Why we’re looking to buy Star Entertainment (SGR)

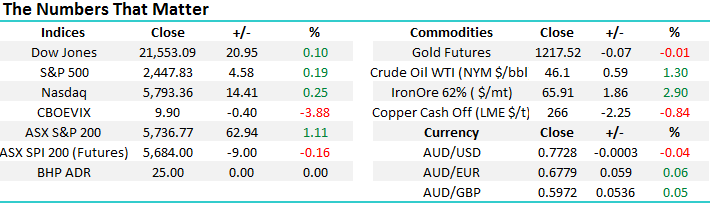

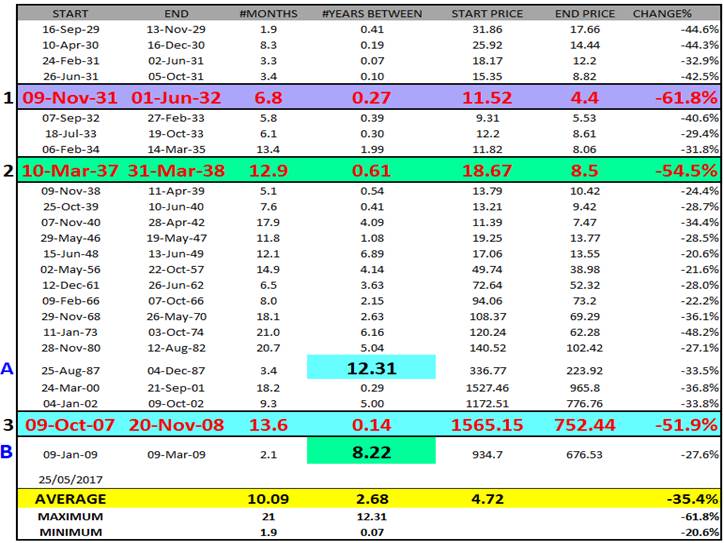

The Australian Market rebounded strongly yesterday with sustained buying throughout the session – the index adding 63pts / 1.11% to close at 5736. US markets have continued to perform well with the Dow Jones trading at new all-time highs while the S&P 500 is trading just -0.16% below its all time high of 2453. Recent sell-offs in the US market have clearly enticed buyers out of the woodwork and the weakness has been short lived.

Bigger picture, we’ve called the US market to new highs and that is playing out as expected, our market has been more stubborn however we remain positive on the two biggest sectors locally, the Financials & the Materials so therefore we should be positive on our index. Best guess is another 6-8% in U.S markets before we should be dusting off the sellers hat once again.

Fidelity International, a global fund manager wrote an interesting article a few days ago (posted on Livewire Markets) titled The best (and worst) outlook for equity markets. The article outlined a path forward that is very similar to the views we’ve been writing about for a number of months. Bull markets are born on pessimism and die on euphoria. By that yardstick, the current bull market - already one of the longest on record – may have further to go. Many investors remain cautious and uncommitted; this has been one of the most miserable and loathed bull markets in memory. Yet, this feature helps to explain its remarkable longevity. Bull markets usually end only after the last buyers are flushed out, but there is abundant cash on the side-lines. (Fidelity)

We couldn’t agree more. This much loathed bull market that started in March 2009 has further to run however the higher the markets go, the closer we get to a meaningful correction – something greater than 20%. The next 12-18months is going to get interesting as we trade within the 5th and final phase.

S&P 500 Monthly Chart

Fidelity went on to highlight two potential scenarios. 1, a sharp correction that cleans out the market or 2., a more benign ‘sideways’ market - a period of consolidation that sees market levels drift, but with significant rating changes beneath the surface supplying opportunities for discriminating investors. History supports scenario 1.

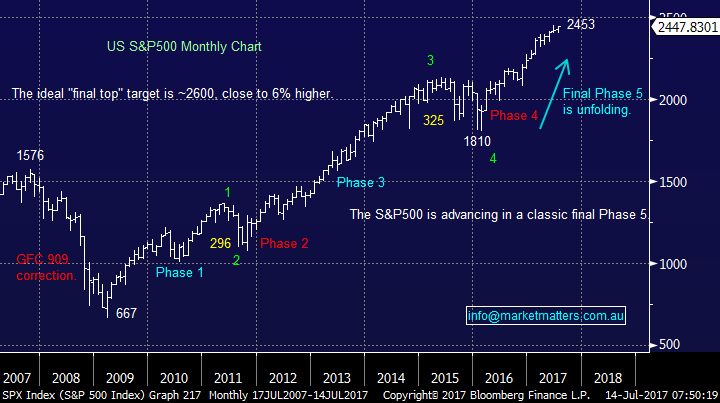

Below is quick overview of bear markets going back to the start of the century. We’re now in the 99th month of a very mature run. On average, the market will have a correction of 20% or more every 32 months (2.6 years) however if we strip out the data from the start of the century given it was more choppy, then we correct 20% or more every 4.7 years. We’re clearly overdue at 8.25 years.

