Subscribers questions

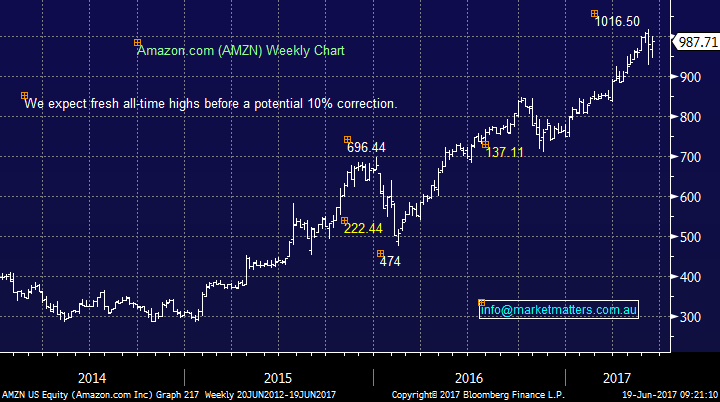

There was little news over the weekend keeping us 50-50 on the short-term direction of the ASX200, it’s all pretty tight out there.

1. A break over 5795 will be bullish for us targeting a retest of Junes 5836 high, and probably beyond.

2. Conversely a break below 5750 will target ongoing May-June seasonal weakness which may easily last another 2-weeks.

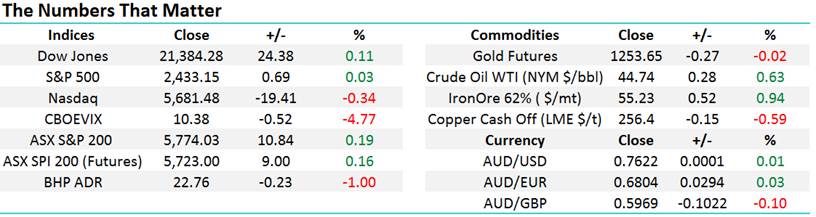

However one piece of news from Friday that in hindsight we should have given more “air-time” was Amazons $13.7bn acquisition of Whole Foods which instantly puts the e-commerce giant into 100’s of brick & mortar stores selling groceries. To you give an idea of AMZN’s huge presence within global retail they are paying the $13.7bn in cash!

As we said in the Weekend Report Walmart was smashed over 7% at one stage on the news as AMZN gave a clear direction to one part of their expansion plans. We feel this must be concerning to Woolworths and Wesfarmers (Coles) who enjoy margins well in excess of most supermarkets on the world stage i.e. potential ripe pickings.

AMZN may only just be arriving in Australia but do not doubt their ability to implement strategies both efficiently and quickly. Amazingly they now spend more on R&D than any other company in the world so expect ongoing improvements / diversification. Technically and fundamentally AMZN remains clearly bullish over the medium-term.

We reiterate our opinion that Australian retail is simply too hard from Harvey Norman to Woolworths and best left alone by investors.

Amazon.com (AMZN) Weekly Chart

Question 1

“Hi there, With so much ahead in the next 24-48 hours is there reason to hedge portfolios with options on the index for short term trade/protection? Your 10% cash holding leaves little ammunition and whilst the ASX200 is reaching its lower levels it is possible for another 3%+ fall if the US comes off on unfavourable outcomes”. Regards – Peter W.

Morning Peter, after having already corrected 327-points / 5.5% we would not be considering buying puts today, especially with the seasonally bullish July now only 10-trading days away. We could write calls looking to generate some income over the next few weeks but would be wary of the potential upside if the ASX200 rallies back over 5800.

On balance we remain happy to have 10% of the MM portfolio in cash having allocated a decent % into the market towards the end of the current pullback. As discussed previously we will put this money to work if the market falls under 5600.

NB If any subscribers wish to have options explained in more detail please let us know.

ASX200 Weekly Chart

Question 2

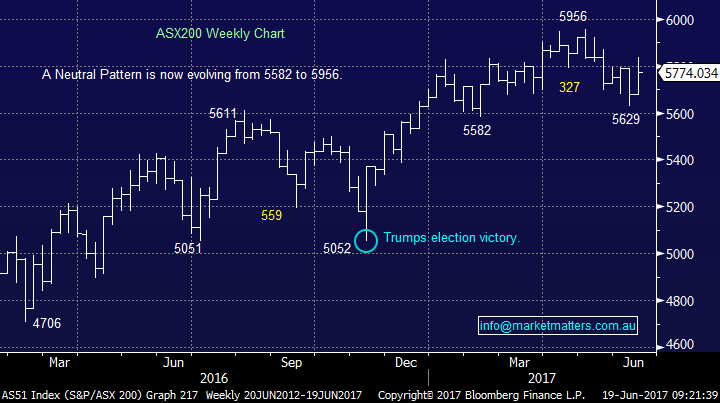

“Hi MM, In the past, I have traded WSA but now find them actually below $2 which is unusual. Can you please advise why their value is now so low and if you have an estimate or target for their price? Have you considered buying some of their shares?” Kind Regards Phil B.

