Judo Bank is a seldom-discussed $1.9 billion financial stock sitting in the ASX200. They make most of their money from net interest income generated by small and medium-sized business lending (SME) i.e. the difference between the rate they borrow and the rate they lend. JDO has a very different business model from the Big Four banks; it’s a specialist lender, whereas the “Big Four” are broad one-stop banks.

- JDO specialises almost entirely in SME lending, no home loans, no large corporate lending, no wealth management, no insurance.

- They are relationship bankers, making tailored credit decisions to a niche customer base who appreciate high-touch, human service.

The benefit to JDO is that SME lending earns significantly higher margins than residential lending, although faster growth potential comes with the risk of higher sensitivity to credit cycles. JDO are forecast to grow top line revenue by almost 20% in FY26 to $505mn, which drops down to an impressive 45% increase in Earnings Per Share (EPS). The stock is trading on 15.7x FY26 estimates, 18% below its 2-year average, although the history here is relatively short with the company listing in November 2021. Conversely, CBA is trading on 24.7x, even after the recent deep correction; it’s still +18% above its 5-year average.

- JDO is a stock with an expected compound annual growth rate (CAGR) of ~36% over the next 3 years vs ~2% for the banking sector more broadly.

- We believe Judo should trade closer to ~25x P/E, reflecting a scarcity premium around growth in both global banks and the ASX200.

- Priced on 25x, JDO is worth ~$2.50 in FY26 and north of $3.00 by FY27

Arguably, the main reason that JDO isn’t a fashionable stock amongst its peers is that it doesn’t yet pay a dividend; it’s very much a growth-oriented stock within the financial sector. To put things into perspective, JDO is trading on just 1.1x Price to book – investors are only paying a 10% premium to the company’s net assets, CBA’s trading on 3.3x! We believe JDO is an underappreciated growth stock, whose services we can appreciate as an SME business, hence MM has added to our Hitlist accordingly.

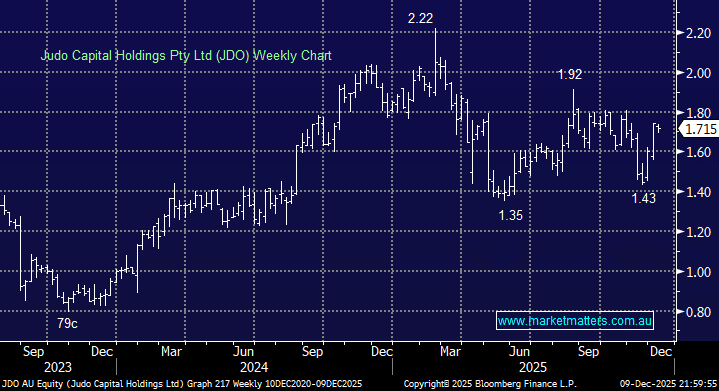

- We can see JDO initially testing the $2 area in the coming months, with an upside rerating likely in the coming years.