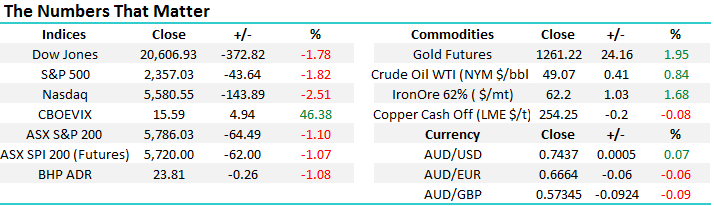

Trump hands MM our market correction!

Finally, as we have been expecting the market has been clobbered, yesterday the ASX200 fell 64-points (1.1%), initially legging down over concerns around the conduct of Donald Trump but this time no buying emerged into the weakness and the selling took control throughout the day. The drop rapidly became the largest one day decline in ~2-months as investors / traders accurately foresaw the likely major negative impact to US markets. As we have been saying over recent weeks “we believe a close under the psychological 5800 area would see a relatively fast slide towards 5700, and potentially 5600” – looks like fast will become 24 hours!

The market is now clearly getting its “sell in May and go away” correction. Remember a few days ago we wrote that it feels just a matter of time until we get a 200-point correction for the Dow, well hold on tight we got 372-points (1.78%) last night.

Let’s look at two influential statistics to put this current weakness into perspective:

1. The average decline for the ASX200 over May / June since the GFC is 6.9%, this targets the 5550 area i.e. 4% under yesterdays close. Overnight futures are targeting a test of 5700 support this morning, still 2.5% above the average seasonal correction target.

2. The average pullback for CBA during May / June since the GFC is over 10% which targets the $79 area.

We are very happily sitting on 28.5% in cash for the MM portfolio, the question is what and importantly at what levels will we start shopping – we still believe this weakness is a time to buy, not panic, so the question is what is the plan?

ASX200 Daily Chart

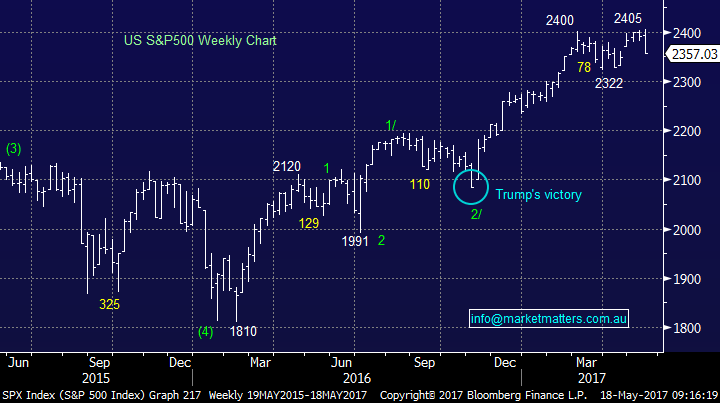

US markets were hammered last night with the high flying NASDAQ suffering the greatest fall, a steep 143-points (2.5%) as investors clearly locked in some healthy profits. However, the S&P500 still only closed 2% below this week’s all-time high, our ideal target remains the 2300 area, a further 2.4% lower which makes our 5600 target for the ASX200 “feel” ideal.

US S&P500 Weekly Chart

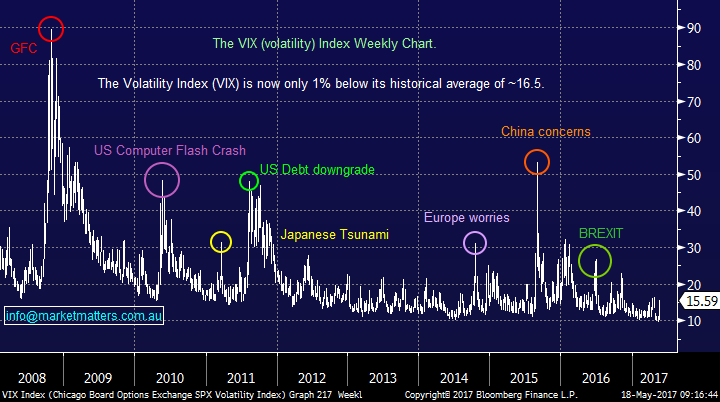

The Fear Index (VIX) surged to levels not seen since the surprise BREXIT vote in the UK as Trump rattled markets to the core. The relatively new US President is facing the biggest test of his tenure and markets are concerned he and his Republican administration will simply not be able to focus on their stimulatory agenda which has sent US stocks soaring over 15% since his surprise election victory last November.

