Hi Debbie,

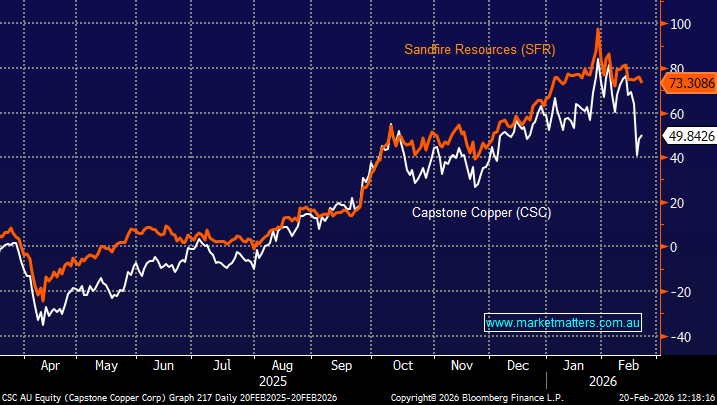

We are very bullish copper over the coming years with the question being what is/are MMs preferred vehicle to gain exposure to the view. Unfortunately, after its recent trading update where the Canadian based miner lowered its production forecasts and guided to higher costs for 2026, CSC is not in the frame for MM at this point – we think it will take time for the market to digest the change in production outlook. Our top two ASX large cap stocks for copper are BHP and Sandfire, and Aic Mines (A1M) at the smaller end of the market.

- In specific terms for CSC we see value if/when the stock drifts back under $13 – we think this is a probably scenario.

As for Emeco Holdings (EHL) its report at a glance looked good:

- Revenue from continuing operations $420.8mn, up 9% YoY.

- 1H Profit $38.7mn, up 15% YoY.

- Operating EBITDA +7% v 1H25.

However, as is often the case after a stock has run very hard, it wasn’t enough and a couple of analyst downgrades came through. We like the stock and mining services area but see real value back ~$1.20, or 10% lower following this week’s result.