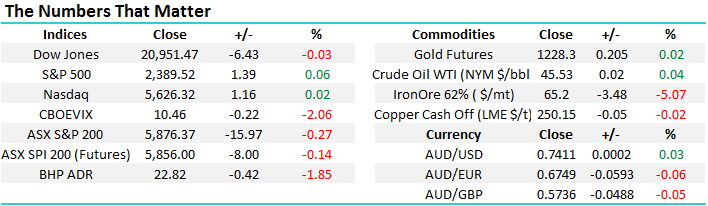

Keeping Our Finger on the Pulse as Volatility Rises

The ASX200 has rapidly declined 100-points from its Monday 1st of May high and we continue to believe it’s “sell in May and go away” time. If we assume Monday’s 5956 high remains the high for May, the below numbers become very relevant:

1. The average statistical monthly range points to a test of the strong psychological support around 5800 in May i.e. during the few coming weeks.

2. The average correction since the GFC during the May-June period is 6.9%, which targets a decline towards major support around 5600.

Overall the pullback targets should not be that scary when we consider the 904-points (17.9%) advance, which the local market has enjoyed since Donald Trump’s US election victory back in November, but what it does remind us is we should be in no hurry to deploy our large ~30% cash holding in the MM portfolio. Obviously there will be some stock specific opportunities, but there clearly is no great hurry to buy the broad market until further notice.

ASX200 Daily Chart

When markets “rollover”, one characteristic we have noticed over the years is the Australian market is often the leader – there is a degree of logic to this when we consider the ASX200 is geared towards global growth.

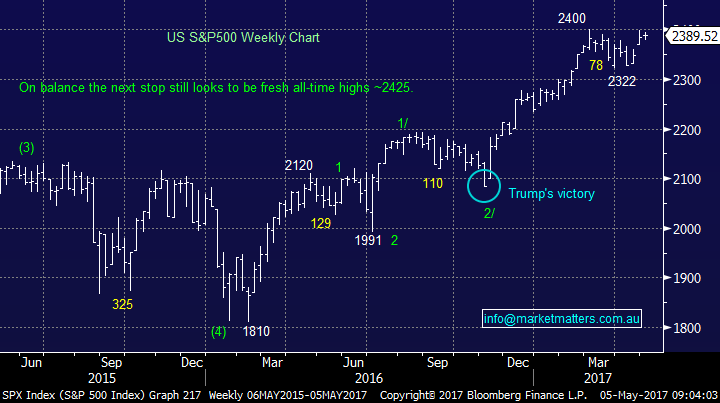

This morning, US stocks have closed marginally higher, ignoring Donald Trump’s belated victory in the senate to repel Obamacare. The market is treading water as it awaits for Friday night’s US Non-Farm Payroll’s numbers i.e. US employment data. Overall, US equities remain extremely close to our initial upside target and the risk / reward continues to not favour general buying:

1. The US S&P500 still looks poised to rally another ~1.5%over next few days / weeks.

2. A 5% correction is still looming rapidly on the horizon, it still feels like we are heading towards a classic "sell in May and go away" scenario for US stocks.

3. Assuming we get a 5% correction over May / June, similar to last year, we will be keen buyers into this weakness, targeting further gains later in 2017. The NASDAQ is likely to be our yardstick for a buy area with US stocks and we will be simply looking for a correction of ~265-points, similar to that of October / November 2016.

US S&P500 Weekly Chart

The Market Matters Portfolio

Building on yesterday morning’s note we are again going to quickly review our sector / stock holdings and importantly, our plans around these exposures to a potentially weakening market. It’s always frustrating to see any stock which you own fall, but it is almost inevitable during market corrections. Our 30% cash position has enabled us to be far more relaxed over recent days, but we reiterate when we believe the market is going to correct 25% later in 2017 /18, not the 5% we are anticipating now, our cash holding will be well over 50%.

Cash; We are comfortable with our 30% cash holding, which in general terms we plan to allocate back into stocks if our anticipated ~5% weakness unfolds for stocks.