US Fear Index (VIX) Weekly Chart

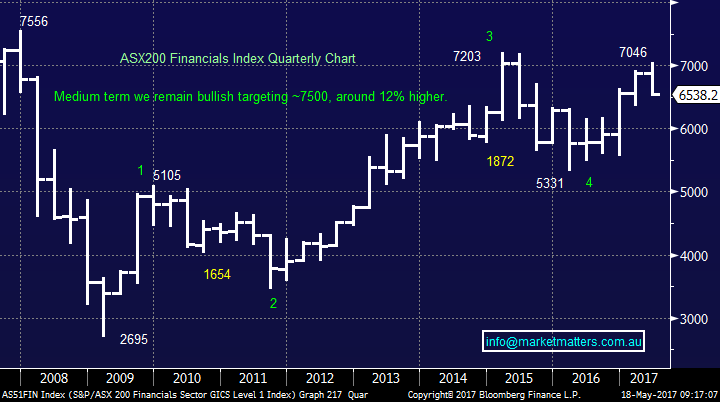

Financials

While the financials remain our major market exposure via CYB, NAB, HGG, QBE, SUN and WBC we have left ourselves the flexibility to add to this large weighting following our sale of CBA at $87 and ANZ over $30. Our main two targets at his point in time:

1. CBA around $79.50 – we already have the order in the market for a 5% allocation, under $80. This would the likely increase to 7.5% under $79.

2. Challenger (CGF) under $11.50.

Technically we remain bullish the financials targeting a final push above 2017 highs but short-term our target remains ~3% lower.

ASX200 Financials Index Quarterly Chart

Resources

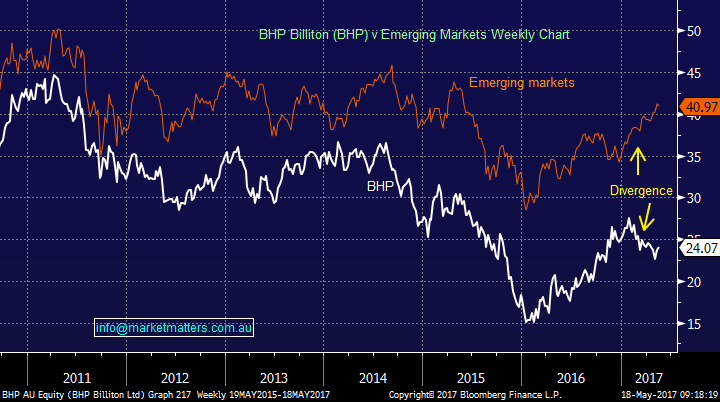

We currently hold a +20% portfolio exposure via BHP, NCM, OZL and RIO. During 2017 we have witnessed a significant divergence between the emerging markets and our resources sector, indices that are usually very highly correlated. We continue to believe that our resources sector will play catch up as opposed to the emerging markets giving up their gains.

On balance our resources exposure is much higher than we would usually hold and there is only one other stocks which we continue to consider buying.

Alumina (AWC) - we are now buyers of AWC under $1.75, almost 5% below yesterdays close.

BHP Billiton (BHP) v Emerging Markets Weekly Chart

We are ideally targeting an additional few stocks to purchase during this market downturn. But considering we see a strong possibility of the ASX200 testing the 5600 area we don’t anticipate being too aggressive just yet.

One stock we are watching carefully into weakness is Seek (SEK), plus of course we may consider topping up one, or more, of our current holdings.

Watch this space as we evolve our shopping list into this market correction.

Conclusion (s)

Today we expect to allocate 5% into CBA under $80 (the order remains in the market) and potentially an additional 2.5% under $79.

This will then take our cash level to 21% - clearly still elevated when compared to the 5% we hold when we are bullish.

*Watch for alerts*

Overnight Market Matters Wrap

· The US markets experienced the biggest decline in more than 8 months, triggered by turmoil surrounding Trump

· The Fed is still expected to raise rates next month, however pundits have pared their bets from 90% to 66%. The yield on the US 10 year note dropped 11bps to 2.22%.

· The ‘safe have’ assets kicked up, as investor fear grows, with gold rallying 1.95% overnight.

· Further weakness is expected today, with the June SPI Futures indicating a 70 point decline in the open with the ASX 200 near the 5,715 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here