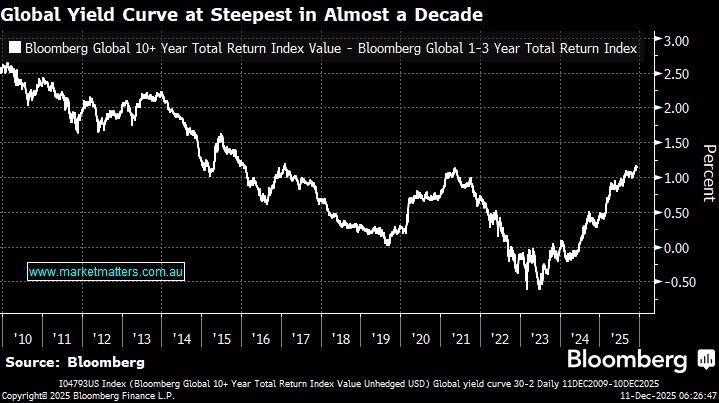

Global bond yields had risen to 16-year highs ahead of this mornings Fed policy meeting, signalling concerns that interest-rate cutting cycles from the US to Australia may be ending soon. Yields on a Bloomberg gauge of long-dated government bonds have returned to 2009 levels. Traders are now pricing virtually no more rate cuts from the ECB, while betting on an all-but-certain hike this month in Japan and two quarter-point increases next year in Australia. Even in the US, where the Fed cut rates as expected this morning, the outlook is rapidly evolving. Yields on 30-year Treasuries have climbed back to multi-month highs as investors eye a less benign outlook for monetary policy, inflation and fiscal discipline, and a better outlook for growth, with the Fed increasing their 2026 GDP forecast overnight to 2.3%, up from 1.9%.

- A “disappointment trade” is unfolding across several developed markets as investors come to grips with central bank rate-cutting cycles that may be ending soon, or even reversing like our own.

Bond investors are now mulling the outlook for global growth, examining inflation risks amid Trump’s trade war and surging government debt from Tokyo to London. Yields on 10-year Treasuries are hovering around the highest levels since September, which suggests uncertainty around the US’s debt pile and who may replace Chairman Jerome Powell when his term ends in May. White House National Economic Council Director Kevin Hassett has emerged as the front-runner and is widely considered a supporter of Trump’s preference for lower rates.

- A steep yield curve usually supports stocks—especially banks and cyclicals—because it signals stronger future growth, though higher long-term rates can weigh on long-duration sectors like tech and REITs.