Do we buy BT Investment into potential weakness today?

The Australian market managed to close marginally higher yesterday but still remains over 3% below the high for May while US stocks continue to make all-time highs. The majority of the weakness locally has come courtesy of our banks who have been slugged with a new tax in the budget, just when investors are becoming increasingly concerned over their exposure to our “very hot” property market – the banking index is down almost 7% for the month. We are watching Canada closely for clues to how our property market may fair moving forward and may discuss this in more detail in a future report.

On an index level we continue to believe the local market is suffering its “sell in May and go away” correction with a close over 5830 required by the ASX200 to switch us back to a neutral stance i.e. 1.1% higher. While we are not receiving any assistance from the US on this view China’s credit downgrade looks to have put a halt on our resources strength for now.

Importantly at this stage we still believe any weakness over this May-June period is an opportunity to buy, not panic sell.

ASX200 Daily Chart

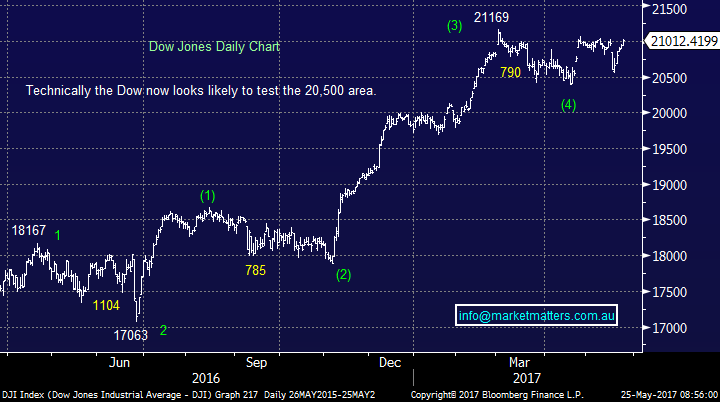

US markets rallied yet again last night with the S&P500 closing up 0.2% at an all-time high. We remain short-term cautious / bearish but very aware of the strength of this underlying bull market, the path of least resistance clearly remains up.

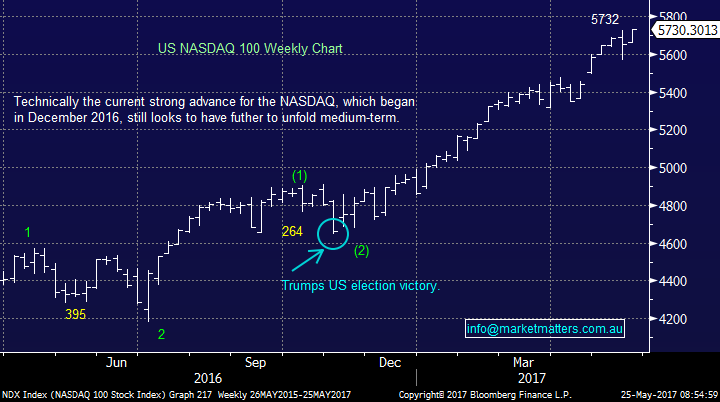

We continue to remain buyers of weakness while not believing this current advance to fresh highs will follow through with any meaningful momentum. Technically we regard the NASDAQ on a weekly basis as one of the clearest charts at present with our ideal buying scenario a +250-point retracement.

US NASDAQ Weekly Chart

In the short-term the Dow remains bullish targeting the 21,500 area / 2.5% higher. Considering the poor market news it has shrugged off recently this has now become our favoured scenario into June before a potential pullback.

US Dow Jones Daily Chart

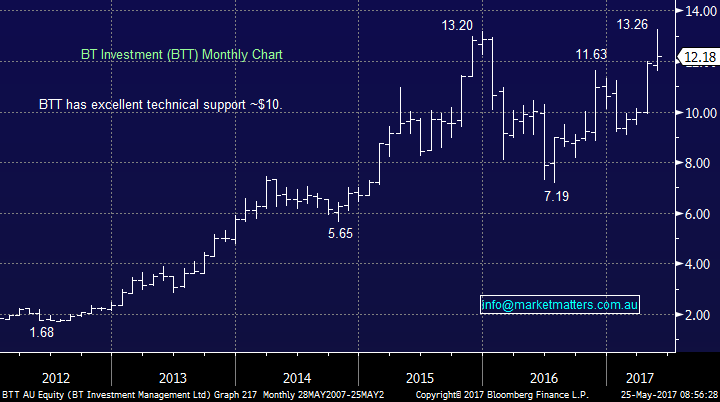

Overnight Macquarie equities desk were handed the mandate to sell Westpac Banks 19.2% stake in BT Investment Management. The targeted price for the 60 million shares was $10.25-$10.75, a significant discount to yesterday’s closing price. The question we ask ourselves this morning is do we buy the potential weakness early today.

BT Investment (BTT) Monthly Chart

We continue to like the local financial sector but we do have significant exposure in the MM portfolio already. Also importantly BTT is very much Europe facing as was illustrated by its plunge following the BREXIT vote. Considering we already own Henderson Group (HGG) within the sector, which has significant exposure to the UK and a potential hard BREXIT we feel it’s prudent for MM not to outright buy any weakness in BTT this morning.

However, if we were not holding HGG we would have definite interest in BTT sub-$11.

Hence we have a potential switch opportunity:

If we are able to take a ~12% profit in HGG around $4.10 and buy BTT below $11 we will switch today – or put another way a $6.90 difference, or better.

ASX200 Quarterly Chart

Conclusion (s)

We will not outright buy potential weakness in BTT this morning but will follow the below switch:

If we are able to take a ~12% profit in HGG around $4.10 and buy BTT below $11 we will switch today – or put another way a $6.90 differential.

*Watch for alerts*.

Overnight Market Matters Wrap

· The US equity market continued its recovery, once again nudging record highs, having now regained all of last Wednesday's sell off, as the Federal Reserve still appears to be sticking to its plans to raise rates at the next meeting in mid-June despite recent weaker economic data.

· Commodities were generally weaker, with iron ore in particular slumping back towards US$ 60.50/t (Chinese futures fell as much as 5.6% yesterday at one point), following the Moody's rating downgrade yesterday of China's credit rating, which increased concerns about China's ballooning debt levels. Oil prices were also slightly easier after the recent strong run, ahead of tonight's OPEC meeting which is expected to extend current production cuts for the rest of the year.

· The June SPI Futures is indicating the ASX 200 to open 14 points higher, towards the 5,780 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here