Subscribers questions

This weekend saw more jawboning from North Korea but this time it was a nuclear threat towards Australia! This whole situation feels to be spiralling out of control and from what we see, Kim Jong-un looks destined to follow in the footsteps of that other notorious dictator Saddam Hussein, the only question being when will China and America agree on the correct strategy.

It feels inappropriate to be discussing investments when potential war is dominating much of our news but in reality all we can do is move forward and hope the "powers that be" will implement the correct moves and this all becomes history for our grandchildren to learn about at school, and somehow try to comprehend.

The results from the first stage of the French election have gone the way markets were both hoping and expecting with the Euro rallying ~1.8% in early trade this morning.

Interestingly neither of the two historically main parties will be contesting the final vote on May 7th as citizens around the world continue to vote for change. Marine Le Pen (Far right) looks set to win the first round of voting with her anti-immigration views proving very popular as expected and Emmanuel Macron (On the Move!) with his only 1-year old party her opposition.

The 39-year old Macron is likely to win the second vote by a significant majority with Le Pen offending most people who did not originally vote for her. In simple terms Macron is good for stocks as he is pro the EU aiming to meet its 3% deficit target while offering to cut business taxes for companies that create jobs.

Later in the week will receive further market sensitive news with the anticipated announcement by Donald Trump & Co. with the details of his "big tax reform and tax reductions" we have been promised since the campaign trail began. The market's interpretation of this plan feels vital to the short-term direction for stocks.

We have no doubt that following the disappointment surrounding recent healthcare reforms the new administration will be trying to significantly lift their diminishing popularity after 100-days in power, it should theoretically be a market friendly package.

Combining how the market interprets this important economic step by the new President, the results from the first stage of the French election and the ongoing geo-political developments promises plenty of market volatility in coming days.

Short-term we are uncertain as to what comes next, we can see an "abc" correction back towards 5700 as well as a sharp rally towards 6000! Theoretically the French news this morning should assist the bullish camp - this morning the US S&P500 futures have opened up an impressive 22-points or 1% while the safe haven of gold is down almost $US20/oz.

ASX200 Daily Chart

Question 1

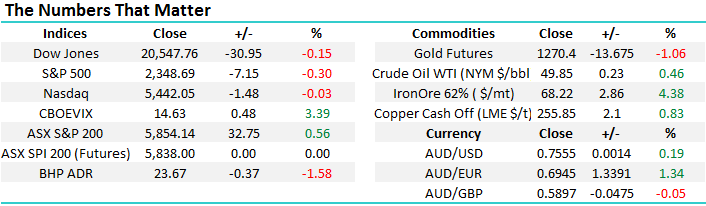

"Hi MM Team, could you please give me your opinion on Betashare’s Harvest ETF - (ASX code HVST). It pays around the 10% mark!!!!! This seems too good to be true, even in today’s market. Also what might it do in the falling market / correction that you guys are fore-shadowing. Is this a “pure “ dividend plus franking return, or is there a whiff of Ponzi / annuity with some capital erosion being used to boost the distribution? Or am I being too gloomy and suspicious?" - regards, Doug.

Morning Doug, an excellent question and very timely after our comments on high dividend stocks in the Weekend Report. The HVST is a fund which aims to provide regular income, comprising of dividends and franking credits from the local Australian market - their goal is to achieve a yield that is at least double that of the broad market. As you say the current yield is ~10.88% and 12.10% grossed up after franking credits.

The obvious observation of HVST since its inception in late 2014 is that while it has generated over 10% yield its actualvalue has fallen by almost 24% to-date, compared to the ASX200 which has appreciated ~8% over the same period,while still paying a decent fully franked yield - a no brainer where you would rather have been invested!

In our opinion the fund, by definition of its underlying mandate, is simply forced to buy the highest dividend paying stocks on the market without any thought to their quality, or the actual timing of purchases (other than that dictated by dividends) - hardly a value add product in our view. We have zero interest in HVST over the medium, or long term.

At MM we would only consider very occasionally using HVST in an attempt to "scalp" a cheeky dividend. Technically we can see Fund rallying ~4-5% from current levels hence if May's dividend has a high degree of franking it may be of interest. However overall we prefer individual stocks even for this more active form of yield chasing.

