Managing the underperformers in the portfolio

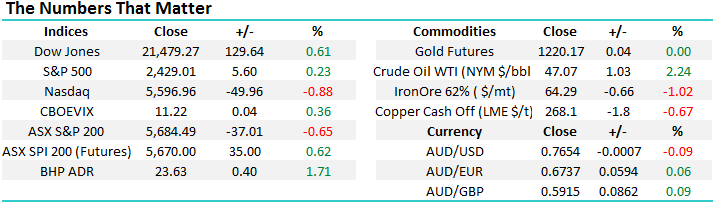

European markets were strong overnight led by the French CAC which added +1.47% and that fed into a positive session on Wall Street, albeit a short one with the market closing early and no trade tonight due to Independence Day. In the fixed income markets, yields continued to climb with the US 10 year yield now sitting at 2.35%, up from a 2.12% just five trading days ago – that’s a very big move. We spoke a lot about US interest rates last week and the big bearing they have on specific sectors and stocks so we won’t re-hash this morning, however suffice to say, our portfolio is positioned for higher global interest rates and the big overweight positions we have in Financials, Insurance and Materials should continue to benefit from this trend. The RBA meets this afternoon in Sydney with no change expected.

Looking at our portfolio, we remain comfortable with the banks and both NAB and Westpac continue to look attractive around current levels. Commonwealth Bank has bounced further and we would only be interested in CBA under $80. In terms of the resource stocks, FY17 was a very choppy year for them with a bit of “Trump, pump then dump” (thanks Rocky!) and some obvious stops and starts to the reflation trade. One of the things we’ve learnt over the years – and this seems pretty simple really – is that commodities are very cyclical. The winnings for FY18 are more than likely to come from the laggards of FY17 and this is where we should be focussing attention. Stocks in this basket include the names we have in the portfolio such as BHP, RIO, Fortescue Metals, Newcrest and Oz Minerals, but we should also be conscious of Sandfire (SFR), Western Areas (WSA), Iluka (ILU) and Alumina (AWC) who all screen well from a valuation perspective.

The Insurance stocks are performing well and they have tailwinds to earnings from both higher interest rates, low inflation and excess capital – we remain comfortable in Suncorp and QBE however we are conscious of taking profits and reducing our big overweight position into further strength.

This leaves 3 stocks that we’re not as comfortable with at this juncture; Clydesdale (CYB), BT Investment Management (BTT) and Seek (SEK).

1. Clydesdale $4.66

We bought CYB originally in early April at $4.73 then increased our weighting to the stock towards the end of the month at $4.67 booking an average price of $4.71 – we’re marginally down in the position. CYB is the spin out of NABs UK operations and is a ‘self-help story’ rather than one that will benefit from strong top line growth. This is a business with a very high cost base currently, low margins but importantly a low valuation (10.1 times 2018 earnings). It doesn’t yet pay a dividend but will start paying a small one soon and it’s exposed to the UK economy which is clearly going through a tumultuous time as they navigate their exit from the EU. Clearly there are pros and cons to holding CYB, however it seems to us this is more than compensated by its low valuation. We like the exposure to the UK despite the ‘headline risk’, we think management has a credible plan to strip our costs which will dramatically improve margins, earnings benefit from higher interest rates and some regulatory changes should mean they have excess capital on their balance sheet. It looks fine technically as long as it holds above $4.50.

