Should Investors Chase the Banks Today?

Yesterday the ASX200 advanced 45-points / 0.8% courtesy of the relief rally in our banking sector which we flagged over the last few days – our “Gut Feel” was on point this week. Here we are again, following the surge by our banks the ASX200 is exactly in the middle of the recent trading range between 5629 and 5836. Pretty uncanny stuff when after 9-weeks of very choppy local stock market action we have a hot day for the banks and the ASX200 has closed at the median price since the 18th of May, to the point!

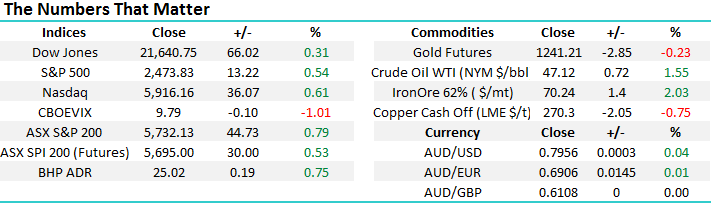

We see 2 potential scenarios unfolding for the local market over the coming few weeks as August looms, now only 8-trading days away:

1. Yesterday’s banking rally losses momentum rapidly and the ASX200 corrects back towards its “abc” target ~5500 i.e. almost 4% lower.

2. The banking sector continues with its bounce plus the rest of the market regains some of its mojo enabling the ASX200 to rally towards 5870 before a likely failure leading to an eventual test of ~5550.

Clearly, either way we are on alert to increase our cash position in the MM portfolio over coming weeks to enable us to buy aggressively at lower levels if either of the above scenarios unfold. Optimal investing is about being prepared for eventualities so you don’t get blinded like the masses by panic in whatever direction.

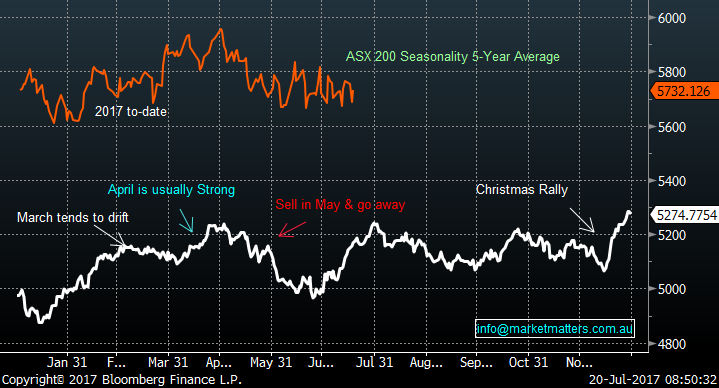

Taking into account that seasonally the ASX200 usually rallies into the end of July before struggling for the next 2-months our preference at this stage is scenario 2. Also remember that since the GFC July has seen the ASX200 gain an average of 4.04% but so far, this month we are up only a meagre 0.2%. Hence, we remain bullish short-term but are looking to increase our cash position if this anticipated strength eventuates.

ASX200 Weekly Chart

ASX200 Annual Seasonality Chart

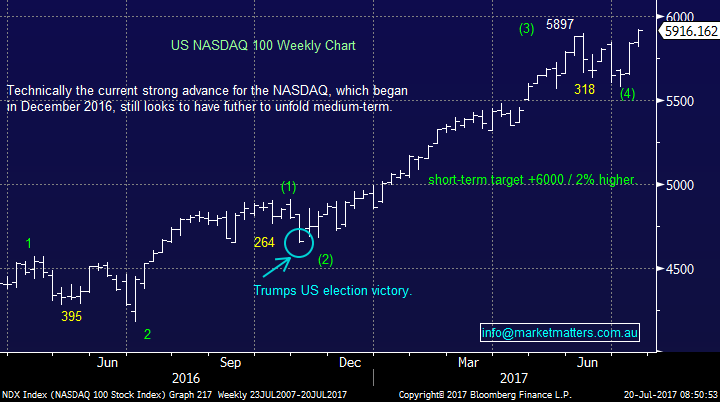

US Stocks

Last night US equities again rallied strongly to all-time highs as the masses of doubters continue to look simply wrong. There remains no change to our current view, we are targeting ongoing all-time highs for the NASDAQ probably over 6000, now only ~ 2% higher, before a decent correction to test the early July lows.