Market Corrections

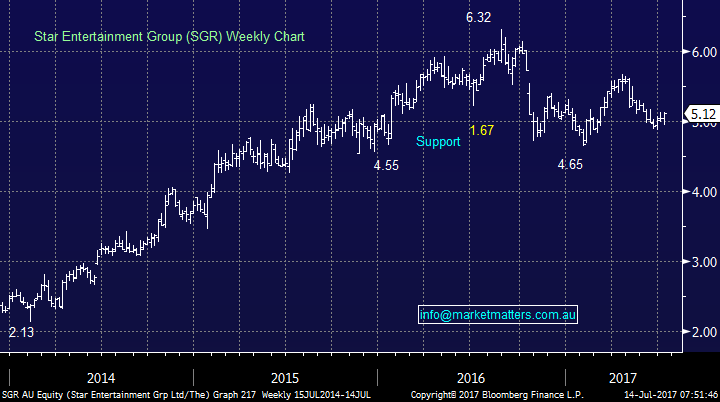

Star Entertainment (SGR) – $5.12

We’ve owned Star Entertainment in the past, buying in February of this year at $4.76 and selling in May at $5.61 - we also picked up a nice 7.5c full franked dividend along the way for a total return of +19.43%. Star is once again looking interesting after trading back down to the low $5’s, closing yesterday at $5.12. As a refresher, The Star operates The Star in Sydney, Jupiters Hotel & Casino on the Gold Coast and Treasury Casino & Hotel in Brisbane. They also manage the Gold Coast Convention and Exhibition Centre. Furthermore, they’re progressing with the development of a new Integrate Resort as part of the Queen's Wharf Brisbane project due for completion in 2022.

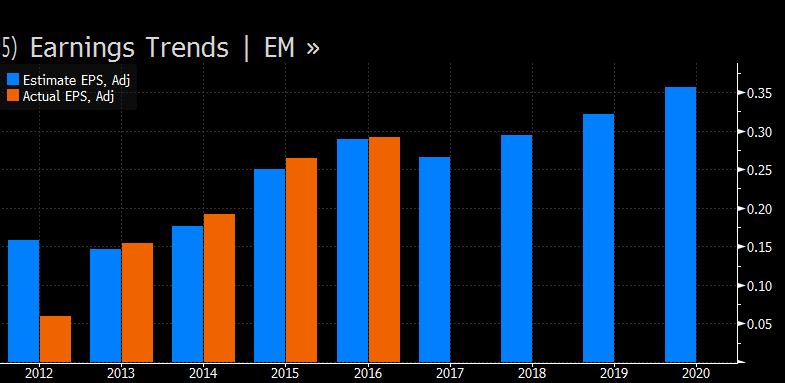

This obviously means that expenditure will be reasonable high as this project completes, however the development will drive long term earnings. It seems recent weakness is driven by a couple of things. Soft consumer sentiment and reluctance to spend in Australia is a well-known theme, however it’s one that impacts Star. The other is around valuation and near term earnings. 2017 is expected to see a decline in earnings relative to 2016 which puts it on a forward PE around 19 x, which is rich for a company that has seen top line (revenue) decline over the 12 months (-2%). However, from F18, given the composition of their assets earnings will once again start to grow putting it on a PE nearer 16 times on FY18 and a yield of 3% FF. Strong balance sheet, good future growth, Chinese Tourism, and the stock has come back to attractive levels.

There has also been some talk (largely being pushed by Citi) suggesting that if Crown were to buy the Star, this would lift Crown earnings by up to 22%assuming they made an all-cash deal at a 30% premium to its last close – equates to around $6.45 when the note was penned. Corporate appeal always tends to help a share price however is not the reason to buy a stock.

**Last night, Genting (second largest holder of SGR) sold its large stake of 46.4 million shares at $5.07 a share – only ~1% discount from its previous close of $5.12**

Star Entertainment (SGR) Weekly Chart

Conclusion (s)

Markets remain in the final stages of a mature bull market, however more upside seems likely.

We are keen buyers of SGR after assessing the open this morning, following Genting’s sell down overnight.

Overnight Market Matters Wrap

· It was a relatively quiet night in the US, with the major indices edging marginally higher as investors await the beginning of US reporting season, with three banks due to deliver earnings tonight.

· President Trump said he may consider tariffs and quotas to stop steel dumping from China and other cheap manufacturers.

· Copper on the LME was lower while oil was 1.3% higher. Iron ore continues to bounce off its mid-June low sub US$55, to trade nearly 3% higher at US$65.91.

· The ASX 200 is expected to follow suit with the US and open with little change, but positive bias, towards the 5740 area as indicated by the September SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here