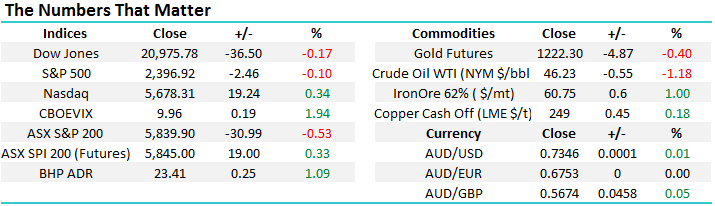

“the game is afoot” – Arthur Conan Doyle

Please excuse todays title however it sprung to mind during our deliberations on the market’s volatility during the last 24-hours. Yesterday was definitely a very rare day with the banks being savaged while Telstra of all stocks rallied strongly. The market fell 31-points but the banks contribution to the day was a whopping -45-points, led by CBA whose 3.85% plunge was the equivalent to over -21-points on the index – hence overall the broader market was actually up! The negative sentiment from the banks was compounded by an awful performance from our retailers and we will focus on these two sectors in today’s report.

The Federal Budget was delivered last night with the previously leaked $6.2bn bank levy quickly supported by Labor – this applies to the big 5 Australian banks (includes Macquarie) however it does not apply to the regionals, like Suncorp and is obviously not applicable to CYBG. There was no major movements in the future’s markets following Scott Morrison’s speech with the $A remaining close to 73c and the SPI stock futures followed BHP higher in US trading – BHP is set to open 1.2% higher today.

Our short-term negative view for the ASX200 remains intact with our initial target of 5800 now less than 1% away, while our potential ultimate target of ~5600 for a May-June retracement is 4% lower.

ASX200 Daily Chart

Overseas markets were again extremely quiet last night with the “Fear Index” (VIX) remaining around its 24-year low. We continue to feel stock markets are feeling “tired” which is no great surprise after their excellent rally over the last 5-months.

Our view at current levels remains essentially unchanged:

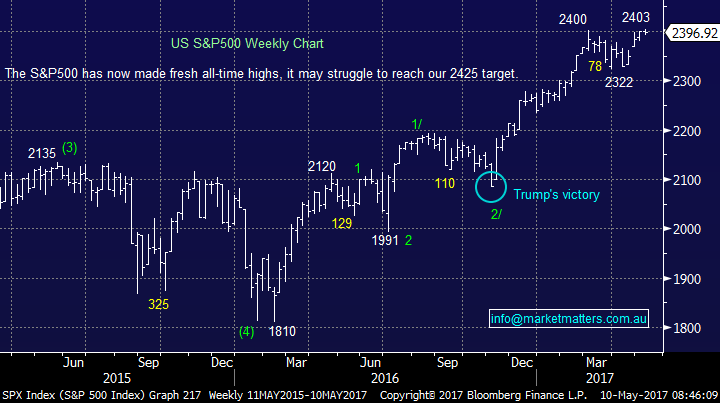

1. The US S&P500 reached all-time highs last night and then reversed lower, albeit in a small controlled way. It may now struggle to reach our 2425 target area.

2. A 5% correction feels very close at hand, it still feels like we are heading towards a classic "sell in May and go away" scenario for US stocks.

3. Assuming we get a 5% correction over May / June, similar to last year, we will be keen buyers into this weakness targeting further gains later in 2017. The NASDAQ is likely to be our yardstick for a buy area with US stocks and we will be simply looking for a correction of ~265-points, similar to that of October / November 2016.

Importantly we now feel all the risks for US stocks are now on the downside.

