BHP powers the ASX200 to a 2-year high

The roads are empty this morning as the school holidays start and Easter holidays loom only a few days away. The trip in from Manly at 6.00am was a quick one on the Triumph! As we have mentioned previously, these "holiday periods" usually lead to low volumes in stock markets, but often large movements in the underlying market itself. Yesterday's was a classic example of this, with the 50-point rally taking the market within 1.4% of the psychological 6000 area. We have little doubt this level will be broken this year and potentially this month!

The last time the local market was trading well clear of 5900 was in April 2015, when CBA was well over $90 and BHP around $30. A move over 6000 would take the local index to levels not seen since the start of 2008, but when we consider the appreciation of local property over the last 10-years, it's an easy argument that Australian stocks have plenty of catching up to do on a comparative basis. Fund managers who are sitting on their reported piles of cash must be becoming increasingly uncomfortable, as the pullback they are all anticipating is simply not materialising.

For the majority of Monday the market's solid advance was led by the banks and financials, courtesy of rising bond yields, as we anticipated in the weekend report. However the real acceleration was provided by BHP, which gained $1 in the last hour of the day's trade, following talk of the demerger of its petroleum business from hedge fund, Elliott Advisors who own over 4% of BHP. This is nothing new, but what was interesting was the ease in which the stock rallied almost 5%. As we keep saying, the path of least resistance remains clearly up, because institutions are underweight the market - we will look at BHP in more detail later in the report.

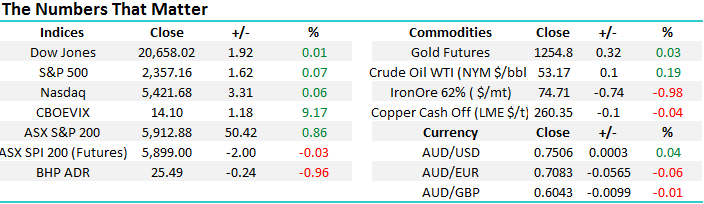

At Market Matters, we remain committed to our view of a rally well over 6000 for the ASX200 in 2017/18 and the toughest question at present is - will the market experience weakness in May / June, to coincide with the usual market seasonal gyrations? At this point in time, we still feel the local market will follow the medium term path illustrated by the arrows in the following monthly chart, but remain open minded as the current bull market unfolds.

ASX200 Monthly Chart

US stocks remain in hibernation and its refreshing to see the local market pushing to fresh 2-year highs, while the Dow remains in a correction, currently ~3.5% - we still feel confident that the ASX200 will outperform US stocks in 2017 for the first time in 11-years, even if we are a touch behind at present.

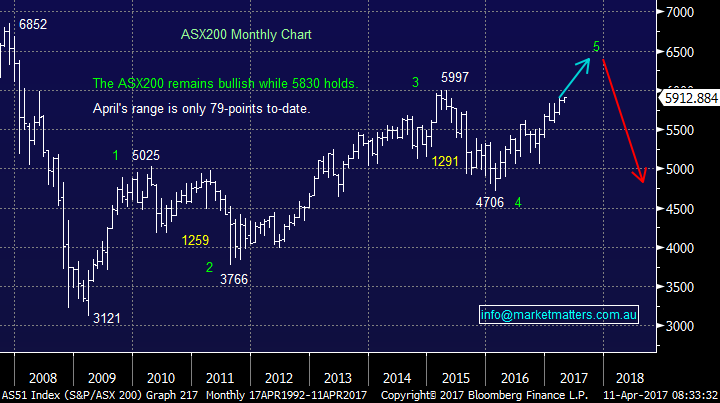

We continue to refer to the NASDAQ for clues to how US stocks will unfold moving forward, simply because it remains the clearest index at present.

Our current take-outs:

1. The NASDAQ has reached our minimum short-term target area, following the US election, but our preferred scenario would be another 3-4% higher.