Good question Phil, WSA is an Australian based nickel sulphide producer with two producing mines plus a few further development projects. We did successfully invest in another nickel producer Independence Group (IGO) but fortunately took our +20% profit over $4.15 back in October 2016 – the stock has since fallen back towards the $3 area.

Both WSA and IGO have been moving pretty much in line with the Nickel price which is down ~20% in 2017. Hence an investment / trade in these stocks is essentially a play on the nickel price. In terms of WSA specifically, it is cheap trading in around 0.55 of net present value (NPV) is we plug in consensus forecast for the Nickel price however using spot prices we get something around 1.5 – which is expensive. This tells us the analysts are more optimistic Nickel prices than traders are now. Too much confusion and the technical picture on both WSA and Nickel is muted.

In terms of our resources exposure, it is at a maximum at present so it’s highly unlikely we will be looking at either of these 2 companies in foreseeable future but if I was considering buying WSA I would be looking for a panic spike under its multi-year $1.84 low.

Western Areas (WSA) Weekly Chart

Question 3

“Hi I am a subscriber to MarketMatters from Brisbane. I would like to know if you know that there is an online comprehensive course to learn more about finance and fundamental analysis etc.“ Many thanks – Peter L.

Morning Peter, good timing. There are a number of both on-line and face-to-face stock market courses available which as you would suspect are of varying quality. We would recommend you start by looking at the ASX’s offering and then use Google to investigate other options, from the areas of interest that you mentioned above perhaps even a formal education course may be appropriate.

In the new financial year MM are hoping to promote an exciting technical analysis course that will be suitable for the active investor.

Question 4

“Hi MM, using my SMSF looking at the way to diversify into international shares. as a general rule do you think that individual stocks or EFT's would be the best option? If EFT do you have a list, or can you point to a site where I can go.” Cheers Lawrence G.

Good morning Lawrence, ETF’s are a very topical growth area as I am sure you are aware. We strongly believe individual stocks are the best option IF you have time to investigate the respective companies / sectors, also remember there are currency risks to performance when investing overseas.

Conversely ETF’s do offer a simple way to gain exposure to varying overseas markets / sectors. Our friends at ETF Securities Australia have introduced the new and improved ETF Landscape which provides a high level overview of all the Australian ETFs on the ASX. Click the link below to view the report

This document will be updated on a quarterly basis, the next one will be distributed in July. It’s a very good high level summary of the available ETFs that trade on the ASX.

Question 5

“Hi MARKET MATTERS Just wanted to send a quick note to say thanks for your advice, suggestions, recommendations ,analysis daily weekly, alerts and much more. This is exactly the kind of input I need. We all think we're responsible for our own success but in my case I couldn't do it without MARKET MATTERS. Again thanks to your hard working people.” Regards Paul S.

Thanks Paul, we really appreciate the feedback. However, importantly are there any ways we could improve the service for you / other subscribers?

Question 6

“Your reports are written and explained to the point, are well directed, and, leave little doubt as to what action to be taken,”Thanks Hedley M.

Thanks Hedley, similar to our comments to Paul any ideas on how we could improve our offering would be much appreciated – bar a crystal ball of course!

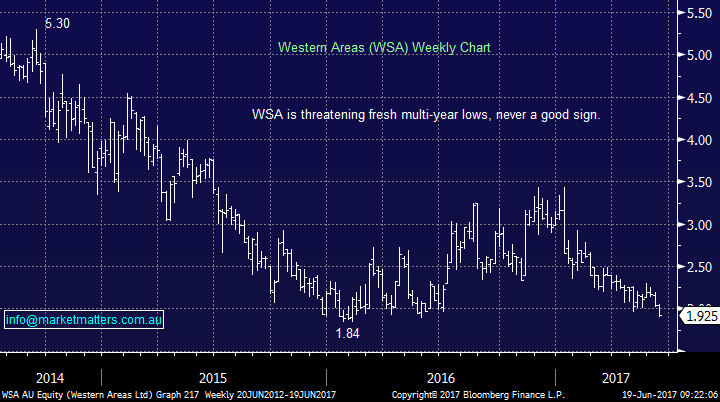

Overnight Market Matters Wrap

· Global markets were mixed over the weekend with the Dow edging ahead to set a new record high of 21,384, and the Nasdaq retreating slightly as tech stocks remained weaker.

· US food retail stocks came under selling pressure following the news that Amazon continued to expand its footprint into the grocery market, with an agreed US$18bn bid for food retailer Whole Foods, sparking fears of significant disruption in the grocery market. Discount food retailer Costco was hit hardest falling 7%.

· The US$ continued to pullback and this led to the A$ jumping above 76c on mixed signals about the pace of further US rate hikes. In the commodity markets. Oil continued to recover ground as did iron ore while base metals were mixed.

· European stocks were more positive with the U.K. Market closing 0.6% higher and the French market 0.8% higher.

· The June SPI Futures is indicating the ASX 200 to open marginally higher, towards the 5780 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here