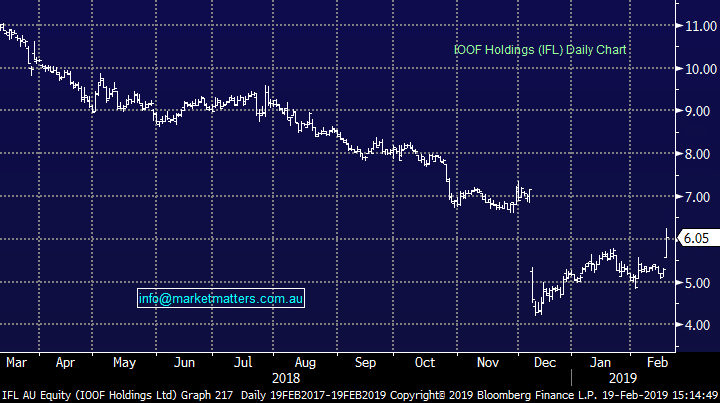

IOOF (ASX: IFL) jumps on a reasonable half year

Stock

IOOF Holdings (ASX: IFL) $6.05 as at 19/02/2019

Event

One of the dogs of 2018, IOOF today reported their half year numbers to the market helping the stock over 10% higher on the session to offset some of last year’s pain.

The wealth management conglomerate saw underlying profit climb 6% to $100.1m while funds under management, administration & advice (FUMA) rose 15% to $137.8b.

The result wasn’t better than the market, but the negativity surrounding IFL has certainly helped an average result look much better. Statutory NPAT at $135.4 is just shy of triple that of the FY18 but a number of one-off additions has added to the growth. This includes the sale of the corporate trust business ($34m), legal cost recovery ($25m) and the release of $28m of impairments relating to the Perennial business it no longer needs to account for. Adding these back gives growth of closer to 4% for the year – a more reasonable figure.

The FUMA growth is also a bit of an anomaly, with the 15% growth driven by IOOF’s purchase of the ANZ dealer group business. Without this transaction FUMA would have fallen around 4%.

The road ahead for IFL is still rocky. There is still the ANZ super business which is due to be taken over by IFL in June, but faces a vote from the current custodians to determine if the transfer of ownership is in the members best interests – tough to determine when a number of the company’s previous executives are facing criminal charges for their handling of the business.

IOOF Holdings (ASX: IFL) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook