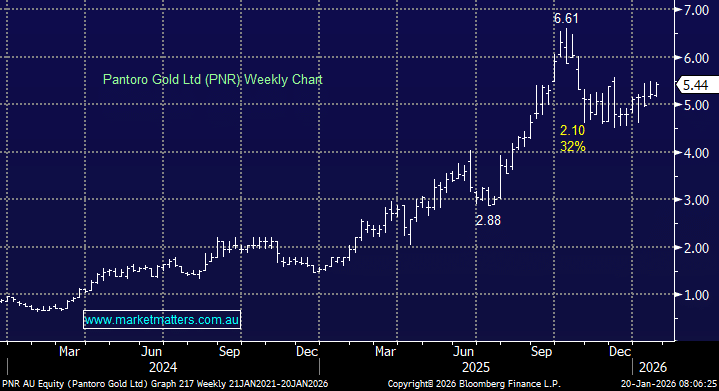

PNR is another gold miner, in this case a $2.1bn WA company that’s expected to more than double its $357mn revenue in FY25 to $765mn in FY27. PNR’s principal mining asset today is the Norseman Gold Project in WA, a project which includes active open-pit and underground mining operations, along with a 1.2 Mtpa processing plant and multiple mining centres i.e. a multi-centred gold mining operation with active underground and open-pit mines and processing infrastructure.

This is one ASX gold name that’s struggled in recent months after director Mark Maloney sold 25.8mn shares – not too worrying to MM as the sale follows the retirement of Kevin Maloney, plus the family continues to hold ~6.1% of the business. This sell-down looks like an opportunity in this relatively low-cost gold producer in the Australian small-cap sector, with FY26 cost guidance of $A1,950–$2,250 per ounce, not bad with gold trading ~$A6970 this morning.

- We like the risk/reward towards PNR after its recent pullback, arguably a rare “cheap” way to take some gold exposure in today’s parabolic bull market.