Hi Octogenarian,

Lindsay Australia Ltd (LAU) is a logistics and rural supply specialist that supports agriculture and fresh food markets with transport, warehousing, farm supplies and integrated end-to-end services. The company is forecast to generate revenue of $1bn in FY26, up ~18% from FY25 with the expected growth reflecting ongoing expansion of its transport and logistics network, including acquisitions integrated into the business.

Lindsay generates strong operating cash flow, to cover debt repayment and while Capex and acquisitions have lifted debt, cash generation has kept pace, preventing balance-sheet stress. The balance sheet relies more on cash flow than accounting profit, which is appropriate for this industry with risks only arising if freight volumes weaken materially or margins compressed.

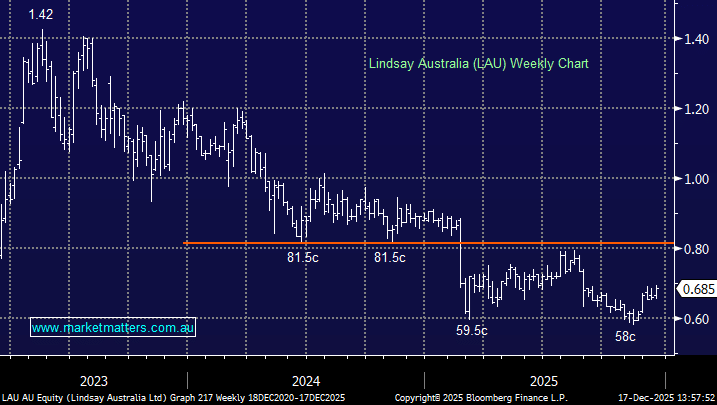

- We like LAU below 70c with the stock trading on 8.1x FY26 and forecast to yield 5.7% fully franked over the next 12-months.

CAR Group (CAR) we hold in our Active Growth Portfolio, a company we like but it’s suffered as valuation contraction has rolled through the high growth names as investors price in interest rate hikes, as opposed for easing’s, in 2026. We think the’re excellent buying ~$30, around 29% below their 2025 high but we did think that 10% ago!

The threat of AI across many industries will be a topic for the coming years, and these sorts of classified businesses do carry an elevated risk of disruption. However, we do not think this will be a case of AI swiftly debunking established players in a short time frame. We can only assess what is in front of us and react if we start to see any impact on their underlying business metrics. For now, that is not the case, noting that CAR is also investing in AI capabilities.

- We remain long and bullish towards CAR Group (CAR).