As we touched on recently, NXG is still in exploration and development stage, affording investors with greater leverage to growing global uranium demand, an energy thematic we remain bullish towards. This month, the company expanded the high-grade uranium footprint by ~23% at its Canadian Patterson Corridor discovery, sending the stock sharply higher with the news highlighting the growth potential across its Athabasca land package.

NexGen’s Rook I (Arrow) uranium project is one of the world’s largest development-stage uranium mines, with ~240–257 million pounds of contained uranium reserves and planned annual production of ~27–30 million pounds over its first decade. To put this into perspective, NexGen’s mine is roughly 4–5× larger than Paladin’s on annual production potential, and materially larger in long-term resource scale — but Paladin is already producing, while NexGen is still pre-production. NexGen’s Rook I uranium mine is currently expected to begin production around 2030 following final regulatory approval and a ~4-year construction period. Hence, assuming everything goes according to plan operationally, NXG is likely to track the uranium price over the coming years.

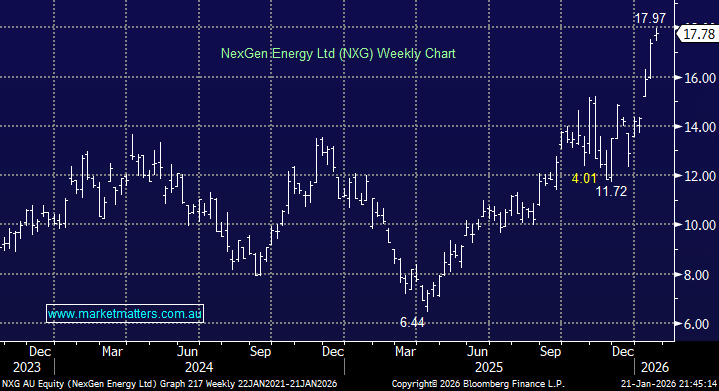

- We can see NXG testing $20 this FY and have no plans to take profit at this stage: MM owns NXG in its Emerging Companies Portfolio.