What to do with tech?

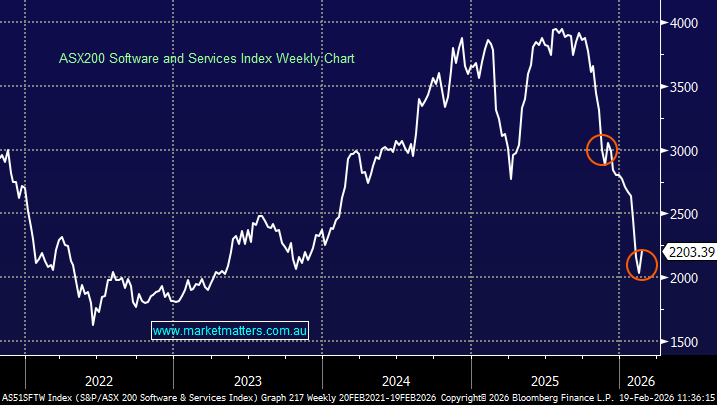

So what do we do about our tech exposure? Like the MM portfolios, mine has also suffered at the hands of the tech sell off. I’ve watched my tech stock values drop and even started adding to positions in December and January (I note MM also had that strategy adding to XRO and noting it would be buying CAT if it didn’t already have exposure). And then watched those shares drop 30% more. MM is currently exposed through WTC, XRO, CAT, 360. I know that you sold out of CAR at the start of February to reduce your tech exposure, but you still have those tech stocks in the portfolios currently down significantly. So, what do we do? Wait and see? Are you planning on trimming anymore or waiting to see when it turns around to increase the exposure? With such a huge paper loss of the values of these companies, it’s hard to know what to do. Not looking for specific advice. If you can speak to how you are thinking about your current tech exposure and the fact that you are down significantly on those stocks. Whats the plan?