A new credit note lists on the ASX today from Stonepeak (under code SPPHA), a large US based (Australian founded) global infrastructure investor currently managing A$115bn, making them one of the world’s largest infrastructure and real-asset investment managers.

While Stonepeak may not be a household name in Australia, they were established in 2011 by Australian Mike Dorrell after working within Macquarie’s infrastructure franchise in Sydney and New York before moving to Blackstone. Stonepeak now manage money for global pension funds, endowments, and other large institutions, having delivered returns of over 11% pa since inception i.e. they’ve been a very successful manager globally, building up a team of over 300.

The security is structured as a floating-rate infrastructure credit note, which is unsecured, deferrable, redeemable and pays monthly interest at 1m BBSW + 3.25%, stepping up to +4.25% if not repaid by the Target Repayment Date of 5 December 2031 (final legal maturity 6 December 2032).

The raise was well supported with the maximum of $300m achieved. Market Partners (adjacent investment manager of Market Matters) participated in the deal and saw some scale back to bids, implying a mildly oversubscribed offer.

- The notes will pay the 1m BBSW + 3.25% p.a, paid monthly in arrears – equates to an all-cash yield of ~7%.

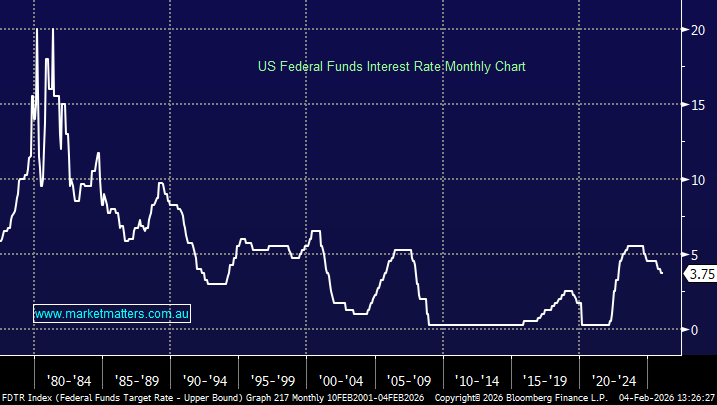

- Floating-rate structure means income will adjust with cash rates rather than being locked in.

- The notes have a 5-year target duration, but if not redeemed at the first call date on 5th Dec 2031, the margin steps up 100bps to 1m BBSW + 4.25% until final maturity 6 Dec 2032.

- There is a first loss buffer funded by Stonepeak, much like the Dominion notes issued earlier this year, creating alignment with investors. i.e. the manager absorbs any losses up to 5% before investors wear any pain.

- If income is temporarily insufficient, it can be deferred but remains cumulative and compounding.

- Deferred interest must be paid by 10 business days after final maturity, or it becomes a Winding Up Event.

- Management fees are acceptable at 0.50% pa.

We like infrastructure as an asset class, and these notes provide a usually inaccessible way for individual investors to gain access to high-quality, global infrastructure-backed debt – a segment with historically lower defaults and better recoveries than general corporate credit. The returns are very comparable to listed credit notes on the ASX (DMNHA, CIMHA, RAMHA) but look attractive relative to hybrid securities.

The majority of holdings (70-90%) is infrastructure-related debt (transport, data centres, telco, utilities, social infra), while a minority (10-30%) will be held in diversifying assets: asset-backed finance, corporate credit, liquid credit and cash. These assets will have an average interest rate duration <1.5 years, keeping the portfolio relatively short-dated. This means the securities will have low-interest rate risk, and any volatility in returns should be credit/spread driven, not duration (i.e. not impacted by changing rates).

Stonepeak do have some flexibility around redemption, with the option to redeem all or some Notes on any interest payment date. If redeemed within 24 months of issue, investors are paid out at 101% of face value. After 24 months, notes are redeemed at par.

In short, we think SPPHA suits investors seeking floating-rate income with infrastructure exposure. While they will be traded on the ASX and can be sold at any time, we believe investors should have a hold-to-maturity mindset given these securities can trade below issue price. When buying a security like this, we need to have confidence in the manager, and Stonepeak has a very strong track record, a high level of resourcing across the globe, and is trusted by many of the world’s largest institutions to manage capital.

- SPPHA lists on the ASX today at 11am