As Healthscope falls is it time to buy private hospitals?

Yesterday the local market chopped around in a pretty unconvincing manner but at least it did recover from its two intraday attempts at falling over 20-points. You are obviously now well aware that we have finally entered April, the strongest month of the year although this historical fact does concern us when we read it in 3 different publications within 24-hours - all statistics have outliers! Technically we remain bullish while the ASX200 can hold over 5810 and yesterday's solid rally after 2pm left the market only 28-points below the 5900 psychological barrier so all looks good at this stage. Remember our work recently highlighted that April regularly tops out mid-month, something we will bear in mind as we plan to increase cash levels into strength.

However, if you play with the numbers April stands out as the best month for Australian equities with Banks / Financials the strongest sectors and Healthcare the weakest. This makes sense with CBA paying out ~$3.4bn in fully franked dividends today and ANZ, NAB and WBC going ex-dividend in May. However the banks are already up 24% for the year and 4.3% in just the last 5 days, hence do not be surprised if we start taking profit if they experience a further 2-3% advance over coming weeks.

ASX200 Daily Chart

It's amazing how often the US market follows the path "little old Australia" set only 24 hours beforehand. Overnight the Dow closed down a mere 13-points but it did attempt a decent correction, falling 133-points intra-day - almost a mirror like trading day to ours on Monday. This rejection of lower levels confirms our short term bullish stance on US equities and we maintain our target in the 2425 area for the S&P500, ~3% higher - before a reasonable correction as we move into the bearish May-June period. If we are correct and US stocks gain ~3% from this mornings close a subsequent rally locally to the 5950-6000 region for the ASX200 is very realistic.

Our current favourite market index the NASDAQ yet again made fresh all-time highs last night which is another good sign for the overall stock markets short-term.

US S&P 500 Daily Chart

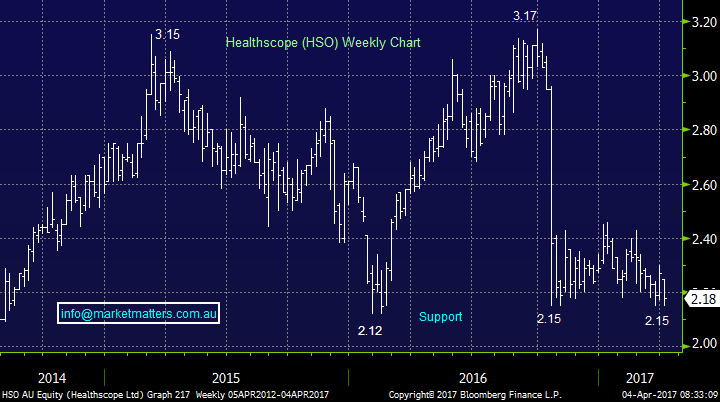

Today we are looking at two healthcare stocks following the appointment of Gordon Ballantyne as CEO of Healthscope (HSO) and the subsequent 4% decline in the share price, testing the lows of recent years. They also released second-half earnings expectations yesterday which re-confirmed that domestic operations continued to experience subdued growth (~2.2%) and this appeared to be the catalyst for the drop in the shares.

Two aspects worth noting;

1. Australian private health operators have recently experienced tough trading conditions as the cost of health insurance continues to rise, which has a negative impact on volume growth (number of users).

2. The insurers have been pushing back on the costs of some procedures as they try to protect their own margins / performance is a tough environment

Interestingly, the new Healthscope CEO did invest $1m of his own money into HSO shares citing the industries bigger picture growth prospects, which we agree with. Australia has undoubtedly got an ageing population which bodes well for private healthcare into the future. The government, which is clearly worried about its own debt burden is keen for future growth in the private health care sector which is supportive of the sector.

Healthscope (HSO) $2.18

At the end of February we sold Healthscope (HSO) for $2.33 and bought Ramsay Health Care (RHC) at $69, pleasingly the switch is currently unfolding as expected with HSO having fallen 6.4% while RHC has risen 1.4%, including its dividend, over the same period. While its nice to see a switch rapidly move ~8% in our favour it's certainly not our planned ultimate outcome. What to from here?

1. We believe HSO's share price will continue to struggle until we see signs of a turnaround in earnings' growth, importantly this is an outcome we believe will occur. We remain buyers of HSO between $2 and $2.10 i.e. over 10% below where we exited the stock in February.

2. HSO is now surprisingly cheap compared to RHC, the obvious question is how much cheaper will it become - HSO is trading on 20.4x est. 2017 earnings compared to RHC which is trading on 26.4x - RHC is 30% more expensive purely looking at 2017 earnings, however RHC has better growth and more diversification to its earnings than HSO and justifies the premium.

Ultimately we believe MM will be able to switch back from RHC to HSO for an improvement of over 15% on Februarys numbers - stage one is being buyers of HSO ~$2.05.

Healthscope (HSO) Weekly Chart

Ramsay Health Care (RHC) $69.43

RHC is one of the best private hospital operators on the global stage. We went long in February ~$69, a touch early as the stock finally experienced a 26% correction as high P/E stocks were dumped across the market. We like RHC in the bigger picture, especially after they reiterated earnings guidance for this financial year targeting over 10% growth. However we still plan to take small profits on our RHC position, ideally around the $72 area where the P/E will be nudging towards the 30x area.

Remember we are only targeting a further 5% upside for the US Healthcare Sector prior to a meaningful correction.

Ramsay Health Care Ltd (RHC) Weekly Chart

Conclusion

We remain short-term bullish equities into April, unless the ASX200 breaks back under 5810 level.

However we are now wearing our "sellers hat" ideally with the intention of increasing cash levels in the 5950-6000 region.

We are buyers of HSO ~$2.05 and sellers of RHC ~$72, if we achieve both these objectives it will represent a 17% value add to our private hospital position.

As discussed in the Weekend Report, we are looking at Oz Minerals (OZL) today as a shorter term trade

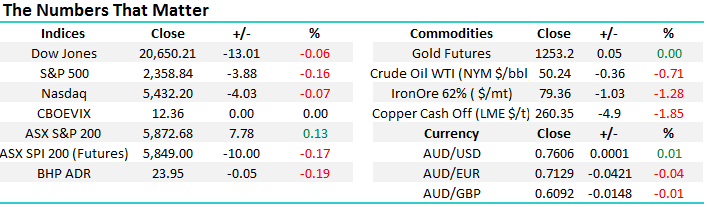

Overnight Market Matters Wrap

· The US Share Markets had a quiet session ending its day slightly lower, with focus seen in the bonds and commodities markets.

· Gold rose marginally higher, while the volatility (VIX) index was unchanged and remained in complacency levels at 12.37.

· Our little Aussie battler remained in underperformance mode for its third consecutive session.

· The ASX 200 is expected to open marginally lower, towards the 5,865 area as indicated by the June SPI Futures this morning. This afternoon, the RBA is expected to leave rates unchanged for April.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/04/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here