Complacency will break – at some point!

The ASX 200 grinded higher yesterday however volumes remain low and we’re yet to see any meaningful conviction in either direction - perhaps the upcoming earnings season in the US will provide the catalyst – which kicks off tonight with Pepsico, before it really heats up later this week / early next with some of the major US banks.

In the US overnight, the Material stocks saw most support up by +0.4% while Technology shares also saw some reasonable buying. Healthcare stocks remain under pressure down by -0.3% and although the moves are only small, we’re seeing a clear rotation out of that sector after an incredible run over the past few years. We remain neutral/negative Healthcare in the States and this influences our thinking around the sector in Australia – we currently have no Healthcare Stocks in our portfolio.

I was coming across the Harbour Bridge this morning looking out on a very nice day here in Sydney – the sun starting to work up through the clouds and making the Opera House glow, thinking about markets as I typically do, and it seems there is an earie calm playing out right now, particularly in the US. Our market has been more choppy however it’s the US which is likely to drive future volatility, and it could well be earnings that create the catalyst for that. When volatility is low and complacency is high the natural view would be that markets are susceptible to a big move on the downside – and that’s a possibility, however we tend to think that markets are simply susceptible to a big move, and more so on the upside than the downside at this point in time. Because cash levels are high, if earnings print ahead of expectations, we may well see a wave of cash enter the market, and another leg higher would play out. If the earnings are weaker than anticipated, then that same cash is likely to buy a dip.

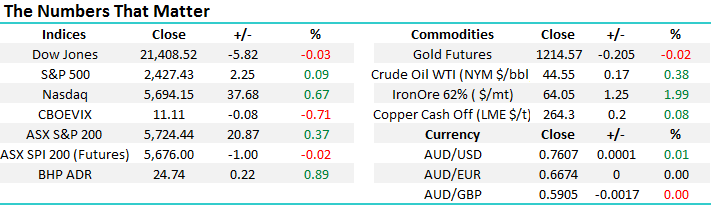

One thing I’ve learnt over the years, is the longer complacency lasts, the bigger the move when it breaks – in either direction, and it will break at some point. Our bigger picture view is still for higher levels for the S&P 500 (and our market), into a blow off style top towards the end of 2017/18.

S&P 500 Monthly Chart

Interesting chart from Bloomberg below that highlights this level of complacency through the volatility index. Some will say the VIX is a backward looking indicator and it is, but a reasonable guide non-the-less.

US Earnings

Earnings drive stock prices overtime, however there are a huge amount of other variables that will dictate the ebbs and flows in the short to medium term. Market positioning and current expectations, the concept of ‘what is already baked into the cake’ is probably the most important aspect when navigating through an earnings period. Right now, the market is expecting earnings growth for the S&P 500 of 7% year on year for the 2nd quarter. This comes off the back of very strong growth in the first quarter, however that was largely a function of a big rebound in Energy Shares as the Oil price was strong – which isn’t likely to be the case this time around.

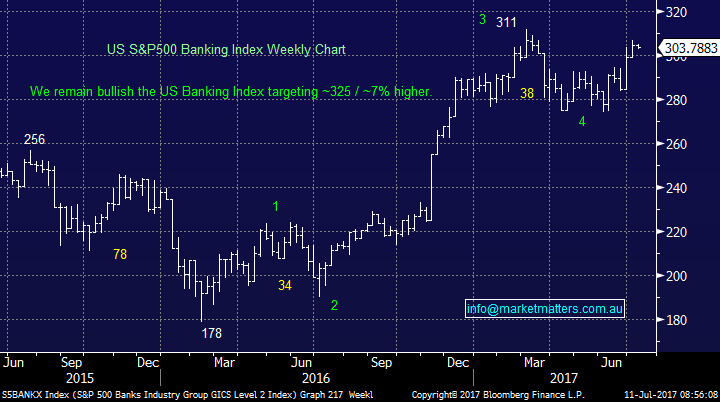

We’ve spoken a lot about higher US interest rates and what this means for particular sectors within the market – the financials being a beneficiary. Financials stocks in the US have been doing well and the ‘long financials’ trade is fast becoming a crowded one. In the short term, US interest rates have probably extended high enough (for now) and this removes one of the short term drivers for the sector. Now, we need to see them deliver strong numbers (and upbeat outlooks) if they’re to break through current resistance.

US S&P 500 Banking Index Weekly Chart

Conclusion (s)

We’re comfortable in our positioning given the key macro trends playing out right now, however US earnings could be the catalyst for another leg up for stocks

We continue to monitor BT (BTT) given it closed yesterday at $11.00 **Watch for Alerts**

Overnight Market Matters Wrap

· A mixed session was experienced in the US equity markets, with the broader S&P 500 ending the day with a marginal change to the upside, while the Nasdaq 100 outperformed and closed 0.67% higher.

· Locally, we expect to have a sombre day as global investors wait to digest the US Fed Beige Book later this week, looking for signs of when the Fed will start to shrink its balance sheet.

· The June SPI Futures is indicating the ASX 200 to open 5 points higher, testing the 5730 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here