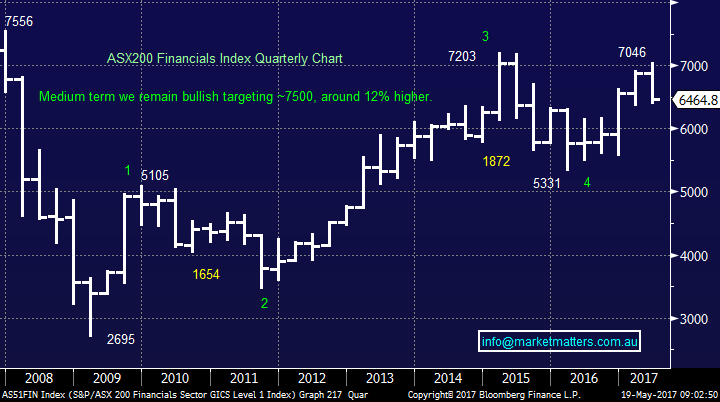

An Exciting Time is Unfolding as the “Trump Slump” Evolves

The market sell-off which we have been waiting for continued yesterday, with the ASX200 testing the psychological 5700 support mid-morning, before staging an encouraging 40-point (0.7%) rally into the close. The selling was pretty broad based although the resources and telco’s did perform well with OZ Minerals (OZL), RIO Tinto (RIO) and Telstra (TLS) all managing to close positive – a very solid achievement following a 372-point decline on Wall Street.

On the end the ASX200 finally closed down another 48-points (0.8%), a sizable 218-points (3.7%) beneath the 1st of May high at 5956 – statistically any monthly decline of over 250-points is stretched unless we are experiencing a major change in trend – not the current view at MM. Hence we believe any spikes under 5700 are likely to attract some decent buying from cashed up investors, like ourselves, unless things really fall apart politically in the US - at least for the next week or two.

The market is now clearly suffering its “sell in May and go away” correction. Remember the two simple statistics we looked at yesterday to put this recent weakness into perspective:

1. The average decline for the ASX200 over May / June since the GFC is 6.9%, this targets the 5550 area i.e. 3.3% below yesterdays close.

2. The average pullback for CBA during May / June since the GFC is over 10% which targets the $79 area – so far CBA has hit $79.53.

Following our 5% allocation into CBA yesterday we are now happily sitting on 23.5% in cash for the MM portfolio, the question remains what and importantly at what levels will we continue shopping – importantly we still believe this weakness is an opportunity to buy, not panic sell.

ASX200 Daily Chart

US markets held together last night, but a 56-point bounce by the Dow following a 372-point decline is definitely not exciting stuff. The S&P500 closed 1.7% below this week’s all-time high, our ideal target remains the 2300 area, a further 2.7% lower which makes our 5600 target for the ASX200 “feel” about right.

With so much uncertainty hitting markets at the moment it’s hard to imagine stocks being pushed to fresh all-time highs any time soon – last night the Brazilian stock market fell a scary 10%!

US S&P500 Daily Chart

European indices are following the US and appear set for a period of consolidation after recent strong gains. We can see the DAX correcting another 400-points, or ~3%, very similar in degree to our view for the Dow and Australian markets.

German DAX Monthly Chart

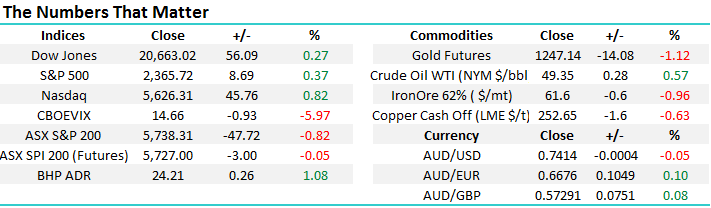

Financials

The financials remain our major market exposure via CBA, CYB, NAB, HGG, QBE, SUN and WBC. However we have left ourselves the flexibility to add to this large weighting following our recent sales of CBA at $87 and ANZ over $30. Our main targets at this point in time are:

1. CBA around $79.00 – we allocated 5% into CBA yesterday at $80.00. We will add another 2.5% under $79.

2. QBE Insurance (QBE) we will consider increasing our position to 7.5% under $12.50.

3. Macquarie Bank (MQG) we will consider allocating 5% into MQG under $85.

Technically we remain bullish the financials targeting a final push above 2017 highs, short-term our target is now less than 2% lower.

ASX200 Financials Index Quarterly Chart

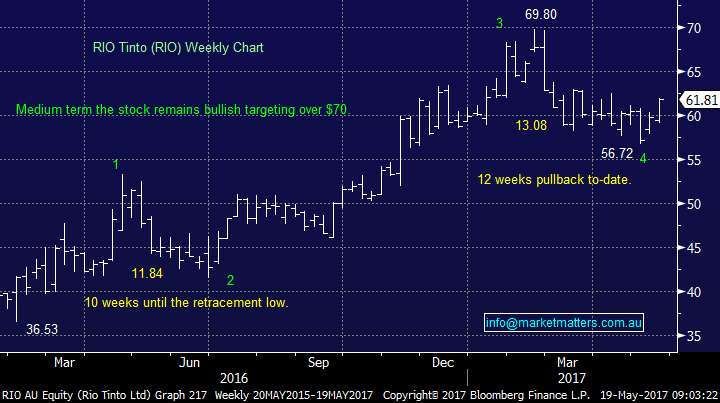

Resources

We currently hold a +20% portfolio exposure via BHP, NCM, OZL and RIO. During 2017 we have witnessed a significant divergence between the emerging markets and our resources sector, indices that are usually very highly correlated. We continue to believe that our resources sector will play catch up as opposed to the emerging markets giving up their gains although last night’s weakness in Brazil did put significant pressure on the EM index which fell ~1.7%.

On balance our resources exposure is much higher than we would usually hold and there are only 2 other stocks which we continue to consider buying.

1. Alumina (AWC) - we are considering allocating 5% into AWC under $1.80.

2. We remain buyers of Regis Resources (RRL) under $3.10.

RIO Tinto (RIO) Weekly Chart – Has been strong over the past 2 days in a weak market

We are ideally targeting an additional few stocks to purchase during this market downturn. However considering we see a strong possibility of the ASX200 testing the 5600 area we don’t anticipate being too aggressive just yet. A further 3 stocks we are watching at present:

1. Seek (SEK) - we are considering buying SEK under $17.

2. Computershare (CPU) – we are considering buying CPU around $13.50.

3. Healthscope (HSO) - We continue to like HSO closer to $2.

Watch this space as we evolve our shopping list into this market correction.

Conclusion (s)

Today we expect a relatively quiet day but we are preparing to significantly step up our buying if global equities correct another ~3% as we expect.

Our cash level in the MM portfolio now sits at 23.5%.

Overnight Market Matters Wrap

· The US equity markets gained some of its previous session’s losses overnight, as investors turn their focus back on the ongoing strength of their economy.

· ‘Safe haven’ asset, gold shed 1.12% as volatility dissipated.

· Despite Iron Ore down 0.96% overnight, BHP and RIO had a positive session overseas, with BHP in the US up an equivalent of 1.08% from Australia’s previous close – expect the miners to outperform the broader market today.

· The June SPI Futures is indicating the ASX 200 to open 15 points weaker, towards the 5,723 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here