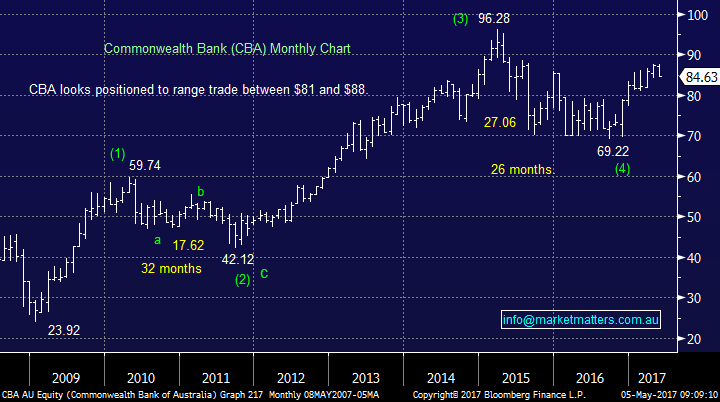

Banks; We have a reasonable exposure to the banking sector via ANZ 8%, CYBG Plc 7.5% and NAB 4%. Our plan at this stage is to sell / reduce our ANZ holding once the stock has traded ex-div. in 3-days’ time.

Ideally then into weakness, we will buy back into CBA closer to the $80-$81 area, plus we may increase our NAB holding to 7.5%. We are currently keen on our Europe exposure which includes CYB.

Commonwealth Bank (CBA) Monthly Chart

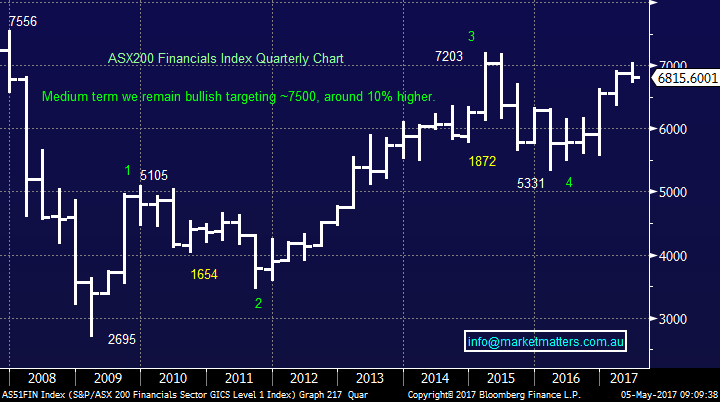

Diversified Financials; We have a chunky exposure to the financials index via Suncorp 12%, QBE 4% and Henderson Group 8%. However this remains our favourite sector during 2017 with our target ~10% higher and happily these are our favourite 3 stocks within the sector, hence we remain comfortable these holdings. We will look to buy the very popular Challenger if it experiences a $2 correction over the next 1-2 months.

ASX200 Financials Index Quarterly Chart

Telco’s; We have a 5% exposure to Telstra around current levels, this a short term yield play with August’s dividend not far away. We would average the position under $4. but if we see a correction in the ASX200 of ~5% and TLS holds up as we suspect it may, then it will become a prime candidate to be used as a funding vehicle for better opportunities that may have pulled back.

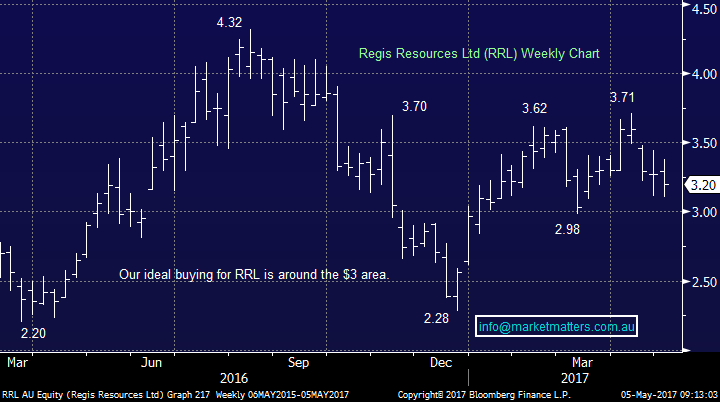

Golds; No major change to our gold sector outlook and plan. We have a 5% NCM position which was in hindsight, entered into prematurely during this current correction and hence, we remain very patient with our planned purchase of Regis Resources (RRL) under $3.05.