BetaShares Australian Dividend Harvester Fund (HVST) Weekly Chart

Question 2

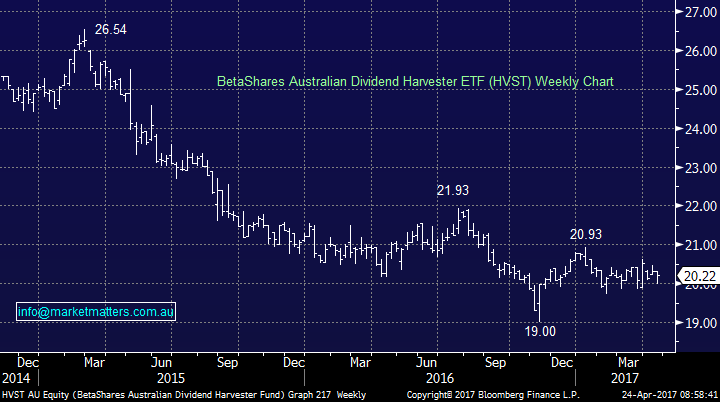

"Hi MM, A question for Monday and keep up the great work. Your miles ahead compared to other reports published. Just wanting your thoughts on Seasonality/Dividends for May. In the last 10 years the S&P 500 (BTV 7739) had 6 months up and 4 months down, while our ASX had 6 down and 4 up. I'm wondering that maybe "seasonality" and "details on Trumps taxes", could see a strong rally in the US in May. This could help reduce our usual ASX Ex Div pullback on banks and we may even see our May higher" Thanks Mark

Hi Mark, thanks for the encouraging words and importantly your well-timed question. We covered a large degree of this question in Sundays Weekend Report hence today we thought we would look at it from a different angle. Firstly looking at our long time view of the Australian Banks and their performance since the GFC:

1. After being thrown out with the bathwater in 2015 the banks have recovered extremely well rallying ~30% from their 2016 lows and are now sitting only 12% below the March 2015 all-time high.

2. We remain bullish both the banking and financial sectors targeting fresh all-time highs in 2017 /8 - note most analysts believe our banks are fully to overpriced.

The only reason to currently sell / lighten banks in our opinion is if you believe there is a strong possibility of buying back into the sector at lower levels. Secondly, let's specifically look at CBA since its low in September 2016.

1. Since Donald Trump's US election victory CBA has rallied 24.4% while also paying a very nice $1.99 fully franked dividend.

2. During this stunning advance, ignoring falls due to its dividend the stock as corrected close to 3% three times and once over 5%.

Our view is that switching between the banks at opportune times, to increase dividend flow and improve the net purchase level of stock makes sense if well can pick a retracement of ~5%, otherwise it's not worth "losing our position". Markets are experiencing significant intra-day / week volatility at present due to steady geo-political news flow, this could easily spike the ASX200 towards 6000 in coming weeks.

Hence our plan is to sell CBA close to $87-88 if we get a rally over coming weeks because we believe we have a very good probability re-enter closer to $80 - ideally this will coincide with a rally in US stocks of 3-4%. Plus we will also consider selling our ANZ holding after its traded ex-dividend on the 12th of May, with a view to buying additional CBA with one eye on its August dividend.

ASX200 Banking Index Quarterly Chart

Commonwealth bank (CBA) Daily Chart

Question 3

"Hi, There, how do you expect to be positioned if the market rallies towards your predicted major top?" - cheers Steve.

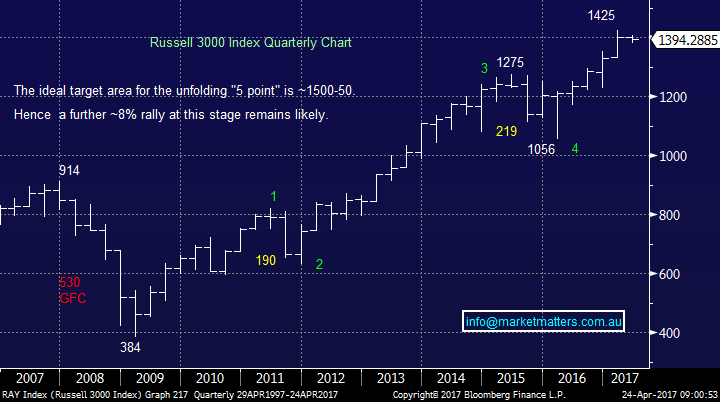

Morning Steve, a perfect question as the 8-year old bull market slowly but surely matures. As you know we are targeting a pullback of ~25% in 2017/8 but from higher levels. The first thing we would point out is the move we are forecasting to unfold is not out of the normal. Since the GFC, while the US market has rallied a massive ~250% we have still witnessed a 23% correction in 2011 and 17% in 2015/6. The stock market has been evolving for many decades and it has regularly rallied and corrected way above / below fair value as the human emotions of "fear & greed" drive prices in both directions on a short-term basis.

