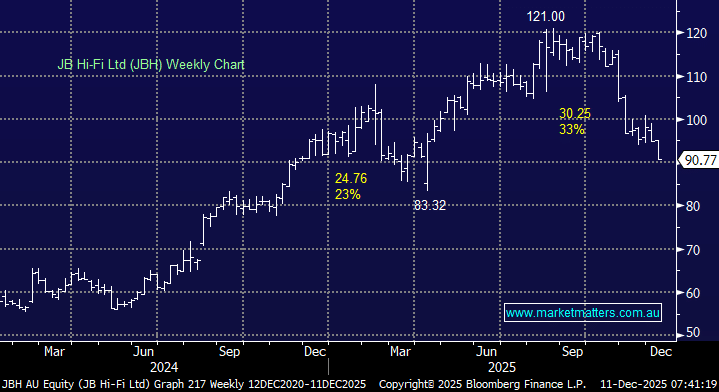

JBH has been smacked in the second half of 2025 as the “Certainty Trade” unwound, and investors finally paid some attention to valuations. Weakness accelerated from late October following its first-quarter update, which came in broadly in line with expectations, but the underlying message was one of resilience rather than acceleration, i.e. a continuation of solid, mature growth rather than anything to excite investors who had pushed the stock’s valuation into realms of strong growth. JBH also faces the risks of growing Amazon competition and diminished AI-driven tailwinds for the replacement cycle, which only a few months ago had analysts expecting Australians to flock to JBH to update their respective devices.

From a valuation perspective, JBH is still on the expensive side, around standard deviation above it’s usual PE of 16x, trading on 19x and yielding just ~3%.

- We were scratching our heads when JBH was trading on 25x earnings a few months ago, and while we’re scratching less now, it’s not yet a compelling buy.