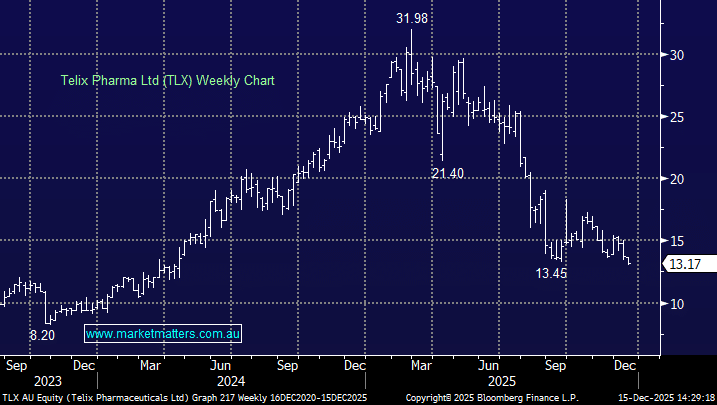

Biopharma TLX has fallen over 46% in 2025, it operates in a space rarely touched by MM due to its volatility and often binary outcomes. TLX is a high value/growth stock that’s struggled through 2025 after a few less favourable updates dovetailed with a very well owned and expensive share price, leading to a big re-rate lower.

This is an unusual company in the biopharma space in that it’s generating solid revenue, having entered Q4 in good shape, reporting 3rd quarter revenue of $206mn, up +53% YoY. However, TLX has struggled in the past few months after announcing that it had received a Securities Exchange Commission (SEC) subpoena request related to the development of the company’s new prostate cancer therapies – the binary card again!

The stock is now trading more than 30% below its average 5-year valuation due to the SEC uncertainty, which we believe offers reasonable risk/reward for the brave believers in TLX. We like TLX as a business and like the risk/reward as the stock tests new 2-year lows, but it’s not one for the proverbial “kitchen sink” with another 10% downside easy to envisage.

- We can see a sharp bounce by TLX over the coming weeks/months, but from where is a tough call.