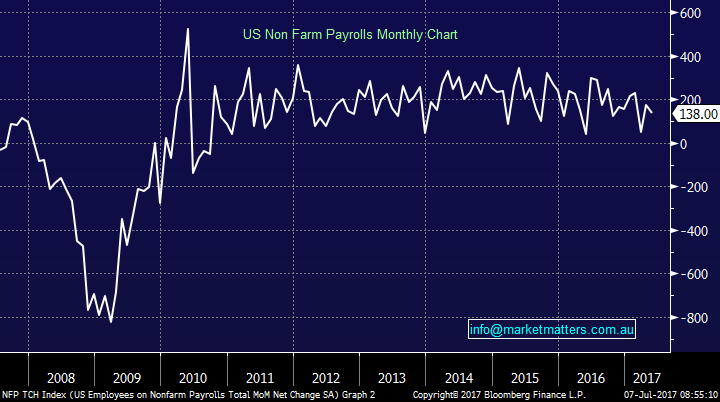

US rates play the tune for stocks – part 3

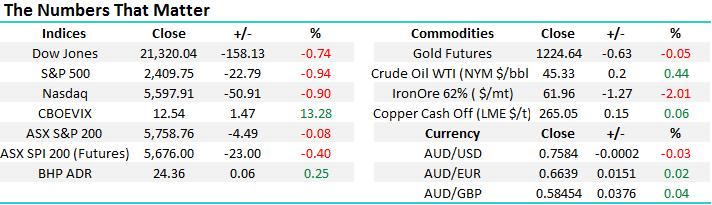

A choppy session for the ASX yesterday with the market finishing marginally lower, down by -4pts to close at 5758. The US market was weak overnight courtesy of another big move higher in US interest rates, a theme we covered twice last week HERE and HERE. The US 10 year yield has traded from 2.11% to hit a high of 2.39% overnight and understandably, this caused some selling in the equity markets with the Dow Jones down by -158pts to 21,320, however as previously suggested, the DOW needs to break the 21,000 before triggering a sell signal.

Dow Jones Daily Chart

When bond yields are rising, it means bond prices are falling as the crowded long US bond trade starts to unwind. Those that were ‘hiding’ in US Treasuries as a safe haven are now getting hurt and we all know what happens to ‘crowded trades’!! US interest rates are rising for a few reasons.

Firstly, there was a big disconnect between how the market was positioned and what the Federal Reserve was guiding towards. Just last week, the market was pricing a bit over 2 rate hikes out to 2019 while the Federal Reserve was guiding for 7. Since then the market has repositioned itself pushing bond yields higher. This was a topic we discussed with Charlie Aitken from AIM in the Market Matters Weekly Video. In our view US interest rates will continue to track higher and the areas of the market that benefit from higher rates (the reflationary trade as we call it) will perform best. The Weekly Chart Pack covers our view here in more detail.

US 10 Year Bond Yield – Weekly Chart

The other driver of higher US interest rates has been better economic data globally. Chinese growth data has been improving as has data out of Europe. In the US overnight, we saw a very strong June ISM Non-Manufacturing print, which basically measures the strength of the US economy outside of manufacturing. The composition of that read was actually very interesting, however overall a lot stronger than the market was expecting - pretty much every component was better.

If we think a little bit more about bonds, and sorry to harp on about this however it’s a topic that shapes our investment decisions at the moment, it seemed the market was positioned for a recession, with a fairly flat yield curve. A flat curve basically means that as an investor you’re getting paid a similar amount for holding short term bonds as you are for holding longer term bonds. Say we have the 2 year bond paying a 2% yield and we’re only getting 2.10% for the 10 year – that is a flattish yield curve. A flat yield curve is typically an indication investors are worried about the economic outlook – and a recession might be on the horizon.

A few weeks ago we wrote about this, saying we thought it was more a function of Central Bank buying of longer dated bonds as part of Quantitative Easing (QE) post the GFC (i.e, buy longer term bonds to put downward pressure on interest rates, with lower interest rates being stimulatory / supportive of asset prices). As Central Bank support comes out of the market (as the Fed has guided to), we should see the yield curve steepen.

One of the baffling things to us was that German 10 year Bond Yields were actually negative for a time – simply crazy! This trend has since turned and it’s another very clear sign that global interest rates are headed higher.

German 10 Year Bond Yield

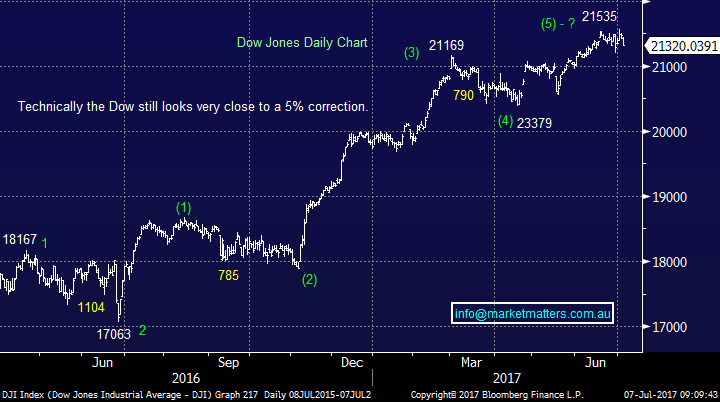

Tonight we have US Non-Farm Payrolls in the US, with the market predicting +200k jobs to be added. Higher interest rates will be tolerated if underlying economic conditions continue to improve, if they don’t and we have a situation where rates are rising yet economic activity is slowing, that’s when stocks will struggle – and we should become more cautious.

US Non-Farm Payrolls

MM portfolio

Yesterday we sold our Fortescue Metals (FMG) booking a nice profit of around ~14%. As we wrote in yesterday morning’s note, we expect a lot of volatility in the Iron Ore space this year and we will remain active around our positioning. We also bought Alumina (AWC), a stock we’d covered as part of our ‘Income Portfolio’ release. Yesterday we added it to the Growth Portfolio with a purchase at $2.01. Technically, AWC needs to break through current resistance around the $2 region.

Alumina (AWC) Weekly Chart

Conclusion (s)

- Global interest rates are headed higher and we should be in sectors that benefit from higher rates

- The ‘reflationary’ trade is alive and well and sectors such as Materials, Financials and Insurance should do well – 3 areas we are heavily weighted towards

- We sold Fortescue and Bought Alumina yesterday

Overnight Market Matters Wrap

· A sea of red was seen across the major global markets overnight, after a weak French debt auction showed some indication to investors that the selling in treasury yields has only just begun.

· Although all sectors were in the red overnight, the Utilities sector outperformed the broader market, while the Telcos lagged.

· Iron Ore closed 2.01% lower overnight, with BHP expected to open marginally lower.

· The ASX 200 is expected to open 30 points lower this morning, as indicated by the September SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/07/2017. 7.40AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here