Is China becoming the Canary in the Coalmine…Again?

The ASX200 managed a solid 0.6% rally yesterday, but the resources again failed to live up to their early promise as the underlying commodities came under renewed pressure during our time zone. The news that China’s iron ore imports dived 13% to a 6-month low with rising stockpiles weighed on prices and did nothing to help the mood e.g. Fortescue (FMG) was up 5% early in the morning, but only managed a gain of 1.5% by the session’s end. Copper also continues to weigh on the miners with the base metal making fresh 4-year lows last night.

Overall, we remain comfortable with our view that stocks are at an inflection point with our first target for the ASX200 at 5800, and a potential test of the 5600 area. However we are still awaiting signals that our sell banks, buy resources call is gaining any traction.

ASX200 Daily Chart

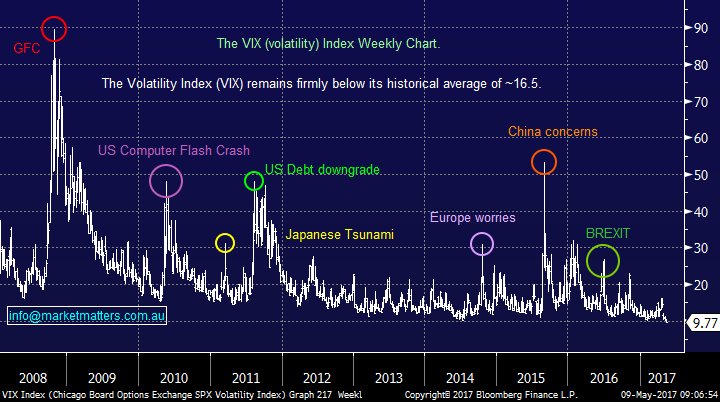

Overseas markets were extremely quiet last night, with the “Fear Index” (VIX) trading at an extraordinary 24-year low - we have a substantial degree of complacency in equity markets at present. However we feel stock markets are feeling “tired” at the moment, which is no great surprise after their excellent rally over the last 5-months e.g. last night we saw European equities fall around 0.5%, even after they received the result they wanted from the French election.

Our view at current levels remains basically unchanged:

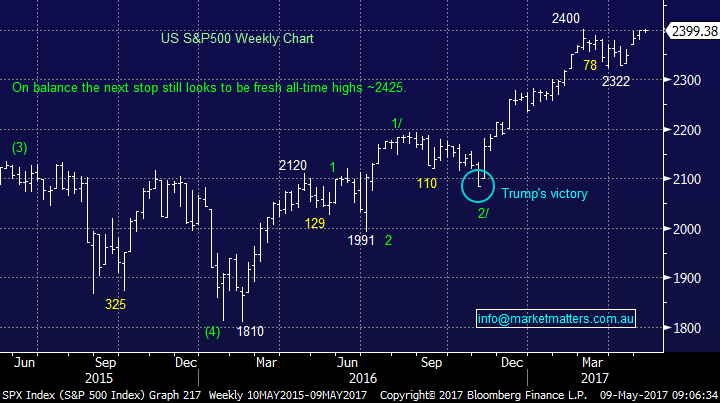

1. The US S&P500 still looks poised to rally another ~1% over the next few days / weeks.

2. A 5% correction is looming rapidly on the horizon, it still feels like we are heading towards a classic "sell in May and go away" scenario for US stocks.

3. Assuming we get a 5% correction over May / June, similar to last year, we will be keen buyers into this weakness, targeting further gains later in 2017. The NASDAQ is likely to be our yardstick for a buy area with US stocks and we will be simply looking for a correction of ~265-points, similar to that of October / November 2016.

US S&P500 Weekly Chart

We saw China rattle global stock markets in a big way back in August 2015 when concerns around a China slowdown sent the VIX to levels not witnessed since the GFC. The panic was far greater than the US Computer flash crash, US debt downgrade and Brexit – the Dow opened down a staggering 1000-points on August 24th, at the climax of the panic. Hence history tells us that when China starts wobbling on the economic front, we should definitely demonstrate caution.

