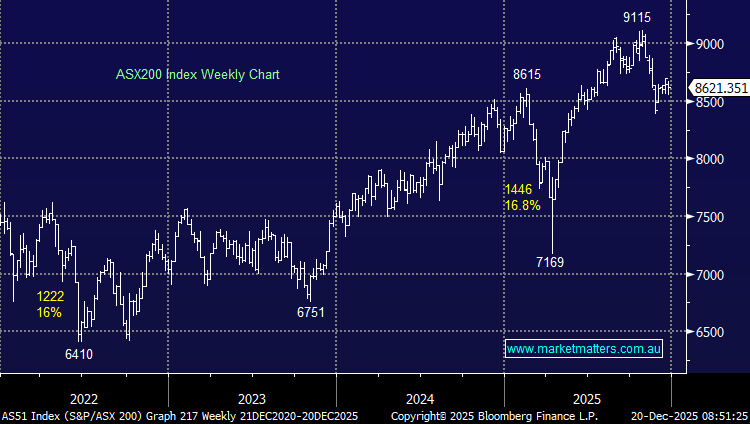

The ASX 200 ended the week down -0.9%, leaving December up just +0.1% with the quiet Christmas period ahead. However, with the market set to open strongly on Monday morning, a Santa Rally could be set to arrive, albeit extremely late. Remember, the average gain for a December over the last 10 and 20 years is 1.0% and +1.2% respectively, still comfortably attainable by the local market from today’s position.

Last week saw further diverse polarisation, this time more on the stock as opposed to the sector level, with 7 of the main board stocks popping by more than +10% while 5 stocks fell by the same degree.

By Friday’s close, the winners’ enclosure demonstrated some huge differences in performance in a week where there was very little middle ground:

Winners: DroneShield (DRO) +33.7%, Bapcor (BAP) +19.3%, Catalyst Metals (CYL) +18.1%, IDP Education (IEL) +16.1%, Digico (DGT) +15.1%, Bellevue Gold (BGL) +13.9%, Greatland Resources (GGP) +11.8%, and HMC Capital (HMC) +8.8+%.

Losers: Boss Energy (BOE) -25.7%, GrainCorp (GNC) -15.9%, Telix Pharma (TLX) -13.9%, NEXTDC (NXT) -11.6%, Treasury Wine (TWE) -10.9%, ASX Ltd (ASX) -8.5%, Woodside Energy (WDS) -7.8%, Pro Medicus (PME) -7.3%, and Deep Yellow (DYL) -7%.

The news was mixed from a market perspective over the week as we head into Christmas:

On Tuesday, NAB and CBA said they now expect a February RBA rate hike, citing capacity constraints and sticky inflation, while HSBC warned policy may already have eased too far.

- On Thursday night, US inflation data (CPI) came in softer than expected, lifting hopes of Fed rate cuts in 2026, sending stocks higher in the process.

- On Friday, the Bank of Japan (BOJ) hiked interest rates by 0.25%, to their highest level in more than 30-years sending their 10-year yield to its highest level since 1999.

- However, following the BOJ’s widely expected move, the Nikkei rallied while the Yen fell, the opposite of what many would have thought if they weren’t aware of expectations.

- On Friday night, the Bank of Russia cut interest rates to 16%, so perhaps we shouldn’t complain too much!

A big shout-out to Michele Bullock and the RBA as we head into what could be a tough year for many with rate hikes now priced in for 2026. The RBA Chair cancelled the bank’s Christmas Party in consideration of how tough many Australians are doing it at present. We hope the boards of many ASX companies act with the same empathy towards shareholders in 2026 after what’s been a year of too many disappointments at the board level.

Overseas markets rallied strongly into the weekend, led by the “AI Trade”. In Europe, the German DAX closed up +0.4% while the UK FTSE ended the session +0.6% higher, only 0.3% below its all-time high. In the US, the tech-based NASDAQ led the way, gaining +1.2%, while the broad-based S&P 500 closed up +0.8%.

- The SPI Futures are calling the ASX200 to open up +41pts /0.5% on Monday following the strong session by overseas bourses on Friday night.