Hi Jan,

Happy Christmas and 2026 to you and all our readers !

We actually feel that GQG won’t necessarily dance to the interest rate tune as opposed to the relative performance of sectors as/if these expected easing’s do unfold – credit markets are currently pricing in two rate cuts by the Fed in 2026.

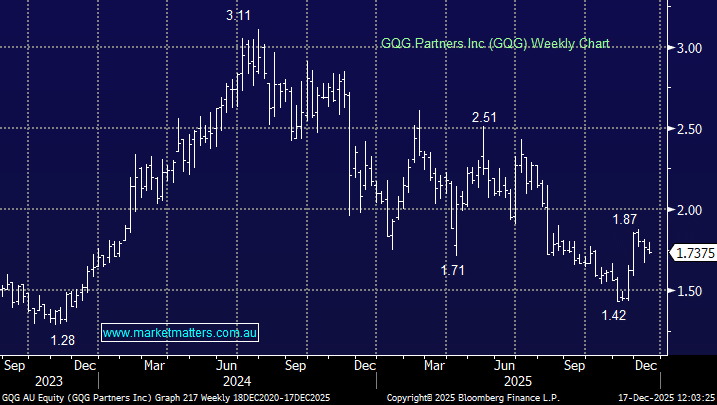

GQG has struggled through 2025 with performance the main headwind, they manage over US$167bn and are expected to generate net profit after tax of US$464m in FY25 (December year-end) but if portfolios continue to underperform outflows are likely to weigh on the business.

- GQG’s 3-year performance, the key metric for fund flows, is 10.89% p.a. and after-fee return being 9.8% p.a. below the benchmark for its flagship global equities strategy.

The reason for the underperformance is they’re migration away from big tech, calling it a bubble, and opting for a more defensive stance – this has played out perfectly in the ASX over the last 3-months, but GQG is a global manager where moves have been far more muted although the press has been full of the “AI Trade” starting wobble.

- We see GQG as a deep-value turnaround story for 2026, with the added advantage of a defensive tilt, and an exceptional yield. We are bullish on this stock, believing that a broadening of market leadership will have a positive impact on their relative returns and fund flows.