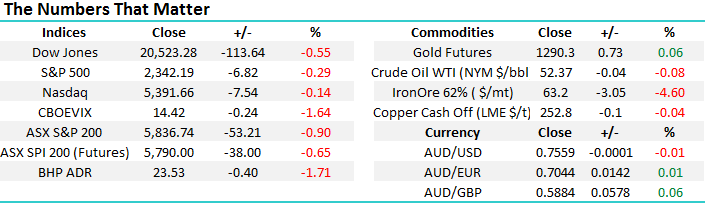

Uncertainty increases as the UK face a surprise election

Overnight US stocks slipped marginally but the main attention was in Europe after Theresa May called a surprise snap election for June 8th. The polls have the Conservatives ahead by over 20 points but the BREXIT result clearly remains fresh in many people's minds. This move by May makes total sense and we believe should eventually be positive for equities, but markets hate uncertainty and the FTSE fell 2.5% overnight primarily due to the strong pound which hurts UK exporters. The pound agrees with our simple analysis:

(a) If May increases her majority, as expected, negotiations around BREXIT should be cleaner at least from a UK point of view.

(b) If the Labour Party surprise everyone and win the election they may take BREXIT back to the polls with the result potentially very different.

Both of these scenarios should ultimately be UK and pound positive, which is good for our holdings in CYB and Henderson (HGG). With US stocks weaker overnight, led by the Financials and Healthcare Sectors, we are hopeful of getting set in our purchase of CYB under $4.60.

Yesterdays selloff in local stocks was far more dramatic than we anticipated over the mornings first coffee but the reasons slowly came to the surface. During the day iron ore fell another 3.7% dragging miners in its wake, Telco's were again smacked as TPG Telecom resumed trading after suspension, gold stocks were smacked led by Newcrest Mining and finally last night as mentioned Theresa May called a snap election in the UK pushing European stocks lower - interestingly CYB who operates in the UK was by far the weakest bank on the ASX200. Today we will outline our thoughts and plans as they evolve in this relatively fast market, focusing on the currently volatile Telco, Gold and Resources Sectors. We are sitting on 15% cash and looking to go shopping into the weaker market, the obvious question is when do we stand in front of the train?

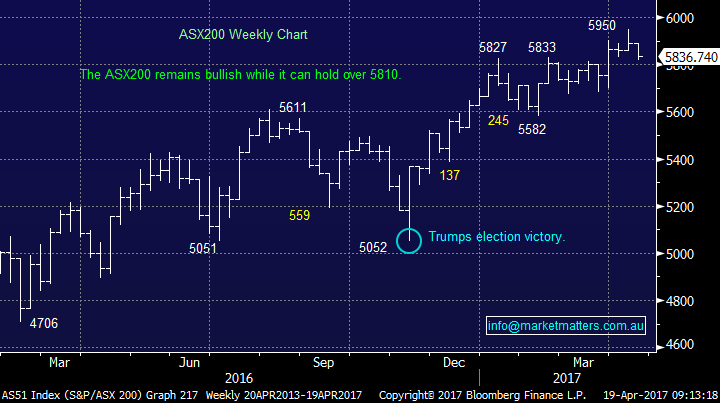

1. In yesterday's Morning Report we highlighted April's small range, this was broken on the downside targeting ~5730 in the next 12-days.

2. However a break of the major 5800 area support is likely to test major support ~5600 as the ASX200 corrects the 900-point advance since the US election in November. Perhaps "sell in May and go away" has arrived early.

While the short-term picture is clearly clouded as we move from one geo-political issue to another we remain bullish local stocks targeting ~6300 for the ASX200 in 2017/8. However for the local market to outperform the US for the first time in 11-years we obviously need to see a decent recovery in the Resources Sector over coming weeks / months.

One quick interesting point is the current weakness in equities should not be attributed to the likes of Syria and North Korea, it's all been about falling belief of sustainable global growth. Hence over the last 48 hours we have seen resources, gold's and banks fall but gains from the "yield play" e.g. Transurban and Sydney Airports - a list that would usually include Telstra!

ASX200 Weekly Chart

As touched on yesterday we believe the key moving forward for equities has very quickly become "is the reflation trade over?". Our view remains that the reflation trade will kick back into vogue moving forward but clearly at present this opinion feels like "catching a falling knife" stuff.

