The Game is Sector Rotation and Reporting Season

Yesterday the ASX200 ignored solid gains from overseas markets, including a 6% surge by Apple Inc. in late trade, following an optimistic outlook and fell 40-points from its strong open, to close down 28-points / 0.5% - yet another example of choppy unpredictable price action from the Australian market. Weakness was pretty much across the board with a few standouts following both positive and negative profit reports. Today we will again look at some stocks that reported, plus illustrate the huge sector rotation that has been unfolding within the ASX200.

The local market is now in its 11th week of trading in the relatively tight range between 5629 and 5836, we reiterate that statistically a breakout is overdue. Our preference remains for a test of the 5500-area as we enter the seasonally weak August / September period, but importantly no sell signals are raised their head. An obvious initial sign of weakness would be a break under 5700, to fresh weekly lows.

ASX200 Weekly Chart

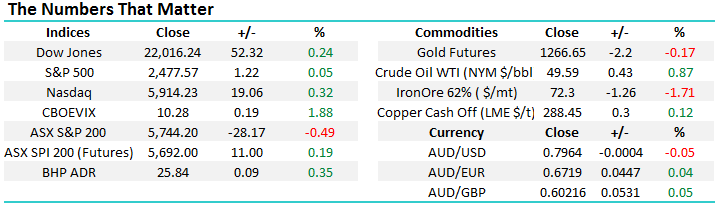

US Stocks

Last night was mixed for US stocks with the Dow closing up 0.24%, over 22000, courtesy of a strong night by APPLE, but the small cap index Russell 2000 closed down over 1% on a night when the majority of US stocks actually closed in the red.

There is no change to our current view that we believe a very strong possibility exists for +5% correction by US stocks in the short-term.

US Russell 2000 Index Weekly Chart

APPLE Inc (US) Weekly Chart

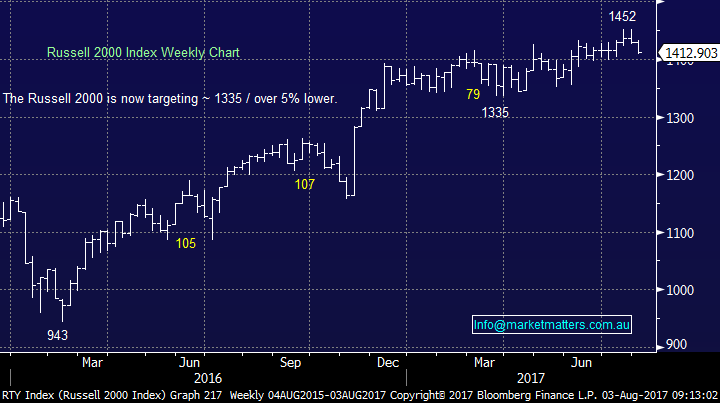

European Stocks

Yet again, no change, with the German DAX holding strong support in the 12,000-area following a 6.2% correction whereas the UK FTSE looks vulnerable to further declines, as investors understandably get increasing concerned around a “hard” BREXIT.

German DAX Weekly Chart

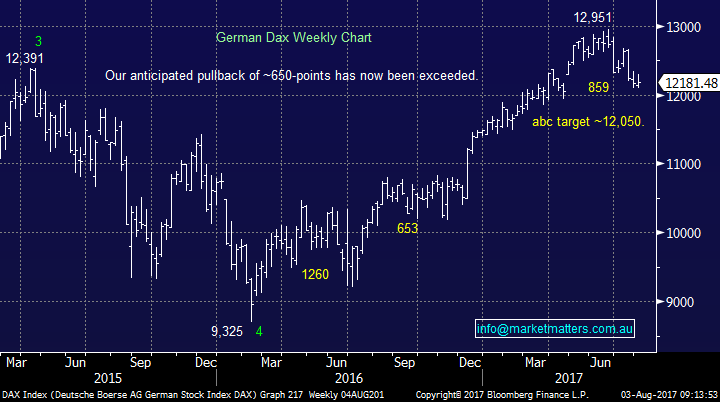

Sector rotation

We’ve been talking about sector rotation for many months but as our strong view to avoid the healthcare sector is unfolding nicely we thought some further illustration of the point made sense. The below numbers clearly show that as the 8-year bull market matures, all stocks are not moving as one, a characteristic that offers great opportunity for investors who remain ahead of the curve:

1 Over the last month – The ASX200 is +1%, Banks +3%, Healthcare -5.7%, Telco’s +0.8% and Materials (resources) +0.6%.

2 Over the last year – The ASX200 is +5.1%, Banks +13.3%, Healthcare -3.2%, Telco’s -47.9% and Materials (resources) +16.1%.

Most pundits have been saying buy healthcare and avoid banks, which as a view is clearly under pressure. Today we have used a simple daily chart to illustrate the huge differential in performance between 3 of our biggest stocks, BHP, CBA and CSL over the last 2 months.

We believe the next rotation may be from resource stocks to Telcos, or Healthcare as investor sentiment swings significantly on the best place to be invested but we are not in a hurry to push the button at this stage.

BHP v CBA v CSL Daily Chart

Results

CYBG Plc (CYB) $4.72

CYBG, the old Clydesdale Bank (CYB) had an excellent day rallying +7.27% to close at $4.72. The company delivered a quarterly trading update which showed higher margins, solid volumes, falling loan losses plus they’re travelling ahead on their cost out story. The weak pound has created some headwinds however the trends in the underlying business remain positive. We continue to like the story and own it in the Growth portfolio, obviously the result and share price reaction was pleasing.