Moving onto your question, we are fortunate at MM that our only mandate is to try and maximise investment returns. Hence if we believe a 25% correction is close at hand from a risk / reward perspective there is no need to be heavily invested in stocks, a few months on the sidelines earning ~3% interest to maintain piece of mind, even if we are wrong, is unlikely to be too costly. Our underlying thoughts at this point in time:

1. We are likely to holding a minimum of 50% in cash.

2. Depending on how different sectors are looking we may have exposure to the gold and / or stable yielding sectors.

3. We may be holding bearish positions via options and / or ETF's.

Hopefully this helps but just remember the classic quote "if in doubt stay out!".

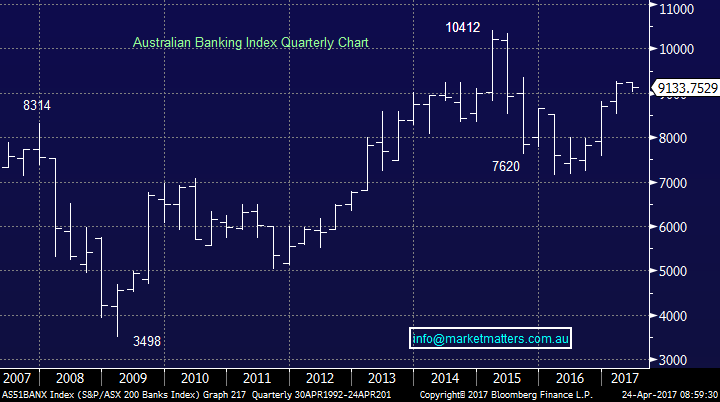

US NASDAQ Weekly Chart

US Russell 3000 Quarterly Chart

Question 4

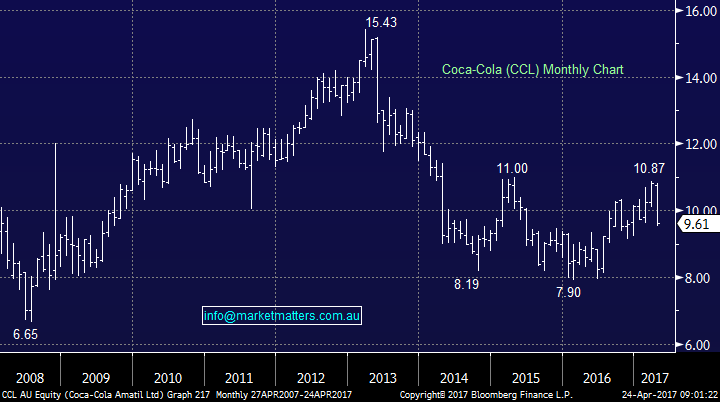

"What are your thoughts on Coke (CCL) after it was smashed last week, isn't this a Warren Buffett favourite?" - Thanks Gary.

Last week CCL was smacked over 10% on a profit downgrade leaving the stock one of the great underperformers of the rally since the GFC - CCL has actually fallen 37% since its 2013 highs. The stock is on an est. P/E of 17x its 2017 earnings while paying a yield of 4.79% fully franked, so theoretically its not toon expensive.

However we strongly believe the world is slowly believing the nutritionists / doctors who are preaching the danger of processed sugars with soft drinks arguably in their cross-hairs the most. Governments in the western world are now spending much more on diabetes than smoking related issues......sugar taxes are likely to only increase as healthcare costs is a major issue to most western countries.

We believe that unless CCL can reinvent itself moving forward the stock will be a massive underperformer at best, we remain bearish CCL both technically and fundamentally.Warren Buffett has been a long term supporter of Coke but we wouldn't be surprised if he's evaluating this investment closely.

Coca-Cola Amatil (CCL) Monthly Chart

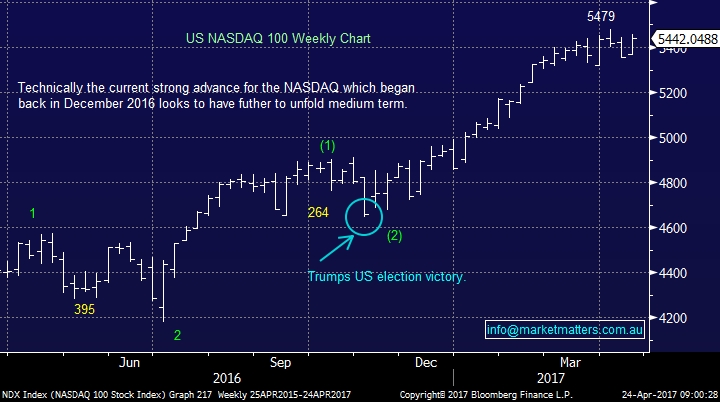

Overnight Market Matters Wrap

· The US share markets closed marginally lower overnight, as all eyes are on the French election, where it is down to two.

· This Thursday, US President Trump is set to provide details for tax cuts.

· A quiet session is expected today, with the June SPI Futures is indicating a 7 point gain above the 5,860 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/04/2017. 8.55AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here