2. We believe a decent correction for the NASDAQ of ~5% is not far away - perhaps "sell in May and go away".

3. Importantly, we are buyers of the next 5% correction as we currently remain bullish the NASDAQ through 2017.

US NASDAQ 100 Weekly Chart

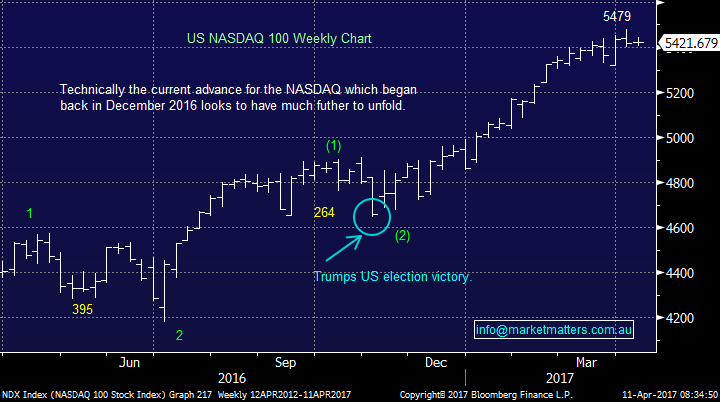

Moving onto the hot topic of conversation this morning, "the big Australian" BHP - the stock closed ~$25.50 in the US, down 23c from yesterday’s storming close. BHP's price action will be fascinating today, can it hold / add to yesterday’s explosive gains? We find it hard to imagine any significant selling unfolding, as the stock remains 8% below its 2017 highs and last night the energy sector gained 0.75% in the US.

Hedge fund billionaire Paul Singer, who runs Elliott Advisors, believes his proposals for BHP will win over most of its shareholders. We are not convinced, but do believe it will return the investment communities focus clearly back to the underlying value of the "cash cow" that is BHP. Singer has a history of using his stakes in companies to improve value for shareholders and yesterday’s 10-page report sending the BHP share price up $1.14, close to 5%, is testament that when he talks, the market does listen.

BHP has been the leader of demergers since 2001 – Onesteel, BlueScope, S32 etc. but overnight BHP have said "the Elliott petroleum demerger proposals would outweigh the benefits".Overall we are likely to see a lot more debate but we believe the worst case scenario is BHP gets it act more into gear and the market pushes the stock higher and the best case BHP is forced to deliver more capital to shareholders e.g. dividends and buybacks - a win-win for BHP shareholders, even while we believe the demerger is unlikely to unfold.

We remain both bullish and long BHP, targeting ~$30 in 2017/18.

BHP Billiton (BHP) Weekly Chart

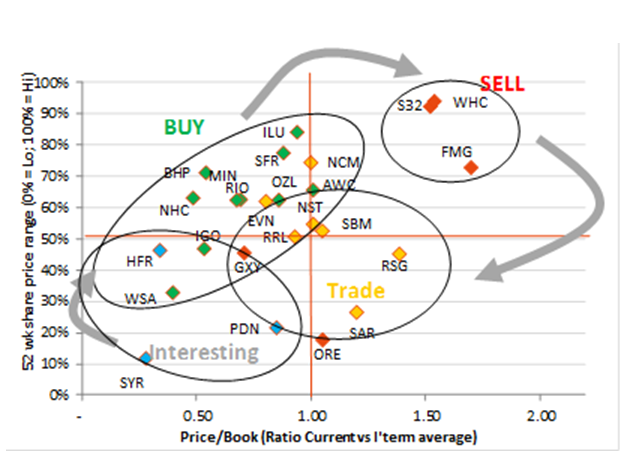

We love the below visual investment thesis provided by SHAW and Partners highly regarded resources analyst. We remain pleased to see our resources investments in BHP, EVN and RIO, plus trade in Oz Minerals, all sitting nicely in the buy side of this representation.

Source; Shaw and Partners Research

Lastly, moving onto our switch yesterday, which certainly made everyone breathe a sigh of relief at MM - a good initial sign. We sold out of our big loser Vocus (VOC) early in the day, before it closed down another 2.4% making its decline now 56.7% over the last year, for MM this is now only a trading stock until further notice.

We allocated 5% of our portfolio into CYB, the spin off bank from NAB that operates in the UK - we are very keen on European facing exposure at this point in time. This clearly leaves the MM very overweight the banking sector, our current intention is to take profit on our CBA position into seasonal April strength, ideally in the $88 region.

CYBG PLC Daily Chart

Conclusions

We remain short-term bullish local equities in April, unless the ASX200 breaks back under 5830 level.

However, we are now wearing our medium term "seller’s hat" ideally with the intention of increasing cash levels in the 5950-6000 region.

Bigger picture, we have some very exciting times ahead!

We believe the demerger at BHP is overall unlikely, but we remain bullish the world's largest mining stock targeting ~$30.

Overnight Market Matters Wrap

· The US markets closed on a marginal positive note, however it was experienced with lower than usual volumes ahead of corporate earnings and geopolitical tensions.

· The energy sector had a good session, rallying 0.19 % and on a winning streak as of late – a good support on BHP after ending an equivalent of 1.01% lower in the US from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 7 points higher, testing the 5,920 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/04/2017. 8.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here