CYBG Plc (CYB) Daily Chart

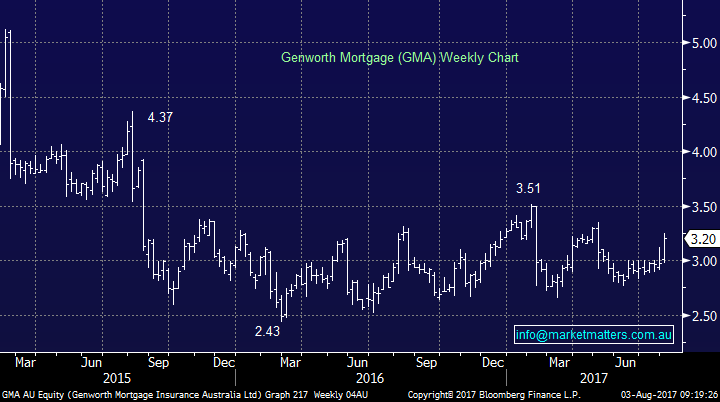

Genworth Mortgage (GMA) $3.20

Yesterday we added Genworth (GMA) to the Market Matters Income Portfolio under $3.20.

GMA provides mortgage insurance to borrowers on highly geared properties and has enjoyed the strong run in property over the past few years. Delinquencies have been low and therefore earnings have been strong, however the real story here is around excess capital on their balance sheet, and importantly their ability to return excess capital to shareholders. As it stands, GMA is holding around $1 per share excess capital and they have announced an on-market share buyback, of up to $100m of stock. The buyback will take place on market at prices below their book value which currently sits at $3.89

As expected they announced weaker profits however in our view this is now priced into the stock. Earnings are likely to remain under pressure given banks are currently less inclined to consider high LVR loans, however given excess capital, high yield, low multiple and strong balance sheet, we think GMA is an excellent addition to the MM Income Portfolio around current levels – with a 4% weighting

Genworth Mortgage (GMA) Weekly Chart

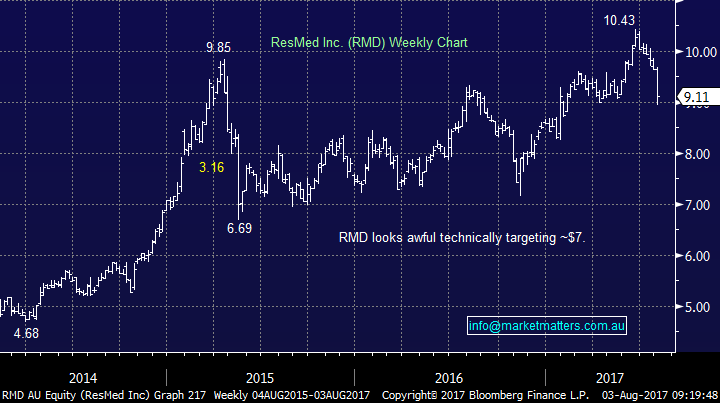

3 Resmed (RMD) $9.11

The sleep disorder company Resmed was sold aggressively following its result yesterday, falling 5.7% after it showed lower growth than its 26x multiple demanded – this feels like yet another example of healthcare stocks struggling with high valuations as they appear priced for perfection. There will obviously be a time to step back into that sector, however we believe more pain is required for now in this “go to” popular sector.

We have no interest in RMD at current levels which technically looks poised for a decent correction.

Resmed (RMD) Weekly Chart

Conclusion (s)

With the MM portfolio sitting on 23.5% cash we obviously continue to look for buying opportunities however we are comfortable remaining patient at present.

Following yesterday’s company reports we are pleased to add GMA into our Income Portfolio but see no good fresh opportunities for the Growth Portfolio.

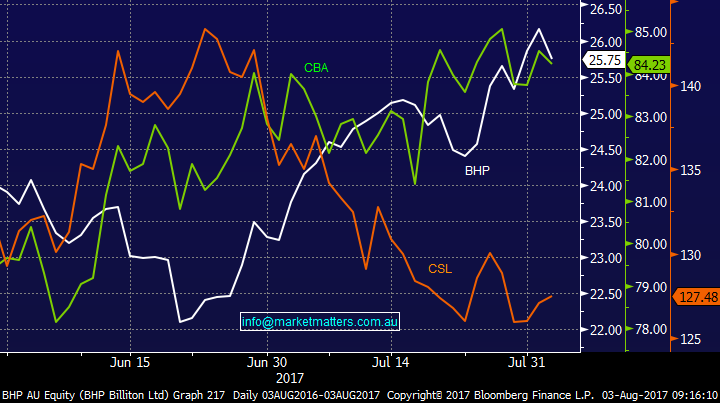

Overnight Market Matters Wrap

· Further record highs were seen in the US overnight, with the Dow breaking the 22,000 handle after positive earnings results from Apple Inc.

· RIO in London and the US lost over 2% overnight following its earnings post after Australia market close yesterday. We expect RIO to underperform the broader market today, conversely BHP is expected to outperform the broader market after ending its US session 0.35% higher from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 10 points higher, above the 5750 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here