Clydesdale (CYB) Daily Chart

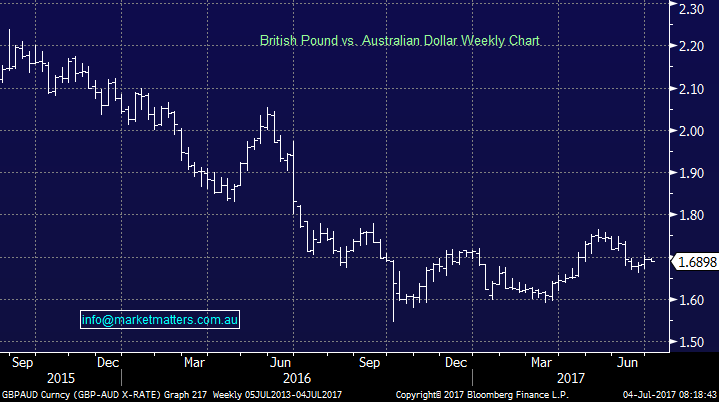

A higher Pound versus the Aussie Dollar should also be helping CYB

British Pound vs Australian Dollar Weekly

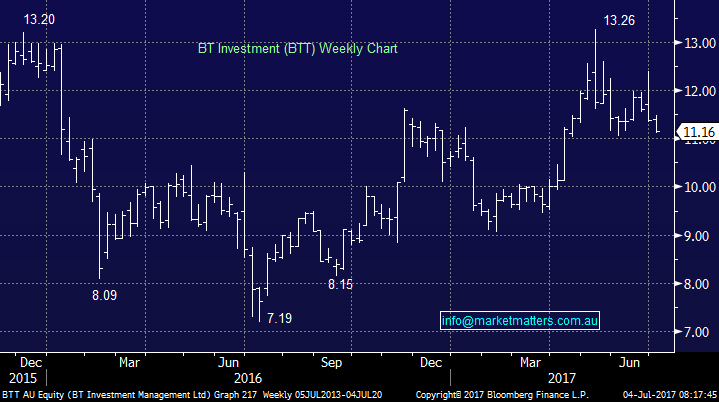

2.BT Investment Management $11.16

A recent BUY in the MM Portfolio with a 5% position taken at $11.20 into weakness (after Westpac sold down its stake). The stock rallied up to ~$12.40 however was hit by a broker downgrade (UBS put it on a SELL) and we now see the stock back to our entry point. BT is a good fund manager, growing sensibly overseas and has a strong earnings outlook with +20% growth expected. The valuation is reasonably high relative to other fund managers we’ve owned such as Janus Henderson, however that earnings growth (if achieved) justifies the valuation.

In terms of the UBS call, they questioned the outlook for performance fee income and reckon that BT will struggle to achieve the numbers factored in by the market. Performance fee income is a big bonus for fund managers – it’s what creates most leverage in their earnings. BT has done well in terms of performance historically however the UBS note did raise a relevant issue given recent trends. Technically the stock looks weak in the short term and a break of ~$11.00 would suggest a pullback nearer to $10. *Watch for alerts*

BT Investment Management (BTT) Weekly Chart

2. Seek $16.69

Another recent BUY with a 4% position at $16.90 and we now have the stocks trading below that level after moving up to ~$17.40 post our purchase. SEK is a high quality, high growth business that has used its dominance (and earnings power) in Australia to expand internationally into some very attractive growth markets. The issue with SEK at the moment is the NASDAQ. It’s one of few ‘tech’ stocks on the local market and a sell-off in the US tech sector clearly has a negative impact on similar stocks here. The NASDAQ has another 2% correction to reach our target and this is likely to put SEK under further pressure in the short term.

We like the business however stocks on high multiples like SEK can move pretty sharply if the market turns against them. We’re also conscious of higher global interest rates which provide a headwind for growth stocks (makes their valuation harder to justify). We remain comfortable holdings of SEK for now however this is a stock we will not hesitate to cut if the tide turns further.

Seek (SEK) Monthly Chart

Overnight Market Matters Wrap

· A mixed session was experienced in the US, with the major indices trading hitting their session highs early in the day, prior to giving back some gains towards the close with the tech heavy, NASDAQ 100 being the lone ranger in negative territory.

· Iron Ore lost 1.02%, however we see the major miners to outperform the broader market, with BHP in the US ending its session up 1.71% from Australia’s previous close.

· Domestically, focus is on the RBA meeting, with an analysts’ probability in favour of no change.

· The June SPI Futures is indicating the ASX 200 to open 37 points higher, back towards the 5,720 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here