Seasonal Weakness Continues to Unfold for the ASX200

Yesterday we saw ongoing weakness for local stocks after a very brief rally on the opening bell, while the selling was on only average volume it was met with minimal buying as most market players appeared to stay on the sidelines ahead of short weeks on many global markets. The current market sentiment and momentum remains very poor, it feels like fund managers are using any excuse to sit on their cash.

When we consider a few influences confronting investors today, it’s easy to understand the current Australian stock market malaise, which has only taken a few weeks to take hold:

1. Most investors are aware of the seasonally weak May - June statistics.

2. The very influential local banking sector remains under pressure following 3 of the majors trading ex-dividend, rapidly rising property concerns and of course the recent new “bank tax”.

3. Economists are suddenly warning of a potential technical recession for Australia in 2017.

4. Iron ore has tumbled almost 40% in just 4-months and is trading at nearly 8-month lows.

5. Plus of course, we have investors’ ongoing concerns about the next “Trump tweet”!

We even see in today’s AFR, the decision by Altair to hand back investors cash, citing concerns over asset prices with special emphasis on Australian property where they see a looming crash. This sort of rhetoric certainly hinders any short-term recovery in our banking shares, however worth noting that these big headline grabbing calls by fund managers who are liquidating all positions, can often be a combination of factors, not just the ‘simple concerns’ about the market. We know we’re cynics but obviously more at play here!

However, as investors start to embrace the negative news, we believe it’s time to slowly start buying local stocks e.g. Yesterday we followed through with our plan to purchase an additional 2.5% of CBA, taking our holding to 7.5% at ~$79.66 – remember only one month ago we sold our holding around $87.

We will continue to remind subscribers of our strong opinion that this is not in the time in the economic / equities cycle to “buy and hold” as the bull market which commenced in 2009 slowly matures, a theme we will be expanding on at www.marketmatterslive.com.au this evening in Sydney.

ASX200 Daily Chart

US markets were closed last night and their futures markets remained very quiet. When we look at the NASDAQ, which has been leading global markets since the GFC, we remain bullish, but acknowledge a 4-5% correction does feel close at hand.

US NASDAQ Weekly Chart

We still hold an “overweight” 21.5% of the MM portfolio in cash, today we will look at 4 stocks we are considering accumulating over the coming days / weeks as the market corrects. While we are likely to remain patient with our buying, especially as global indices are overdue a correction, 2 statistics are slowly putting us back in the “buyers camp” which we are afforded this flexibility having significantly reduced our equity exposure during the ASX200’s recent foray over 5900.

1. The average correction for the ASX200 during May / June is 6.9%, which targets 5545 – 2.8% below yesterday’s close.

2. The average correction for CBA during May / June is just over 10%, so far in 2017 we have now witnessed a 10.1% correction.

Importantly at this stage, we still believe any weakness over this May-June period is an opportunity to buy, not panic sell.

1 Banks

Our banking exposure is slowly approaching our optimum levels, but if this almost panic selling continues, we are likely to add to our holdings.

Two likely prospects:

1. An additional 2.5% in CBA ~$78. At yesterdays close CBA is yielding 5.34% fully franked while trading on a P/E of 14x.

2. An additional 2.5% in Westpac (WBC) ~$29. At yesterdays close WBC is yielding 6.26% fully franked while trading on a P/E of 12.5x.

If any property correction is not too severe and the banking tax gets mainly passed onto customers, these valuations are attractive.

2 Resources

We remain buyers of Fortescue Metals (FMG) around the $4.60 area and ideally closer to $4.50, targeting a quick 20% rally. This is an aggressive play, but over the last 3-years, FMG has been very kind to us both from a long and short perspective. We also take some comfort from the evident fact that FMG can rally / fall strongly, independently of how the overall market is trading.

