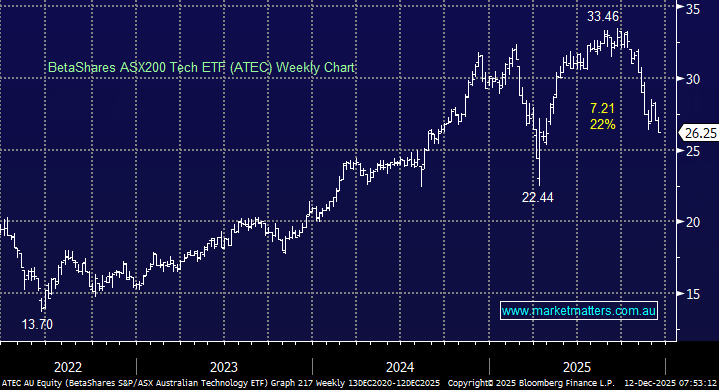

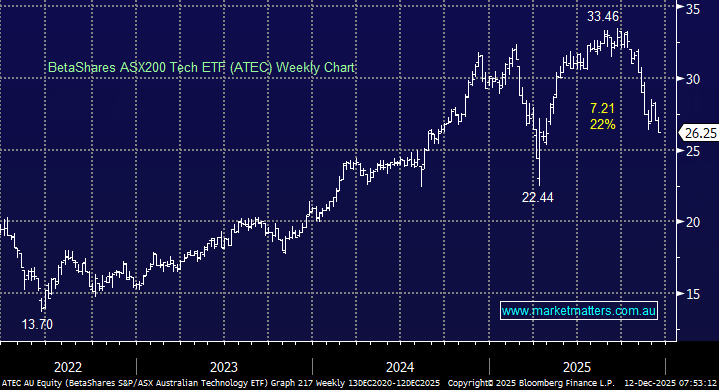

This ETF is made up of the large cap ASX tech names although it may surprise some subscribers to know that Computershare and Pro Medicus make up 20% of it. As we showed earlier, tech has fallen out of favour in the last two months after being hit with a Mike Tyson-esque one-two: Firstly, interest rates are now expected to rise, as opposed to fall, in 2026, removing an important tailwind for high-value growth stocks. Secondly, the “AI Trade” is being called into question as spending vs. potential returns has led to a major re-rating on global bourses – as we saw overnight with Oracle (ORCL US) falling another -10.8%, taking its correction to ~46% in just 3-months.

The ATEC ETF is slowly starting to look interesting after correcting over 20% in recent weeks. Following moves in the US overnight, we wouldn’t be jumping in just yet, but this ETF is close to a buy MM – as we often say it’s “looking for a low”.

- We can see the ATEC ETF testing below $25 in the coming weeks, but the correction is maturing fast.