- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

- 1H26 Reporting Calendar: Spreadsheet Version Here, PDF Version Here

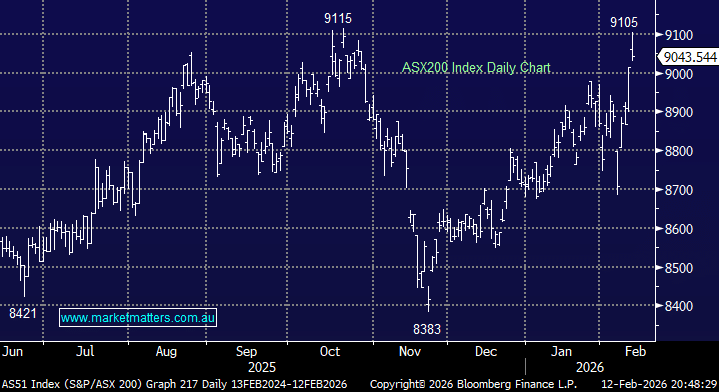

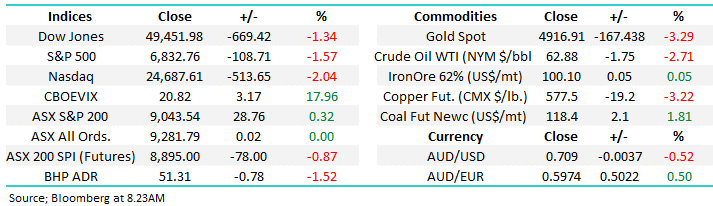

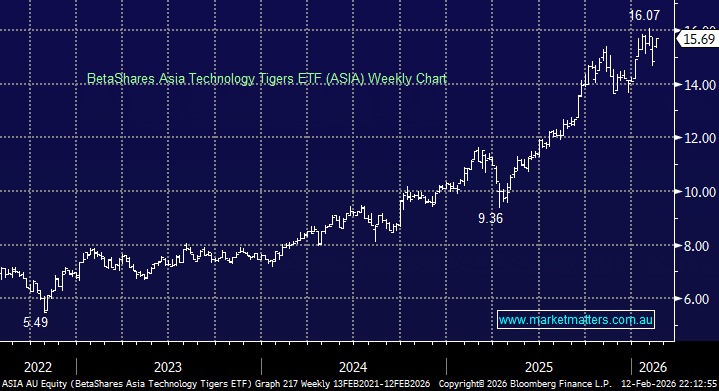

The ASX 200 tested its all-time high at lunchtime yesterday before peeling away to close up just +0.3% as the dramatic polarisation across the ASX continues in earnest – already in 2026, we’ve witnessed the Tech Sector hammered by over -20% while the Materials have gained more than +12%, compounding the dramatic rotation through FY26. It’s becoming almost monotonous to quote how far the major tech names have fallen day to day. However, it’s hard to ignore; it felt like capitulation on Thursday, but there’s already been a few chapters in that particular scary book – on the day, SiteMinder (SDR) -12.9%, Xero (XRO) -8.4%, Life360 (360) -8.3%, and Technology One (TNE) -6.9%.

We have reduced our exposure to tech last week, not because we profess to know how this will all play out, but to reduce risk given a higher level of uncertainty around AI tech valuations more broadly. In the Growth Portfolio, that included selling CAR Group (CAR) and HUB24 (HUB), even though we continue to like both businesses. A few days later, they’re both trading below our exit price, even after CAR delivered a solid 1H26 result this week. Similarly, Xero (XRO) delivered a very encouraging trading update 10-days ago, bringing forward Melio’s earnings breakeven point, yet the stock closed a whopping 20% lower by Thursday.

We are witnessing one of the most aggressive sector moves we can remember as AI uncertainty feeds on itself. The counter argument that tech focussed fundies will use is that fundamentals remain largely intact, with cash-generative businesses maintaining strong margins and competitive positions, and that is right (for now). But we should also be very conscious that things are changing quickly, and solid fundamentals today can be disrupted. Fund managers that are simply sticking to their guns and not managing risk should be avoided in our view.