1. If the NASDAQ is going to reach our short-term ideal buy zone ~5215 it still has a further 3.2% to decline.

2. Conversely the S&P500 looks to be a good risk / reward buy around the 2300 area, only ~1.8% lower.

3. However medium-term the NASDAQ continues to look very bullish and our preferred stance is buyers of weakness, not sellers.

4. The important US Banking Sector has now corrected almost 12% and is in our "buy zone".

We are 50-50 whether the NASDAQ now continues its rally towards 5600, or retraces further towards the 5200 area but we continue to look for ~5% corrections to buy. Hence overall we currently have no major concerns surrounding US equities, our issues are mainly domestic i.e. our Telco and Resources stocks.

US S&P500 Banking Index Weekly Chart

Yesterday we took a small profit in Ramsay Healthcare following the plans we have outlined in reports over recent weeks as we look to move from the "security" of the Healthcare Sector - we are also watching our Ansell (ANN) position carefully. We remain positive the "reflation trade" despite its recent weakness and will be looking for areas to increase this exposure into any panic selling, hence today we are looking at 3 sectors that have been very much at the forefront of recent weakness in local stocks.

1. The Telco Sector

As we all know, TPG Telecom (TPM) have paid up big time to become the fourth player in the Australian mobile space, taking on Optus, Vodafone and Telstra. The sector is now down over 46% in the last 12-months, probably worse than the most extreme bearish forecasts that were circulating on the newswires. The impact of this extra player in the years to come is clearly going to damage margins and has led to the sudden de-rating of TLS in particular (given they charge they most). Today we are focusing on TLS primarily because we own it from slightly higher levels. Let's look at some important numbers:

1. TLS is now trading on a 7.75% fully franked yield but we believe this will be cut.

2. If the dividend is cut to 25c / almost 20%, which is more than analysts are currently forecasting, TLS will still yield 6.25% fully franked.

3. So although the recent developments are clearly negative for TLS, we feel the sell-off is slowly reaching a panic climax - interestingly nothing TPG has done was a surprise but markets were clearly asleep at the wheel.

4. Since TLS's dramatic 40% decline from its 2015 high ($6.73) it has bounced strongly many times, including 17.7% in mid-2016 and 12.5% around last Christmas.

Bear markets can be compared to a ping-pong ball bouncing down the stairs, it's going to ultimately reach the bottom but it will have some large bounces back up along the way. Our view is that we bought TLS a touch early around $4.28 but we would be accumulators into further panic selling under $4. Hence:

1. If we had a very short term view we would look to take the ~6% loss now and consider re-entering at lower levels.

2. If we are looking to hold medium term to enjoy the large fully franked dividends, we will look to average at lower levels.

We plan to be patient for a few more days / weeks as our entry level is ok, we have missed 35% of the decline. We may consider averaging into panic selling under $4 but also we are likely to sell a decent bounce being cognisant of the ping-pong ball analogy.

Telstra (TLS) Monthly Chart

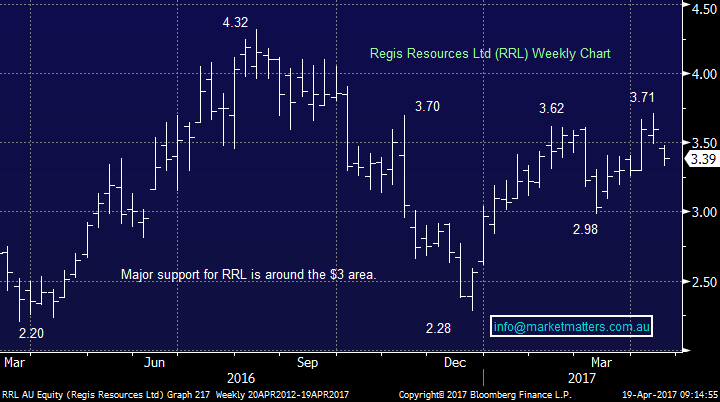

2. The Gold Sector

We regard gold stocks as short-term / trading stocks to add cream to our portfolios performance. The sector has been very good to us over recent years, including 2 nice profits in recent weeks:

1. We took an 18% profit in Evolution Mining (EVN) on Friday after only ~5 weeks.

2. We took a 20% profit in Regis Resources (RRL) earlier in April after only one month.

We remain positive gold moving through 2017 and have been planning to buy weakness in the sector which arrived extremely quickly yesterday. Investors have rapidly become more relaxed around North Korea and although the $US has drifted back under the psychological 100 area it feels like too many people were long the sector in anticipation of geo-political disaster. Our anticipated plan moving forward :

(a) We allocated 5% of the MM portfolio into NCM around $23.60, we would average this position if the opportunity arises ~$21.

