Hi Scott,

In terms of the $A we do have a bullish outlook through 2026 but much of the move has already materialised hence using hedging with the Aussie above 70c isn’t something we would be actively pursuing.

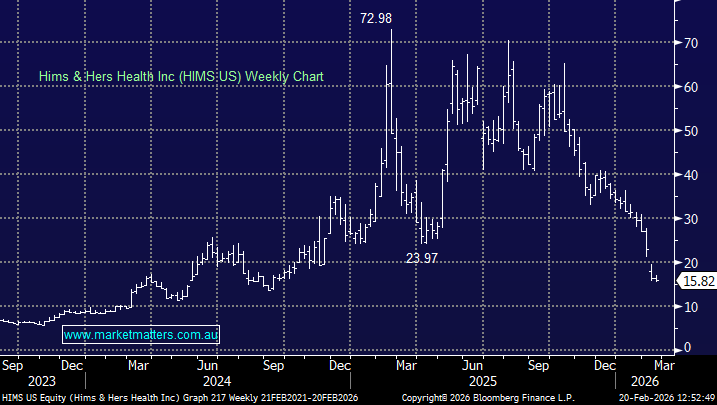

For subscribers not familiar with Hims & Hers Health Inc (HIMS US) it makes money by selling subscription-based telehealth services and prescription products directly to consumers, including treatments for weight loss, mental health, sexual health and dermatology. It earns revenue from recurring membership fees and the sale of medications and wellness products fulfilled through its platform.

As you say, Hims briefly partnered with Novo Nordisk to distribute Wegovy, but Novo quickly terminated the agreement, alleging Hims continued promoting compounded semaglutide products. Novo then sued Hims over its compounded oral version, prompting Hims to withdraw the product amid legal and regulatory pressure.

But Hims is not a simple “deep value” stock driven by cost cuts or cyclical earnings, it’s a growth play tied to expanding digital healthcare, new markets and recurring revenue — the exact space that the “AI Disruption Trade” has hammered in recent months. If HIMS can successfully integrate Eucalyptus and repair confidence after the Novo issue, its current price could reflect an opportunity but in the current environment, like many growth stocks it’s a high-risk play in the current “sell first, ask questions later” environment.