US NASDAQ Weekly Chart

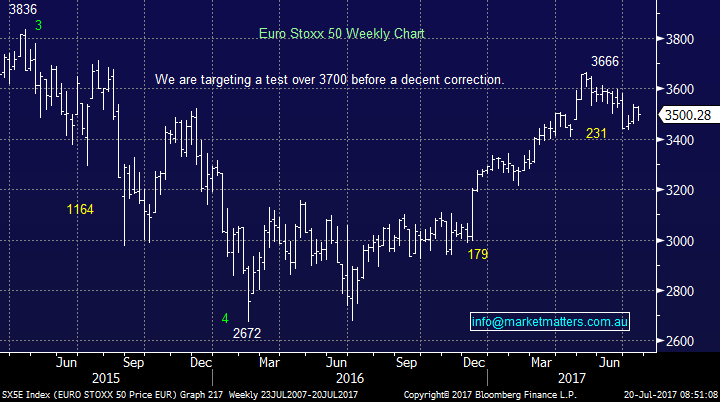

European Stocks

No change, the Euro Stoxx 50 looks very aligned with the NASDAQ ideally targeting a break over 3700 prior to a decent correction but conversely the German DAX is targeting further weakness before it hits our target pullback area. The key question is “if” the US and European stocks can make these anticipated fresh 2017 highs will the local ASX200 finally manage to eke out some gains – today should be a very good indicator.

Euro Stoxx 50 Weekly Chart

Moving onto the main topic in town, the banks. Numerous articles have been written over the last 24-hours following the Australian regulators decision on capital requirements for our banks but the below headline sums up the positive outcome for the banking sector. “APRA has said the banks can get to its new target without equity raisings or cuts to its dividend” – Australian Financial Review.

We believe the market is neutral to underweight the banking sector and although risks clearly remain e.g. house prices fall leading to increased bad debts, no equity raisings are a huge short term bullish outcome for the sector. So, the question is how do we invest in the banks from here?

The typical May / June weakness played out in the banking sector and we are now moving towards the end of the ‘theatrically’ strong month of July. To date, the Banking Sector is up +2.5% versus the average post GFC gain for the sector of +4.49%. Short-term we can comfortably see another few % upside in our banks following yesterday’s announcement and the obvious removal of the much-hated uncertainty.

Firstly, let’s look at both the local and US banking sectors for some clues to future direction. Overall, we have no change to our view:

1. Medium-term our banks still look ok following the last few years correction.

2. The US banking sector remains bullish short-term

ASX200 Banking Index Monthly Chart

US S&P500 Banking Index Weekly Chart

The noise around which bank is best positioned following the APRA decision will be forgotten quickly and investors will focus on the quality of the respective underlying businesses. We have 2 favourites depending on investors hunger at this point in time for dividends.

1 Commonwealth Bank $83.81

CBA has often been our favourite bank and one that has looked after us nicely from an investment perspective. We like CBA, especially while it can hold over $83, and its dividend should remain very supportive.

CBA goes ex-dividend in mid-August, investors who buy the stock today will pick up 3 dividends over the next 13-months hence yielding close to 8% p.a. fully franked over that period, clearly attractive to local yield hungry investors.

Commonwealth Bank (CBA) Weekly Chart

2 Westpac (WBC) $31.94

While we hold CBA, WBC, CYB and NAB in the MM portfolio our preferred pick along with CBA at today’s levels is WBC. From a risk perspective, we would be concerned if WBC now falls back under $31. WBC’s next dividend is not paid until November with the stock currently yielding almost 6% full franked.

Westpac Bank (WBC) Weekly Chart

Conclusion (s)

We remain bullish the banks but are very conscious that we see a likely pullback in equities over August / September. Hence our thoughts at this stage are:

1. CBA remains a BUY – and we may also consider selling options against our holding if the stock rallies towards $88

2. WBC is a HOLD considering our outlook for stocks over August / September.

Overnight Market Matters Wrap

• New highs were reached overnight in the US broader S&P 500 and NASDAQ with the Energy and Materials sector leading the charge.

• BHP is expected to follow its performance in the US, ending its session up an equivalent of 0.75% from Australia’s previous close.

• Domestically, investors brace for its latest employment data, with analysts expecting an increase of 15k, and unemployment rate of 5.6% and a participation rate of 64.9%.

• The June SPI Futures is indicating the ASX 200 to open 20 points higher, towards the 5750 level with volatility expected for July Index Options Expiry this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here