(b) RRL yesterday closed ~ 7% below where we exited our last position. We are happy buyers initially ~$3.25 and secondly ~$3 - note RRL can be more volatile than NCM.

Newcrest Mining (NCM) Weekly Chart

Regis Resources (RRL) Weekly Chart

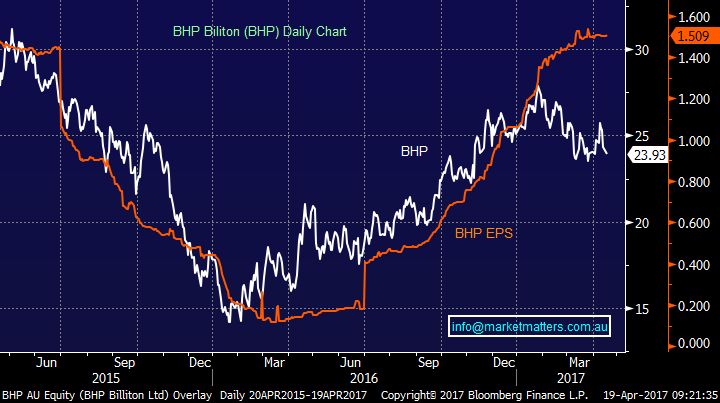

3. The Iron Ore Sector

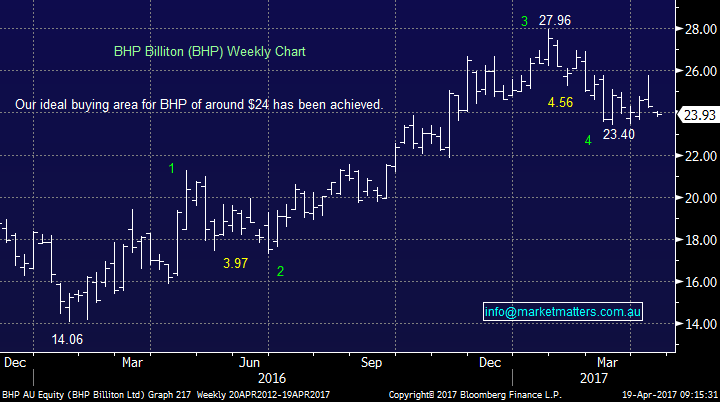

We are long both RIO and BHP from early March but even after recent falls in the sector the positions are only showing small paper losses as we purchased panic selling at the time. Overnight iron ore was again crunched 4.6% and importantly is suddenly trading ~10% below consensus analysts' forecasts for the bulk commodity in 2017 - nobody believed the dizzy heights it reached earlier in the year. We remain buyers of both of these diversified miners into current weakness.

We will be considering "topping up" our holdings in BHP ~$23 and RIO ~$57. The below chart which overlays BHP share price and current earnings highlights the reason for this view. We’d be concerned about the sector if the share price had outpaced earnings but we see the reverse playing out at this juncture. Over time share prices will track earnings implying more upside. (RIO very similar to the below BHP chart)

BHP Daily Chart (white line) BHP Earnings Per Share Est (orange line)

Additionally aggressive traders may want to consider buying Fortescue Metals under $5 for a decent bounce but we are not investors in FMG at present.

BHP Billiton (BHP) Weekly Chart

RIO Tinto (RIO) Weekly Chart

Conclusion

We remain bullish stocks in 2017/8 with the ASX200 targeting well over the psychological 6000 area before we prefer cash and sitting on the sidelines.

We believe it's time to slowly re-establish the reflation trade by selling healthcare / utilities and buying cyclical stocks like banks / resources.

Overnight Market Matters Wrap

·The US resumed the recent downtrend, with most indices losing most of yesterday’s gains.

·The metals and miners remain to be the laggards, with iron ore down another 4.6% lower overnight.

·The Volatility (VIX) Index is slowly creeping up out of complacency.

·The June SPI Futures is indicating the ASX 200 to open 24 points lower, towards the 5,810 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/04/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here