We still intend to allocate 5% of the MM portfolio into RRL under $3.05.

Regis Resources (RRL) Weekly Chart

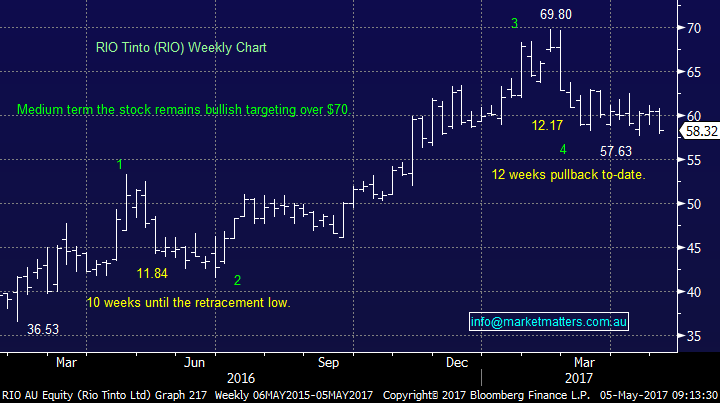

Resources; We own a larger resources sector exposure than at any time over recent years, as we have stepped up and bought the current pull back in the big miners. We are comfortable with our stock selection of BHP, OZL and RIO with a relatively large 17.5% exposure to the sector, however the pullback has now run further than anticipated and we currently have no intention of averaging these 3 holdings at this stage, however nor are we looking to exit them!

RIO Tinto (RIO) Weekly Chart

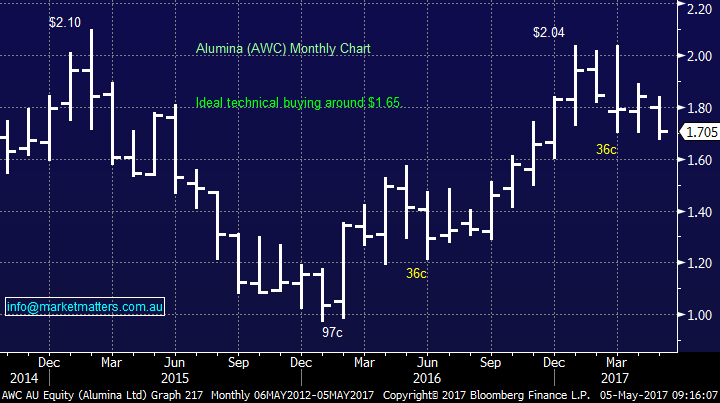

We like AWC under $1.70 and are considering this as a medium-term trade. The only reason we will not buy as an investment is our already decent exposure to the resources space.

Alumina (AWC) Monthly Chart

Conclusion (s)

The market has unfolded to-date as we expect over May-June, we intend to become active buyers into further weakness.

Overnight Market Matters Wrap

· Another uneventful day in the US share markets overnight, after the repeal of Obamacare and the US Senate providing its final legislative approval to a US$1.2 trillion spending tab.

· Oil slid to its lowest in nearly 6 months, along with Iron Ore in Asia trade ending limit down yesterday with concerns over the global outlook for demand vs. supply.

· Domestically, BHP is expected to underperform against the broader market after endings its US session down an equivalent of -1.85%, while Macquarie Group (MQG) is expected to outperform, after a massive beat on its earnings against consensus.

· The June SPI Futures is indicating the ASX 200 to open 6 points higher, towards the 5,880 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/05/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here