China trumps North Korea!

Firstly please excuse the slightly corny title but it does sum up our feelings on equity markets moving forward. There is currently a substantial amount of geo-political "noise" in financial markets which can easily send investors scampering to the sidelines but we remind readers of our opinion stated in a few recent reports - "Politics will create bumps in the road for stocks but economics will determine their real direction". Since the surprise strike on Syria Donald Trump would appear to have acted very smartly by strengthening ties with China both economically and politically around North Korea, perhaps he sees himself going down in history as the American President who ended North Korea's military threat to the world.

Over the Easter break Chinese data was very strong showing the economy grew at 6.9% in the last quarter, the first back-back acceleration in over 7-years - we still believe that both China and Europe will outperform economists' expectations this year, especially given the leadership change looming in China. Importantly if China continues to grow the "reflation trade" which has backed off over recent weeks should reawaken with a bang soon.

The local market was thumped last Thursday as traders / investors saw no reason to be brave and buy stocks ahead of the Easter break – which is understandable. The 44-point (0.7%) drop was driven by the resources with BHP -4%, RIO -4.4% and Fortescue -6.8% after iron ore plummeted last week & FMG missed production forecasts. Iron Ore has now fallen a colossal 30.2% since the later February highs. The break under 5900 by the ASX200 ended our very short-term bullish stance but importantly we remain positive stocks through 2017/8 still targeting well over the psychological 6000 area.

We have recently increased the MM Portfolio's cash position slightly to 16% so we are now buyers of certain sectors while remaining sellers of strength, as we remember the seasonality factors:

This is an ideal time to consider the statistical analysis we did around April's trading for the ASX200 since the GFC, back in the Thursday 6th April report:

1. 75% of the time the ASX200 formed a meaningful top around mid-April.

2. April is seasonally the strongest month of the year but the ASX200 has hit our initial 5950 target.

So far this April has actually been quiet in terms of range with the index only trading between 5833 and 5950 (117-points) hence a break of these extremes is statistically likely to target either 6050, or 5733 - great lines in the sand for both traders and investors.

ASX200 Monthly Chart

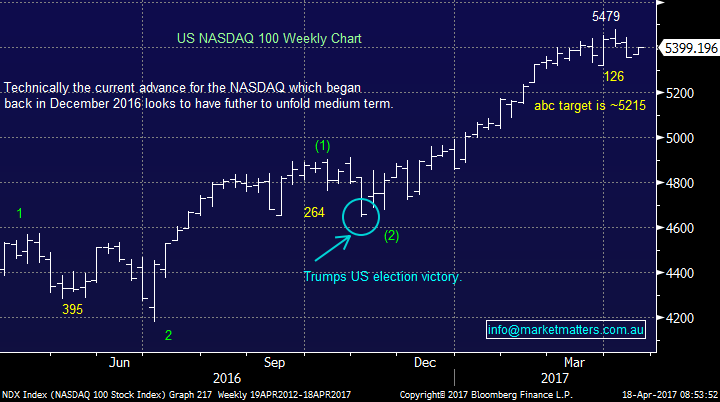

As touched on earlier we believe the key moving forward for equities has very quickly become "is the reflation trade over?". If it is interest rates rises will lag expectations and both banking and resource stocks will struggle. The market is now only factoring in a 36% chance that the Fed will hike interest rates to 1.25%-1.5% this year, the lowest level since February. Let's have a quick look at the leading US index, the NASDAQ, which we continue to find the clearest technically:

1. If the NASDAQ is going to reach our short-term ideal buy zone ~5215 it still has a further 3.4% to decline.

2. Conversely the S&P500 looks to be a good risk / reward buy around the 2300 area, ~2% lower.

3. However medium-term the NASDAQ continues to look very bullish and our preferred stance is buyers of weakness, not sellers for now

We are 50-50 whether the NASDAQ now continues its rally towards 5600, or retraces further towards the 5200 area but we continue to look for ~5% corrections to buy.

US NASDAQ Weekly Chart

We believe the time to switch from defensive stocks (healthcare and utilities) to the cyclical sectors (banks and resources) is now, or very close at hand. Hence we took some excellent profits from our gold holdings in Evolution (EVN) and Regis

Resources (RRL) recently as we anticipate its safe haven lustre will fade over coming weeks, however as we continue to believe the $US will weaken over 2017 the strong likelihood remains that we will again be establishing a gold exposure moving forward - the plan is to buy again into weakness!

US banks recovered strongly last night and while so far they have fallen short of the ideal "buy zone" the trend remains up so this is no surprise. We continue to see further 15-20% upside for US banks.

US S&P500 Banking Index Weekly Chart

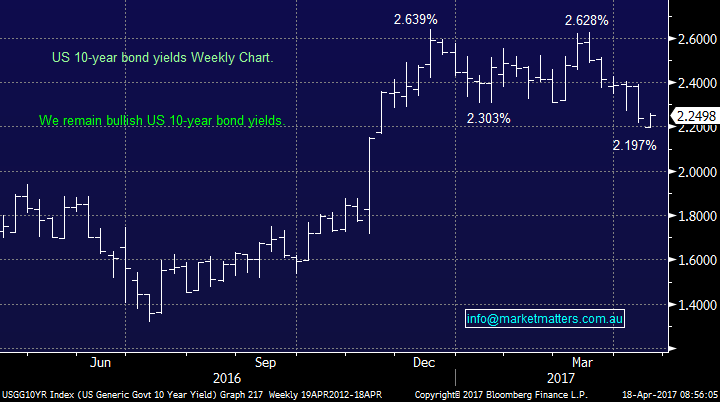

From both technical and fundamental perspective we do not believe the 2016/7 reflation trade has run its course and we remain bearish the $US which is bullish commodities and oil, plus with the Chinese economy regaining strength the rally may surprise many. The US bonds which arguably are the dominant player in the mosaic of factors determining the direction of both stocks and sectors has not yet generated a clear technical buy signal but last night's rally was encouraging - a close back over 2.325% for US 10-year bond yield will be very bullish and likely to send bank stocks soaring.

US 10-year bond yields Weekly Chart

Conclusion

Clearly there is a huge number of political and economic undercurrents at play right now which we certainly take into consideration however at time like this its often best to sit back and look at price action and money flow between assets as outlined above

We therefore remain bullish stocks in 2017/8 with the ASX200 targeting well over the psychological 6000 area before we prefer more bearish positioning or simply sitting on the sidelines.

We believe it's time to re-establish the reflation trade by selling healthcare / utilities and buying cyclical stocks like banks / resources.

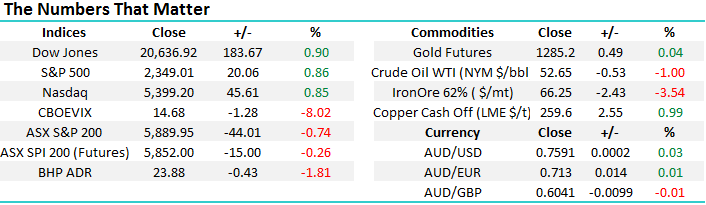

Overnight Market Matters Wrap

· The US share markets started the week in the green, breaking its 3-day losing streak, focusing on corporate earnings and ignoring the current geopolitical tensions.

· On the treasuries side, the US 10-year bond yield increased to 2.25%, with expectations for future rate hikes now fairly low

· Iron Ore was a disappointment last night, losing 3.54% as investors’ concerns of a rising stockpile in China continues to weigh on prices

· Australia is likely to follow Asia’s weak lead and open 16 points lower to 5874 as indicated by the June SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/04/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here