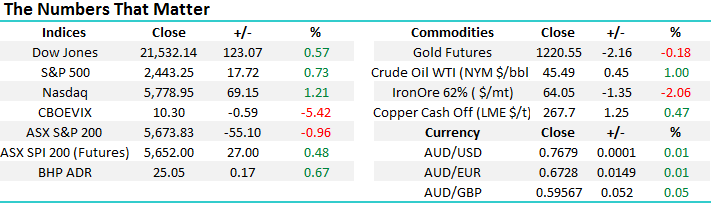

Canada hikes Interest Rates – is it a sign of things to come?

A very weak session yesterday for the market in Australia with the ASX down by -55pts/0.96% with most weakness focussed on the Healthcare Stocks followed closely by the ‘yield names’ that we covered yesterday morning. Once again outperformance was seen in the Resource sector and we remain comfortable with our large position here. As it stands, the Market Matters has a total of 27.5% of the portfolio in resource names, although 5% of that is in Newcrest.

The technical picture in Australian market remains neutral at best, and we continue to target a break back up above 5750 to become more bullish.

ASX 200 Daily Chart

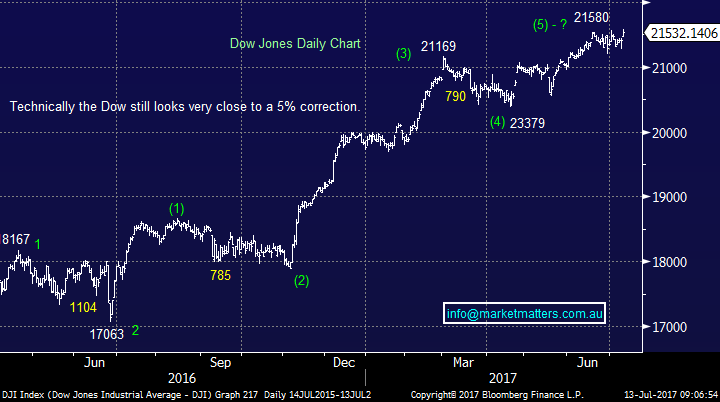

The US market continues to be strong with the Dow Jones making new all-time highs overnight.

Dow Jones Daily Chart

Yesterday we sold out of BT Investment Management (BTT) for a small loss - a few reasons;

We bought BT into weakness following Westpac’s sell down, a good fund manager with strong growth, a lot of which was coming from their international arm. When a ‘short term’ event, such as the Westpac sell down puts downward pressure on a stock, it often creates a buying opportunity. The sell-off was not earnings related, it wasn’t a reflection on the business and this saw the stock come back to a reasonable multiple, given the outlook for growth at the time. We bought it and the stock moved up pretty sharply in a short amount of time.

UBS then issued a report on BT, questioning market assumptions around performance fees, and like all good investors, we think about the views of others, and either take them on board or not. In this instance, it gave us reasons to be on ‘high alert’. We thought the UBS report had merit, however we always prefer to let the market guide us. A break of a key technical level ($11.00) and the formation of a bearish chart pattern was enough for us exit the stock. BT may turn around from here, however it became a more 50/50 proposition and when that happens, we’d rather be in the comfort of cash – which now sits at 14.5% in the MM Portfolio. That’s not ideal given our positive stance on the market but it does give us flexibility – which remains key.