The carnage in the tech sector has severely damaged the performance of some large, well-established growth funds.

- Hyperion’s Global Growth Companies Fund is down 12.1% over the past year (to Jan 31), and off -19% over the past 3 months alone.

- Bennelong’s Flagship Australian Equities Fund is down 20.1% over the past year (to 31 Jan)

- Well regarded Doug Tynan’s GCQ is down 11.8% over the past year (to 31 Jan)

- Jun Bei Leu’s Tencap is down 1.2% for the year, around 8.5% below benchmark.

While tough periods happen to all managers, the extent of the weakness is jarring, and speaks to the level of concentration (and therefore risk) in a lot of these funds. In contrast, the Market Matters Active Growth Portfolio is up 13.67% over the past year, 5.8% ahead of the market (which is up 5.81%). Latest monthly performance report here

This degree of underperformance in certain pockets of the market appears to be feeding on itself, causing fresh forced selling almost daily. History tells us it will bring with it tremendous opportunity, as Warren Buffett says: “Be fearful when others are greedy and greedy when others are fearful.” Sounds easy, of course, all we need to do is pick out the opportune risk/reward time.

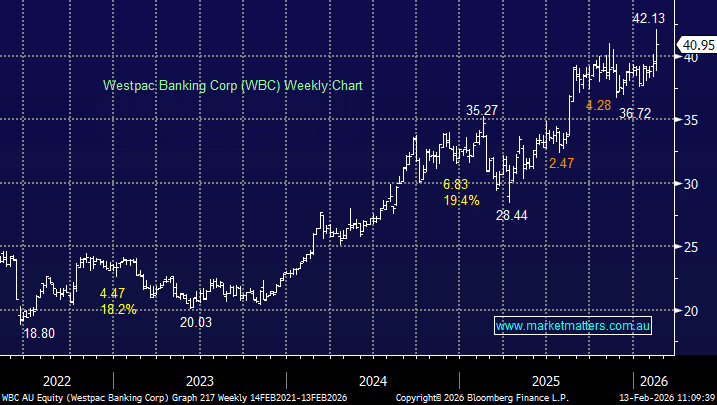

The wave of tech selling washing through the ASX on Thursday was easy to overlook compared to some colossal moves on the downside as three companies missed earnings expectations badly, all plunging by over 20%, while by the closing bell, in total, six companies finished the volatile day down by more than 10%. Conversely, the banks continued to deliver, with ANZ surging +8.5%, posting an all-time high after a solid beat, close on the heels of CBA on Wednesday. Combined with some ongoing strength from our influential miners, it was enough to see the index close higher, but not with the same gusto as we saw in the morning.

Losers: Temple & Webster (TPW) -32.6%. AMP Ltd (AMP) -26.7%, Pro Medicus Ltd (PME) -23.9%, SiteMinder (SDR) -12.9%, IDP Education (IEL) -12.2%, and Lovisa (LOV) -11%.

Winners: ANZ Group (ANZ) +8.5%, Commonwealth Bank (CBA) +5.4%, Northern Star (NST) +4%, RIO Tinto (RIO) +2.6%, BHP Group (BHP) +2%, and Westpac (WBC) +1.87%.

To put the relative moves into perspective, the materials and financials added 102-points to the ASX200 while healthcare, tech and consumer discretionary names took 57-points off the index, with over 70% of the main board actually closing lower on the day.

Overseas markets were weak overnight as big tech selling was accompanied by weak commodity prices. In Europe, the UK FTSE retreated by -0.7% while the EURTO STOXX 50 fared better, finishing down 0.4%. In the US, mounting concerns around AI disruption appeared to broaden into a wider risk reassessment after more than a year of steady asset gains. The tech-heavy Nasdaq and small-cap Russell 2000 both fell 2%, signaling pressure extending beyond software stocks.

- The SPI Futures are calling the ASX200 to open down -78pts/0.9% this morning following the weak session on Wall Street.