Fortescue Metals (FMG) Daily Chart

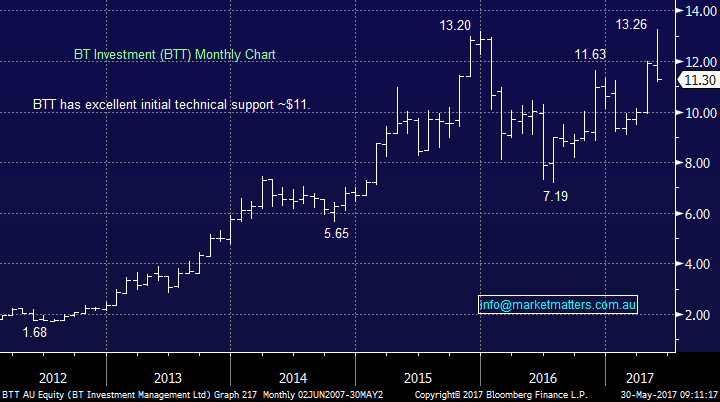

3 BT Investment (BTT)

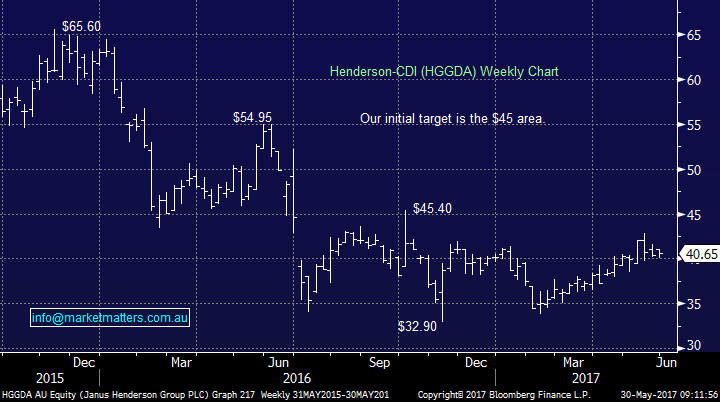

BTT is a company that has been on the MM radar for some time, and the recent sell down of Westpac’s stake we believe is offering an excellent opportunity to enter the stock which has now corrected 14.8% over the last 3 weeks. We currently have 8% of the MM portfolio in Henderson Group (HGGDA) which is in a similar space to BTT that also restrains us from simply buying the stock outright, hence our refreshed plan:

1. Take ~11% profit on 3% of our 8% exposure to HGGDA.

2. Allocate 5% of the MM portfolio into BTT, around yesterday’s prices.

3. Overall this will increase our exposure to the space by 2%, while leaving us with a healthy spread of risk by holding 5% in BTT and HGGDA respectively.

Looking at BT v HGGDA, BT is more expensive, but has better earnings growth (and importantly, positive earnings momentum now). HGG is cheaper with less growth, and slightly higher risk given the merger with Janus, and the associated risks of integration. By ‘down weighting’ HGG and taking a position in BT, we increase exposure to an area we like (Europe) while reducing our stock specific risk in Henderson.

BT Investment (BTT) Monthly Chart

Henderson Group (HGGDA) Weekly Chart

3 Healthcare stocks

Over recent month, we took some healthy profits from the sector via Ansell (ANN) and also closed out Ramsay Healthcare (RHC) at higher levels, both stocks are trading below our last exit, which feels good for now. Into further weakness, we are considering the following which in 2 cases may seem a distant dream, but we are in volatile times on the stock specific level – just think Sirtex (SRX).

RHC closer to $60 and ANN closer to $20. We had previously targeted Healthscope (HSO) around $2 and yesterday it dropped to that level on the back of a broker downgrade. Until further notice we now have no interest in HSO given the anaemic price action in recent times that smells of a potential ‘bad news event’!

Conclusion(s)

The May / June correction is unfolding as expected / positioned for, we are simply planning to accumulate stocks slowly into weakness.

*Watch for alerts.

Overnight Market Matters Wrap

· Quiet overnight with major markets in China, UK and the US all closed for their respective holidays.

· The June SPI Futures is indicating the ASX 200 to open with little change from the previous close of 5707 this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/05/2017. 8.30AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here