Did the IMF Ignite the Resources Sector?

The ASX200 again rallied strongly yesterday, gaining 50-points / 0.87% as the major resource stocks powered towards their fresh 2017 highs, something we’ve been targeting since we started aggressively accumulating weakness in the sector 3-4 months ago. MM is currently holding its largest exposure to the resources sector since our inception via AWC, BHP, OZL and RIO, not including our small exposure to the gold sector via NCM. Today we are going to clarify our thoughts on the sector, following its recent strength, plus comments by the IMF (International Monetary Fund) around global growth earlier in the week.

Our current view around the overall index has not changed, but obviously it now looks likely that this July will now be the tightest range since mid-2014!

1. The ASX200 remains range bound between 5629-5655 support and 5836-5810 resistance.

2. Our preference is still for a further correction back towards 5500 in August / September and the more begrudging the pullback the keener MM will become to buy the retracement.

This morning, resources look set for a rest with BHP gaining only 10c even following strong gains in oil and copper.

ASX200 Daily Chart

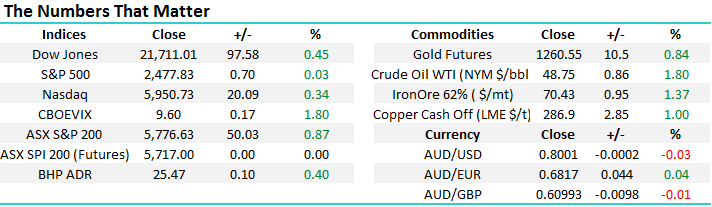

US Stocks

Last night, US equities were a touch stronger as reporting season continues to unfold with a clear positive bias. The NASDAQ may now fall marginally short of our 6000-targetarea and it’s important to remember we are targeting a 6-7% correction from this hot sector in coming months.

However, importantly for local investors, when the NASDAQ corrected sharply over 5% in June / July the ASX200 basically ignored the move. The broad S&P500 will need to correct before we are likely to take notice and we are looking for a smaller 4-5% correction here.

US NASDAQ Weekly Chart

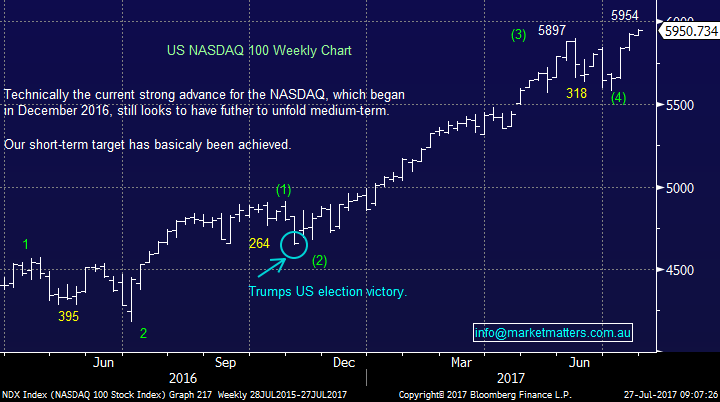

European Stocks

No change, Europe has recently been tricky with the German DAX now approaching strong support in the 12,000-area, following a 6.2% correction, while the UK FTSE looks vulnerable to further declines, especially as investors understandably get increasing concerned around BREXIT.

German DAX Weekly Chart

Earlier in the week, the IMF lowered growth forecasts for the UK and warned it sees the US fading as the global growth engine, however it sees growth picking up in China, Japan, Canada and the euro zone. Overall, they are looking for the world economy to expand by 3.5% this year, up from 3.2% last year and by a healthy 3.6% next year. The markets seem to be agreeing with the IMF as the $US fell to its lowest level for the year and this morning we see the $A back over 80c - its highest level since mid-2015. Their projected 6.7% growth for China definitely looks positive for commodities for now.

Moving on to MM’s 4 positions in the general resources sector and our importantly plans moving forward:

1 Alumina (AWC) $1.93

AWC is our only resources position in the MM portfolio which is currently behind following last week’s weakish result from Alcoa in the US. We are comfortable to hold for now with a potential ~3c fully franked dividend looming in August. Our ideal target remains close to $2.20 in the first instance and potentially $2.50.

Alumina (AWC) Monthly Chart

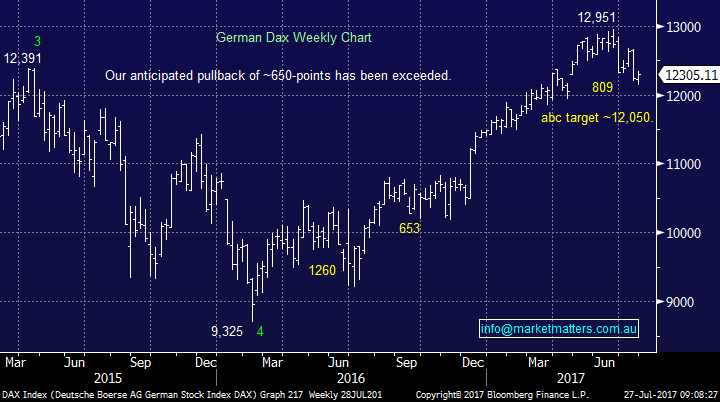

2 BHP Billiton (BHP) $25.37

BHP has finally regained its mojo with the likes of iron ore, oil and copper all rallying nicely. Our target remains over $28,plus there is a nice ~50c fully franked dividend looming in early September.