The Fear Index (VIX) Weekly Chart

So here we are today reading the comment in the AFR of “China’s iron ore imports slump” while our miners are being caught in a downdraft of concern that China may be changing gear – not a new concern we might add! . As we have discussed recently the resources segment of our portfolio is certainly getting the most attention at present.

The Chinese government continues to crack down hard on its financial markets and although this may be painful in the short-term, any policy around dealing with potential systemic issues must be a good thing in the bigger picture. The current trend of forcing the reduction of debt plus over-leverage is already leading to weakness in the Chinese equities markets, plus other liquid assets that Chinese wealth managers have been buying e.g. iron ore futures!

We are understandably concerned as to where the selling emanating from China is in its cycle, importantly is it close to capitulation? Over recent times we have witnessed some significant weakness in the following inter-linked markets:

1. The Chinese Shanghai Composite has fallen 6.6% since the first week of April.

2. Iron Ore has tumbled 36% since late February.

3. Crude Oil corrected 17.5% since mid-February.

4. The Australian dollar has fallen 4.5% since late March.

Chinese Shanghai Composite Weekly Chart

These falls have obviously coincided with the deep corrections in the likes of BHP and RIO. Buying when forced selling is unravelling very often leads to optimum entry into a stock / sector, hence we are currently very reticent to reduce our underwater positions for 2 reasons:

1. Our 17.5% exposure to resources is not excessive, although larger than we usually hold. At this point in time it feels that the pullback in resources is slowly reaching maturity.

2. The MM portfolio is already sitting on over 33% cash giving us the ability to buy weakness and importantly, not be forced sellers. Remember – flexibility is key this year!

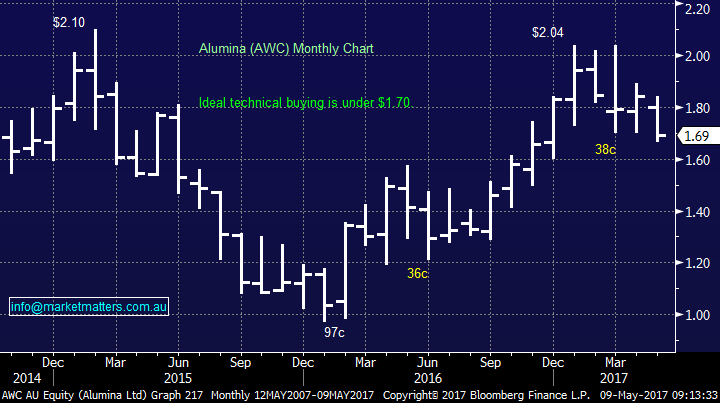

Hence for now, we are holding our BHP, OZL and RIO positions, but are not increasing these holdings into current weakness even though we like AWC under $1.70 – its pure risk / reward.

Alumina (AWC) Monthly Chart

We have been wondering what the catalyst could be for our forecasted 5% correction in equities over May / June, and of course the major 25% pullback we are ultimately forecasting over the next few years.

At this stage our macro thoughts are pointing to the following:

1. A seasonal pullback of ~5% may have China to blame although the US and European markets look tired, perhaps they will play catch-up.

2. We still think the larger pullback will ultimately be blamed on global central banks failing to stop a recession after the GFC but just delaying it.

However this is just postulating, history tells us that what causes market corrections is rarely being discussed prior to the event.

Conclusion(s)

The market still remains positioned for a period of seasonal weakness – “sell in May and go away”.

The Chinese government’s sensible crackdowns on leverage / debt are leading to selling in markets which have caused weakness in our resources space.

Overall we are not convinced this has reached its conclusion, but we are hesitant to dump our position(s) during perceived forced selling.

Overnight Market Matters Wrap

· The US share markets resumed their recent trend with marginal change overnight.

· Gold Futures kicked 0.38% higher, while Iron Ore retraced 2.56% lower.

· The energy sector is expected to outperform the broader market again today, following its US peers. BHP will benefit from this, as it closed in the US an equivalent of 0.20% higher overnight from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 14 points higher, towards the 5,885 area this morning. A lot of attention today on tonight’s Federal Budget.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here