Hi Young,

We are watching/considering the rare earth space for our portfolios but its currently a hard sector to value with China producing the largest share of global rare earths, about ~60–70 % of mined rare-earth oxide equivalent output. Plus, they control ~90 % or more of the world’s rare earth processing/refining capacity, turning raw ore into the separated elements used in magnets and high-tech components. For heavy rare earths (used in high-performance magnets), China’s share is even closer to ~99 %.

- Rare earths have become a political hot potato between the US and China generating significant volatility across the space.

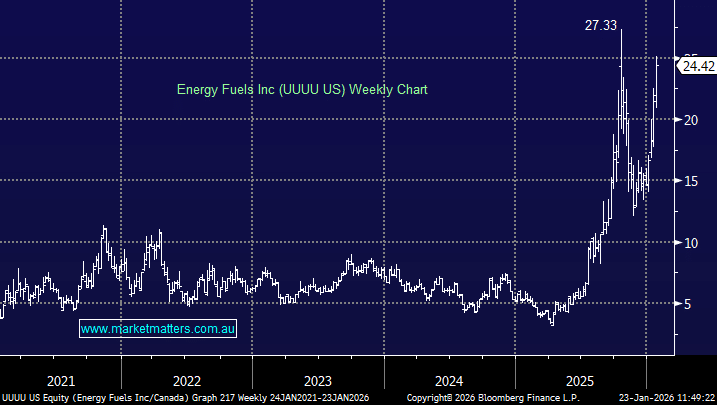

So far in the last year the Energy Fuels Inc (UUUU US), which is a U.S.-based critical minerals company primarily focused on uranium mining and production, rare earth element (REE) processing and other strategic minerals like vanadium and heavy mineral sands has surged over +500%, fallen ~50% and again doubled primarily on rhetoric out of the words largest two super powers. Hard to buy or hold that without having some sleepless nights!

- We would rather be invested in pure uranium or REE stocks as opposed the combination in Energy Fuels.

Lynas (LYC) is the obvious go to locally for Rare Earths, its experienced similar volatility to UUUU but it’s hard-to-get too excited buying a $17.5bn business, into any strength, which is highly dependent on NdPr prices which China could crush whenever the mood took them.