US S&P500 Weekly Chart

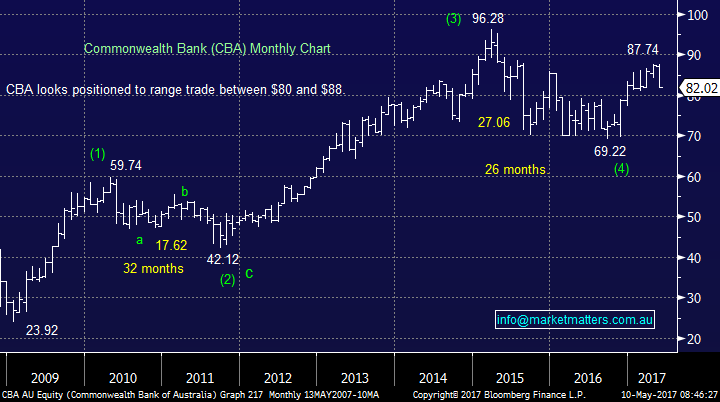

Banks

Yesterday’s aggressive selling of the local banking sector was welcomed by MM as we have recently sold both our ANZ and CBA positions – we are now looking to buy this current weakness. Our holdings performed extremely well on a day when the banking index fell 2.3% with Nab -2% and CYB up +0.4%. Our well flagged plan has been to re-establish our CBA position into this forecasted weakness, the question is now has the budget plus CBA’s lacklustre performance up-date altered our thought process.

In simple terms even after yesterday’s sell-off fundamentally we do not believe the banks are particularly cheap, another 3-5% would make them far more attractive. While investors will eventually expect the banks to pass on the $6.2bn levy to their customers two negative influences are looming rapidly on the horizon:

1. APRA is taking big - forceful steps to slow down the Australian housing market and will ultimately lower credit growth – which is how the banks make $$.

2. The bad debt cycle feels to be at a low which can only hinder banks profitability into the future. We covered this in a meeting with the NAB CEO yesterday morning , and although they remain very comfortable with their book, they are seeing some slight signs of arrears building.

These two factors may easily lead to a continuation of the last 5-days 4.5% decline from our banks.

Yesterdays $3.28 fall by CBA was its largest in 7-years but we ask ourselves how does it fit in to a typical May-June retracement. CBA’s average decline over May-June since the GFC is 6.9% which targets ~$81.60, less than 1% away. Technically the mid-point of the “Trump bump” for CBA is at ~$78.50.

At this point in time, taking into account both our short-term view for global equities and the sentiment towards our banks, we are pulling are targeted buying in CBA to sub $80. Also, following their pretty average report yesterday we are now only likely to allocate between 5% and 7.5% into CBA.

Commonwealth Bank (CBA) Monthly Chart

Westpac (WBC) would make a good addition to our portfolio if it weakens over the next 8-days, prior to its 94c fully franked dividend. Before its dividend we like WBC around $32 i.e. around 2.7% lower.

Westpac (WBC) Weekly Chart

Retail stocks

Australian Retail Sales came in yesterday at -0.1% compared to estimates of +0.3%, this was an awful number but should not be overly surprising. We as consumers are being made to worry about the value of our house, while interest rates are creeping higher and the Govt remains in a bubble by not expecting the banks to pass on $1.5bn annual impost announced overnight – overall a very bad combination if you hope the average Australian will open up their wallet for some discretionary spending, it’s more like baton down the hatches until further notice!

Also remember this is all before Amazon arrives on our shores, they are going to make a huge impact on how / where we spend money. The US goliath is going to force anybody competing with them to significantly raise their service levels while also trimming their margins – not ideal for local retailers.

This looming effect has already had a dramatic impact on our retailers share prices e.g. both Myer and Harvey Norman at 18-month lows, JB Hi-Fi at an 8-month low and Oroton at an 11-yerar low.

Investing is often about “KISS” – Keep it simple stupid!

We believe there is absolutely no reason to be buying Australian retail stocks until further notice. Fund managers will want to get a clear understanding on the impact of Amazon in Australia before risking funds.

Source; Bloomberg

Conclusion (s)

The market still remains positioned for a period of seasonal weakness – “sell in May and go away”.

While we like Australian banks into weakness our targeted buy areas have been lowered.

We have absolutely no interest in buying local retail stocks until further notice.

Overnight Market Matters Wrap

· Another quiet session in US markets was experienced overnight, with the Dow off less the 0.2% and the broader S&P 500 down 0.1%.

· Iron Ore was 1% higher with BHP expected to outperform the broader market after rallying an equivalent of +1.09% in the US from Australia’s previous close.

· Our ‘Aussie (Dollar) Battler’ lost ground, as local investors continue to digest the Federal budget reported last night.

· The June SPI Futures is indicating the ASX 200 to open 24 points higher, above the 5,860 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here