ASX200 closed at fresh highs for March –, with the market looking to challenge 5850 today a new 2017 high, statistically we should be testing 5900 by Friday!

3. Bigger picture the current quarterly range is the lowest since mid-2016, another bullish statistical proponent of our short term 5900 minimum target.

ASX200 Daily Chart

We have been calling a test of 6000 by the end of April and this is a view we are becoming increasingly comfortable with, but remember we will be selling into this strength if / when it evolves.

In the bigger picture we can easily see a test of 6500 by the ASX200, over 10% higher, in 2017 - ideally after a pullback in May/June and before a deeper correction plays out. Hence our planned selling in late April to increase our cash levels will be with the view to re-entering back into the market around early July - when the seasonals are working don't fight them. This is one way we aim to add value at MM, the recent example being our switch within the banks courtesy of the 10.6% correction in US banks. We sold Macquarie Group ~$88.60 and bought into NAB ~$31.70 a few days later, MQG is 40c below our sell level and NAB is $1.14 above our buy level.

ASX200 Quarterly Chart

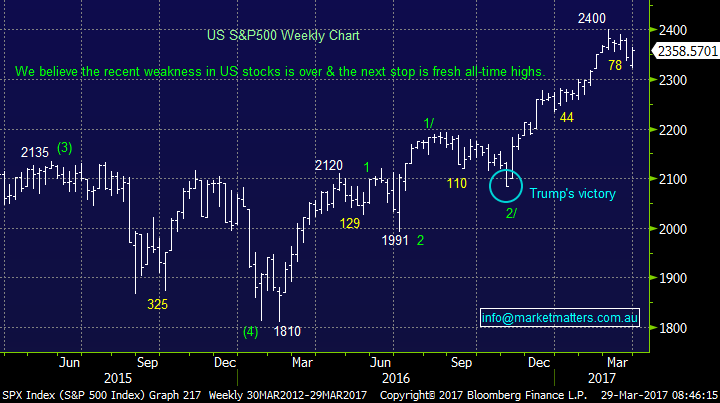

US stocks have rallied strongly overnight led by the financials, a very similar picture to what we enjoyed yesterday. US stocks have just experienced a minor 3.2% correction which our local stocks have largely ignored i.e. the S&P500 is still 1.7% under its March high but the ASX200 is set to make fresh highs for the year on the opening today. It's refreshing to finally witness some outperformance from the Australian market and our view is this will continue to unfold during April. We maintain our target in the 2430 area for the S&P500, around 3% higher, before a reasonable correction as we move into the bearish May-June period. If we are correct and US stocks gain 3% from here then a 4% rally locally is very realistic and this targets ~6050 in April.

US S&P 500 Weekly Chart

Now moving onto the hugely influential banking sector - you all know we are currently bullish the Australian banks with holdings in CBA, ANZ, NAB & SUN totalling 29.5% of our portfolio. US banks corrected perfectly for us back to the 280 area (over 10%) and we are now again bullish US banks anticipating a continuation of the bullish trend since early 2016 - remember the "trend is your friend" is a regularly coined phrase because it works! Our initial short term target for US Banks is a move to fresh 2017 highs, at least 10% higher. Potentially our forecasted 4% rally by the local banks in April may be too conservative.

US S&P500 Banking Index Weekly Chart

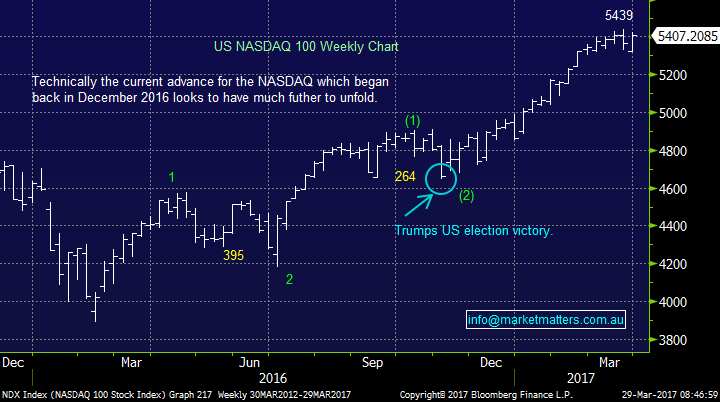

Lastly moving onto our current favourite market index the NASDAQ. We remain bullish the NASDAQ which looks set to again make fresh all-time highs in the coming days, an ideal target for this current advance prior to a consolidation would be around the 5550 area, or ~35 higher.

US NASDAQ 100 Index Weekly Chart

Conclusion

We remain bullish equities over the next 4-5 weeks, the caveat being if the ASX200 breaks out towards 5850 and then suddenly fails and closes under 5800

Overnight Market Matters Wrap

- Another bullish session in the States overnight with Financials leading the market higher

- Iron Ore bounced, Copper was up, Gold was down a tad (-$4) however a reasonable performance given a higher market + a higher $US

- A lot of talk now being centred around M&A in Australia with the following companies seemingly in play; Fairfax (FXJ), Myer (MYR), Mantra (MTR) & QBE (QBE).

- Another jump of 22 points higher is expected this morning in the ASX 200, towards the 5845 area, as indicated by the June SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here