BT Investment Management (BTT) Daily Chart

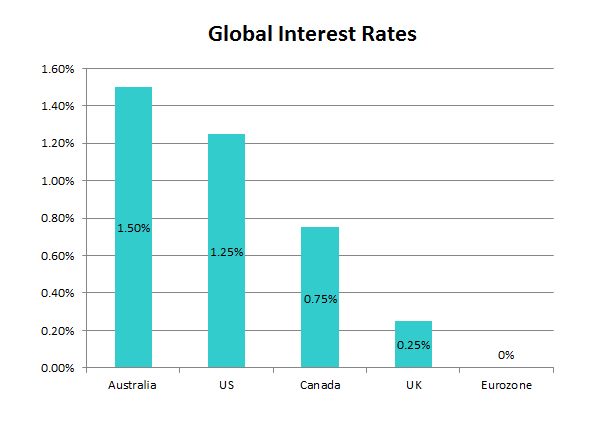

Interest Rates

A few months ago, the Bank of Canada started discussing the prospect of raising rates and that seemed to be the catalyst for global interest rates to start moving higher. Although the US Federal Reserve led by Janet Yellen had been guiding the market to higher rates for some time, there was a high level of scepticism around whether or not they would follow through – which is understandable, given their track record of inaction – basically, the market didn’t take it seriously and positioned accordingly. It was when Canada started talking rate hikes the market sat up and listened – and overnight the Canadian Central Bank followed through and raised rates by 0.25% to 0.75% - the first hike in rates since 2010. At 0.75%, the Benchmark is still a long way below our own while the economic picture in Canada seems more positive. The Central Bank said that future hikes will be data driven however the Canadian economy has really got it’s mojo back following the 50bp of cuts in 2015. Canada is in the midst of one of its strongest growth spurts since the 2008-2009 recession, with the expansion accelerating to an above 3% pace over the past four quarters. Clearly, interest rates are going up in Canada, and around the world in our view.

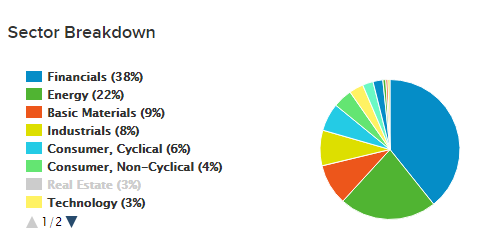

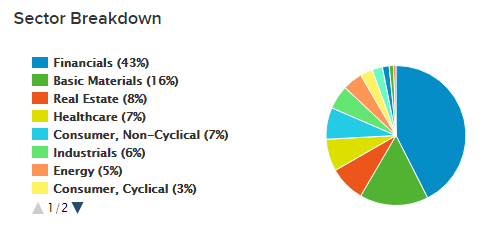

We often talk about Canada as a guide for our own market given the composition of its main index, dominated largely by Financials and Materials/Energy. Here’s a quick comparison.

Canadian Market Composition

Australian Market Composition

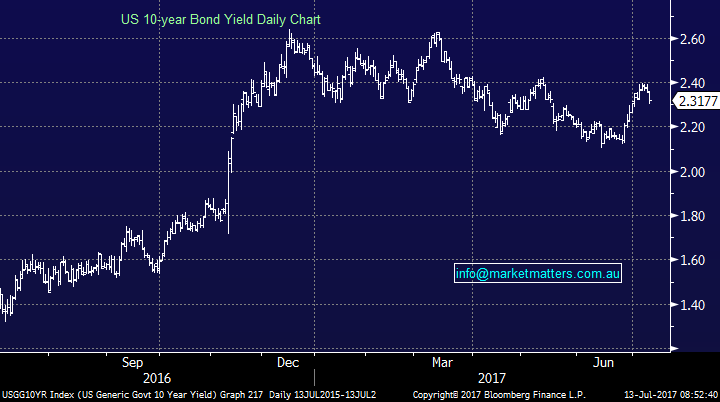

We also had the US Federal Reserve Chair Janet Yellen out with her testimony to Congress overnight, and pretty much kept the same script as she had laid out last month, however the moves in the Fixed income Market were interesting. Yesterday we flagged that US rates had run too hard, too fast and were due for a pause, which played out overnight. The 10 year yield back down to 2.32%. The main aspect to watch in terms of US and global interest rates will be the US CPI print (Inflation) which is due for release on Friday. The Fed is saying low inflation is a short term theme and it will bounce back – the market is less convinced.

US 10 Year Bond Yields

All in all, we have a backdrop of rising interest rates globally, and last night’s move by Canada was simply confirmation of that. In an environment of rising rates, long duration assets like property and infrastructure in general terms will struggle, so too will stocks on high multiples. Materials, Financials & Insurance stocks should be the core of a portfolio in this type of environment in our view.

Conclusions

Global interest rates are headed higher and that should shape our overall positioning

We now have 14.5% in cash and this feel a little high given the typical strength that plays out in July

**Watch for Alerts**

Overnight Market Matters Wrap

· The US equity markets closed higher overnight, with the NASDAQ outperforming the broader market yet again.

· The rally was sparked after US Fed Chair, Janet Yellen mentioned that US rates won’t have to rise too much to reach a neutral level, also noting that they would start to wind down its bond portfolio.

· Across the road, the Bank of Canada had lifted its key interest rates by 0.25%, as most had anticipated.

· The June SPI Futures is indicating the ASX 200 to open 33 points higher, towards the 5710 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here