BHP Billiton (BHP) Weekly Chart

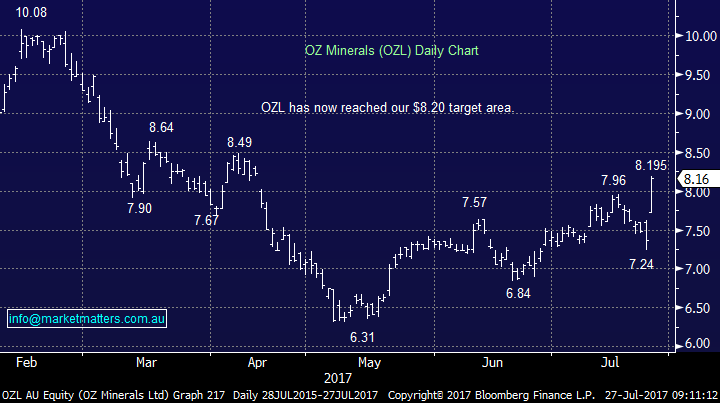

3 OZ Minerals (OZL) $8.16

OZL has taken us on a rocky road with both our investment and trading position in and out of profit, but finally the market listened to our view yesterday sending OZL up almost 11% into our initial target area.

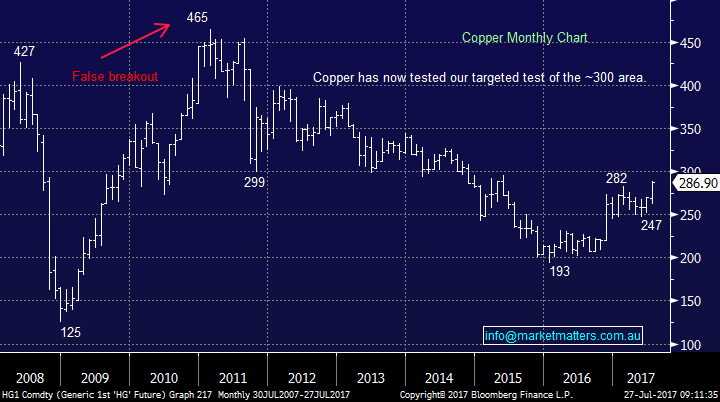

Our investment position is now showing a +13% profit and trading position +3.3%, not spectacular but considering the stock was a $1.85 / 22% lower in May a very refreshing result to-date. Also copper which OZL follows closely finally hit our target area yesterday as it surged to new levels not seen since mid-2015 – very similar to the $A. We think it’s time to take the $$ and pare back our resources exposure by selling OZL into the current strength.

OZ Minerals (OZL) Daily Chart

Copper Monthly Chart

4 RIO Tinto (RIO) $64.65

We remain bullish RIO targeting an eventual break of $70 in 2017 plus RIO is forecasted to pay a healthy fully franked dividend early next month.

RIO Tinto (RIO) Weekly Chart

Conclusion (s)

We remain bullish resources moving into the second half of 2017, but we have regularly discussed the stock / sector rotation that the ASX200 is currently experiencing as the major bull market matures. Hence, we are looking to take profit on OZL this morning, looking to slightly pare back our resources exposure into the current strength *Watch for alerts*.

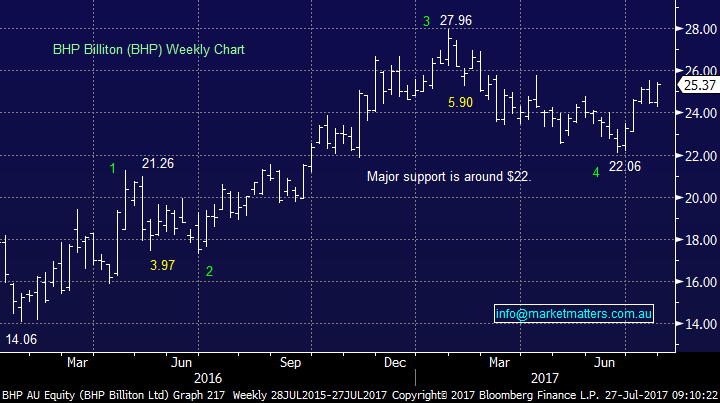

Overnight Market Matters Wrap

The US equity markets finished their session on record highs overnight, following the US Federal Reserve leaving its key interest rate unchanged.

Iron Ore continues its strength, rallying 1.37% overnight with BHP expected to outperform after ending its US session up an equivalent of 0.4% from Australia’s previous close.

The ASX 200 is expected to open with little change this morning at 5775 as indicated by the September SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here