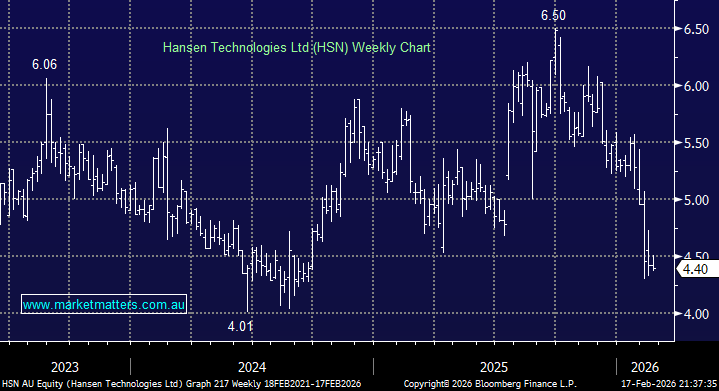

Looks a solid result from HSN this morning, highlighting the benefits of its recurring revenue base, tighter cost control and improving operating leverage – while we also got a good sense of how they are approaching AI, and they’re a good example of what we want to be seeing from the software stocks we own.

1H26 Highlights:

- Revenue: $191m, +7.3% YoY (slightly below exp of $199m)

- Underlying EBITDA of $55.7m, +46% YoY – broadly inline with exp (~$57m)

- Underlying profit: $30.5m – broadly inline

They said revenue will pick up in the 2nd half, which is important, as consensus sits at $414m for the FY + EBITDA of $119m. AI has obviously been a very big focus, and these sorts of software companies need to be leaning into AI rather than approaching it incrementally, and this is what HSN is doing.

HSN have AI embedded directly into core billing, settlement and revenue systems, areas that are mission-critical, regulated and deeply embedded in customer operations. This is aligned with our thinking in this space, focussing on stocks with the data, the complex workflows, and the customers to leverage AI and benefit from it.

Hansen sits at the system-of-record layer, the source of truth for billing and cash flow. Proprietary, decades-long datasets that generic AI can’t access. High switching costs for customers, long implementation cycles and regulatory complexity create a strong defensive moat, while AI is improving efficiency, accelerating implementations and lowering cost-to-serve

- HSN are a company leaning into AI, with AI hubs in California and London, eight AI solutions already embedded, and measurable customer outcomes being delivered.